Last week, the government tabled its first supplementary demand for grants for the current financial year, seeking additional gross spending of Rs 4.36 lakh crore. The net outgo of cash is expected to be Rs 3.26 lakh crore. The rest will be covered through savings and enhanced receipts.

The government had estimated a total expenditure of Rs 39.45 lakh crore this year. The additional spending is sought for fertiliser subsidy, food subsidy, payments to oil-marketing companies (OMCs) for domestic LPG operations, and allocation towards the rural job guarantee scheme.

The biggest component of the additional spending is fertiliser subsidy. The need for additional spending of around Rs 1.09 lakh crore has risen as the fertiliser subsidy burden has exceeded the budget estimates due to the Russia-Ukraine war. The government increased the fertiliser subsidy to shield farmers from the rise in international prices of fertilisers.

The government has sought additional expenditure of Rs 80,000 crore for food subsidy including the free food grain distribution scheme. The scheme has been extended till December end. The budget had allocated Rs 2.07 lakh crore for food subsidy. Additional funds are also sought for the rural jobs guarantee scheme and the Pradhan Mantri Awas Yojana-Rural.

Also read: Persisting inflation worries, bright growth prospects give RBI room for more future rate hikes

Priorities in the upcoming budget

The authorisation from the Parliament for additional spending gives some idea about the spending priorities of the government. The government stepped up its spending on fertiliser subsidy to insulate the farmers from the steep increase in the international prices of fertilisers.

The government’s fertiliser subsidy bill will rise to more than Rs 2 lakh crore in the current year. However, with the recent moderation in prices, the next year may see a reduction in the outgo on fertiliser subsidy.

Growth for the next year is expected to slow down due to global headwinds and fading of the favourable base effect. The budget will have to address issues of boosting demand, job creation, infrastructure and putting the economy on a sustained growth path amid global challenges. The spending priorities need to be considered in this backdrop.

Boost to capex

In the budget for FY 23, the government had pegged capital spending at Rs 7.5 lakh crore to support economic revival amid a weak private investment. The government has been incentivising states to step up capital spending through Rs 1 lakh crore in long-term, interest free loans for their capex needs.

The upcoming budget should continue its thrust on capital expenditure. In the first seven months of the current year, the government has spent 54.6 per cent of its budgeted capital expenditure. For the corresponding period last year, the government managed to spend 45.6 per cent of the budgeted amount.

The government enhanced its capital spending by more than 35 per cent in the hope that this will crowd in private investments. While there are indications of private investments picking up, given the geo-political risks, elevated inflation and monetary tightening, continued thrust on public capex to promote growth is desirable.

At the same time, it is important to nudge states and public sector enterprises to raise their capital spending to improve the overall environment for capex. While states have increased their budgetary allocation for capital expenditure, the recent data suggests that the capital expenditure in the first half of the current financial year has been less than 25 per cent of the budgeted expenditure.

