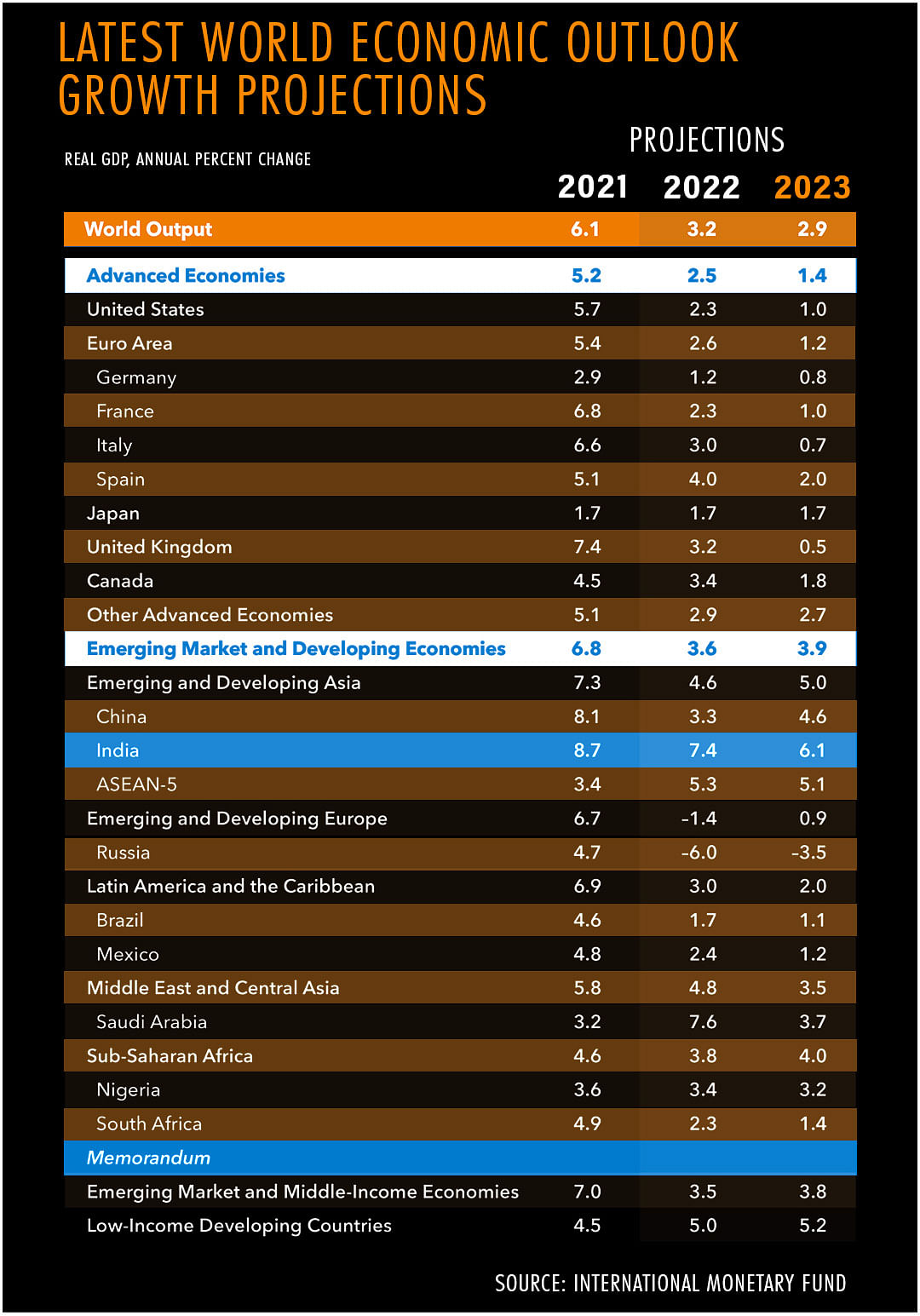

The International Monetary Fund in its July update of the World Economic Outlook (WEO) has lowered India’s growth forecast for the current year by 80 basis points to 7.4 per cent. The revised growth projection is closer to the official estimates and appears more realistic. For the next year, the IMF has projected India’s economy to grow by 6.1 per cent. The revision in growth projections is attributed to less favourable external conditions and rapid policy tightening.

While global growth is projected at 3.2 per cent for 2022, the IMF report has flagged concerns regarding an oncoming global recession (defined as two consecutive quarters of negative growth). This could be a concern for the US and other advanced economies. However, the probability of recession in India seems to be low as of now.