Enhanced spending on rural jobs scheme should be maintained

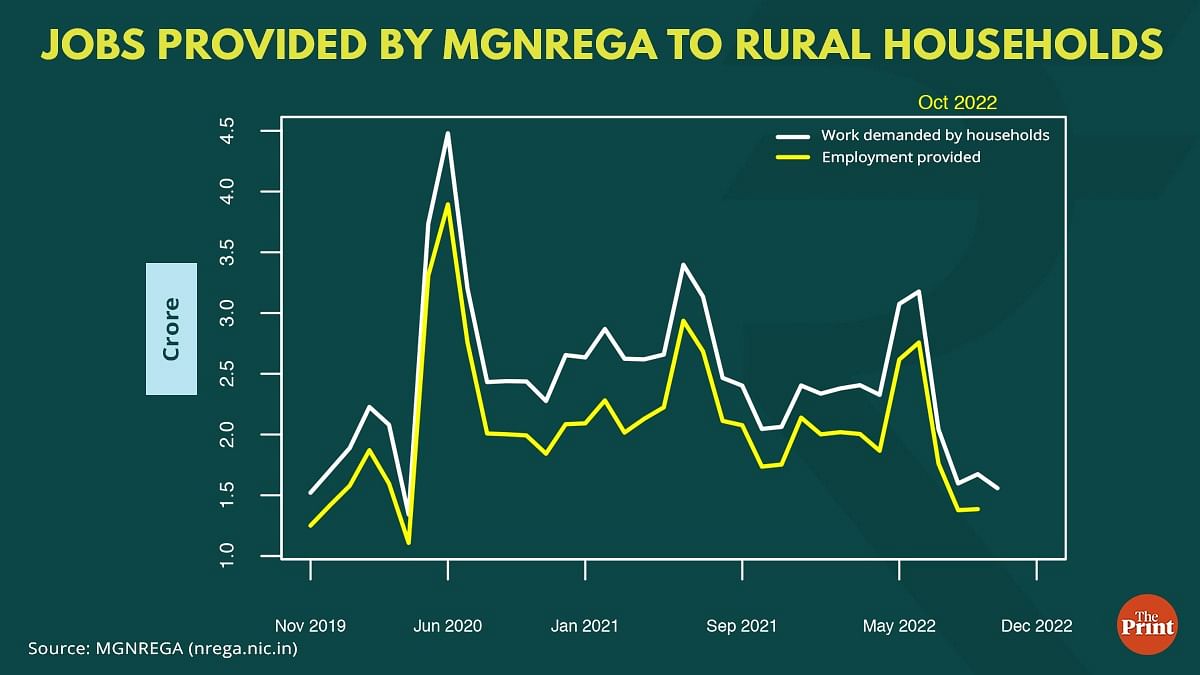

The government had allocated Rs 73,000 crore for the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) in FY 2022-23. During the national lockdown, MGNREGA was instrumental in cushioning the impact of Covid-induced job losses. It provided jobs to reverse migrant labourers.

Two years after the first wave of Covid struck, while the demand for work under the programme is showing some signs of moderation, it still continues to remain higher than the pre-Covid period.

Higher demand for work under MGNREGA led the government to seek more funds for the scheme under the supplementary demand for grants.

The government must consider maintaining the budget allocation for MGNREGA to ensure adequate employment generation for rural households. Further, the government must take effective steps to address the recurring issue of delay in payments. Budgetary allocation should ensure that flow of funds for payment of wages, material share, etc. is maintained seamlessly.

Continue the focus on low-cost housing to promote jobs

The Budget for the current year had allocated Rs 48,000 crore on affordable housing under the PM Awas Yojana, in rural and urban areas. The budget for FY 24 should continue the focus on low-cost housing. This has the potential to generate jobs in sectors having forward and backward linkages with the construction sector.

Continue support for the MSME sector

The MSME sector was adversely impacted by the pandemic. The Emergency Credit Line Guarantee Scheme introduced by the government helped MSMEs revive and scale their businesses and also helped in controlling non-performing assets (NPAs) in MSME lending.

The upcoming budget should consider extending the ECLGS scheme for another year till 31 March, 2024 to ensure access to finance and working capital amidst an increase in input cost prices. The issue of delayed payments to MSMEs by public and private enterprises also needs to be addressed.

Extend PLI Schemes to labour-intensive sectors along with performance measurement

The Production Linked Incentive (PLI) scheme aims to increase domestic manufacturing in India. It gives financial incentives on incremental sales to companies that set up their manufacturing in India.

Currently, the PLI scheme covers 14 sectors and aims to boost domestic manufacturing and exports. The budget must consider extending the PLI scheme to more labour-intensive sectors such as the toy industry to generate employment opportunities.

Sectors such as leather, glassware, furniture also need to be brought under the purview of the PLI scheme. The incentives given could be based on the proposed number of jobs created and value-addition. At the same time, there is a need to set up objective criteria to measure output and value-addition by companies that avail the incentive scheme.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also read: India’s GDP growth slowed to 6.3% in Q2 — why this isn’t as worrying as it sounds