Probability of a recession in the US

The IMF report has sharply revised the US growth projection to 2.3 per cent in 2022, a 1.4 percentage point decline from the April report. In 2023, the US economy will likely grow by 1 per cent. This growth is expected to weaken substantially in the second half of 2023. The economy is projected to grow by only 0.6 per cent in the fourth quarter of 2023.

There are mixed signals on the possibility of a recession in the US. In the January-March quarter, the US economy posted a contraction. According to the latest estimates from the Federal Reserve Bank of Atlanta’s GDPNow forecasting model, GDP for the April-June quarter is projected at -1.6 per cent. According to this metric, recession may have already started in the US. The Federal Reserve Bank of Atlanta’s analysis provides a running estimate of real GDP growth, pending the release of the official estimate of the GDP, which comes with a lag.

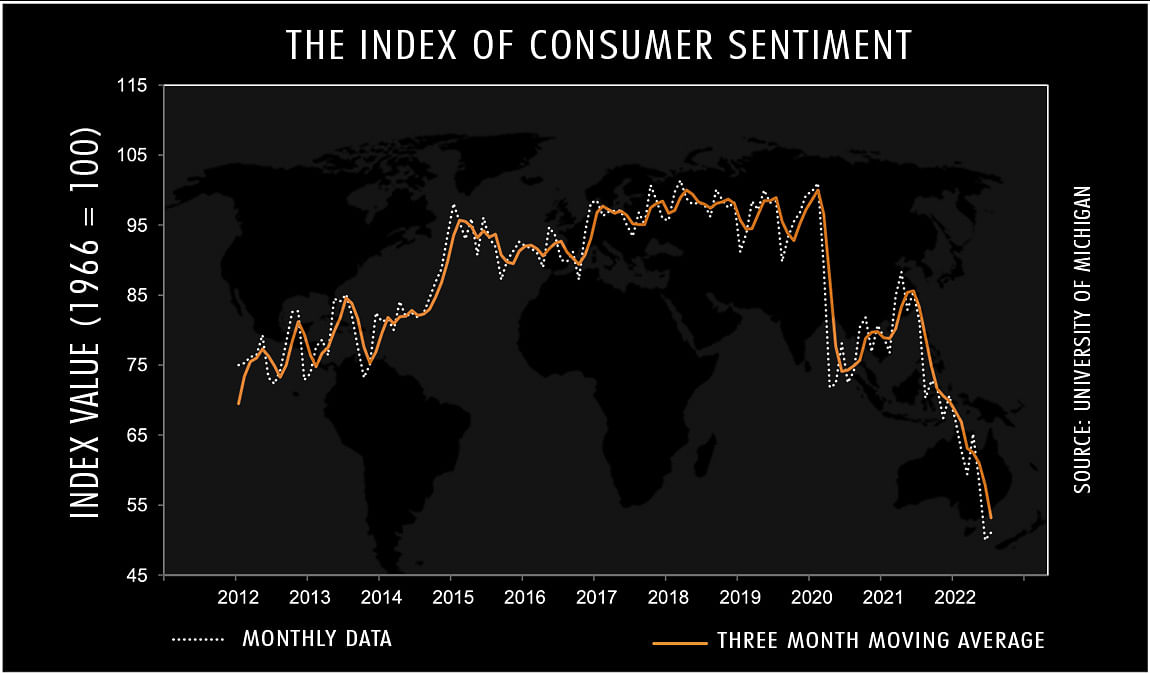

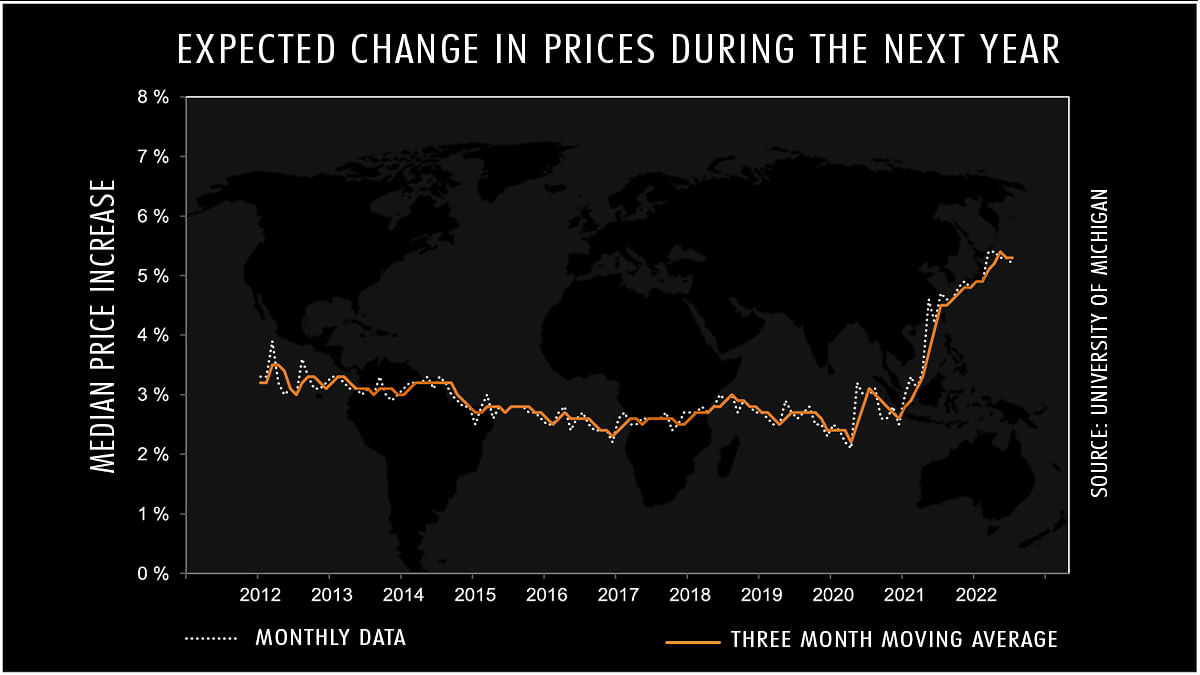

As inflation is beginning to hit spending, consumers have turned increasingly pessimistic. The University of Michigan’s Index of Consumer Sentiment is at an all-time low. The median expected one year ahead inflation is 5.2 per cent, much above the inflation target of 2 per cent. However, there are other important indicators such as corporate sales and employment numbers that do not show the economy headed for a recession. Based on a variety of indicators, a survey of economists by Bloomberg puts the chance of a US recession at 38 per cent over the next year.

The IMF report projects global inflation to peak at 8.3 per cent this year. It is projected to fall below 6 per cent next year. Inflation in advanced economies is projected to fall to 3.3 per cent next year from 6.6 per cent this year. Oil prices are projected to decline by 12 per cent next year. If the actual inflation trajectory turns out to be closer to these projections, the pace of interest rate hikes could see a moderation, though not immediately, but in the coming few quarters.

Slim chance of recession in India

According to the Bloomberg survey of economists, the probability of recession is zero for India. Inflation and a possible growth slowdown are primarily due to global shocks. The external headwinds having a bearing on the Indian economy could see a moderation. The US Federal Reserve raised interest rates by 75 basis points in its latest meeting to tame inflation. The Fed signalled that it would set policy on a meeting-by-meeting basis, rather than offering concrete forward guidance. The European Central Bank’s decision to raise the benchmark rate by 50 basis points has led to some moderation in the US Dollar Index. Reversal of sharp foreign outflows and a correction in crude and commodity prices have helped the rupee gain after touching the 80 per dollar mark.

High frequency indicators suggest that there is a lesser probability of a sharp slowdown in the economy. Credit registered a strong growth of 14.4 per cent for the fortnight ending 1 July. A noteworthy feature is that bank credit to industry is showing signs of sustained uptick. Data on sectoral deployment of bank credit shows that credit growth to industry accelerated to 8.7 per cent in May 2022. While credit to micro, small and medium industries has shown strong growth driven by the Government’s Emergency Credit Line Guarantee Scheme, recent two months have seen credit to large industries also picking up. With an increase in capacity utilisation, pick-up in infrastructure spending and the financing of the Production Linked Incentive Schemes, there seems to be an appetite for borrowing from corporates. With improvement in profitability, capital position and asset quality, banks are in a better position to support the demand for credit.

Most of the indicators in the services sector have shown a significant rebound in the past two months. Recent data suggests that consumers have also turned more optimistic about economic prospects. The Index of Consumer Sentiments (ICS) is set to make a recovery in July after a tepid growth in the past four months.

The projection of decline in oil prices bodes well for India’s inflation outlook and could influence the pace of interest rate hikes by the Reserve Bank of India.

Slowdown in global economy could impact India’s growth prospects

While the economy has shown resilience, it cannot remain immune to a slowdown in the global economy and a possible recession in advanced economies. Exports could see a moderation in the coming months after registering a record growth in 2021-22. Particularly, a recession in the US would impact India’s IT services exports. While order flows from offshore clients is still strong, profitability margins of IT firms are seen to be shrinking owing to stagflation concerns.

The policy focus should be on macro-economic stabilisation, consolidating the gains from export competitiveness and inflation targeting.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also read: 10% in Telangana, 5.4% in Kerala — why some states are feeling inflation heat more than others