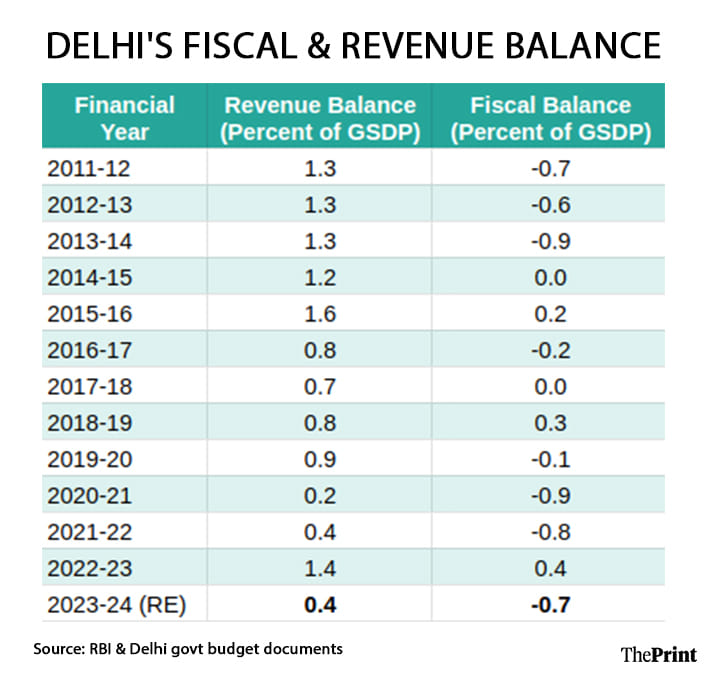

Delhi has historically been in revenue surplus, a feat not achieved by many states. This is set to change.

After peaking in 2022-23, the surplus on the revenue budget is shrinking and is most likely to slip into a deficit in the current year as expenditure commitments are set to surpass revenue.

The additional subsidies and cash transfers promised as part of the electoral manifesto could escalate the revenue deficit, unless accompanied by a concomitant increase in revenues. This could also entail a substantial cut in productive spending.

Inching towards a deficit

Barring 2016-17, Delhi also had a fiscal surplus from 2014-15 to 2018-19. Though its fiscal deficit was estimated at Rs 7,878 crore in 2023-24, as a percentage of GSDP (gross state domestic product), it was manageable at 0.7 percent.

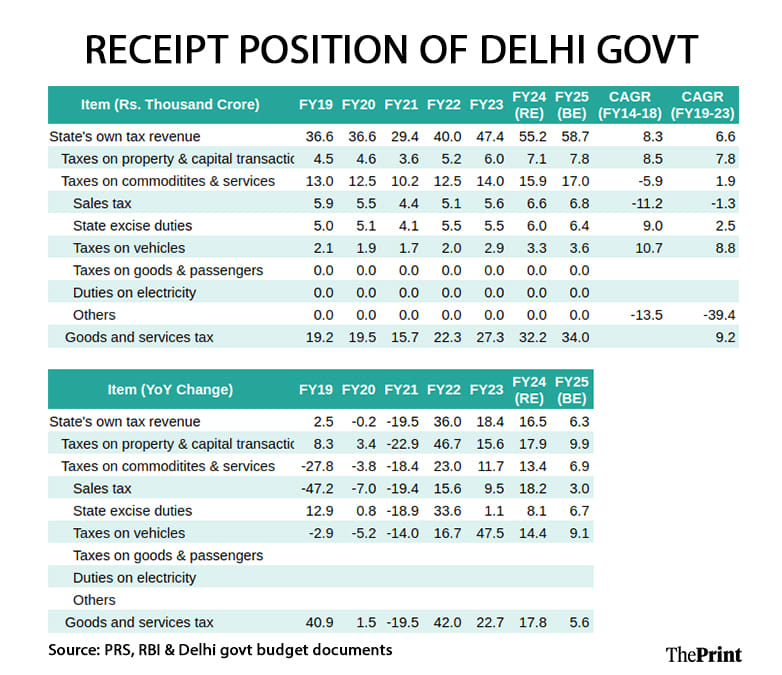

Delhi’s revenue surplus touched a high of Rs 14,457 crore in 2022-23. This was on account of a 27 percent increase in revenue receipts. Revenue receipts comprise of tax revenue, non-tax revenue, and grants and other receipts from the Centre.

While tax collections grew by 18 percent, grants and other receipts from the Centre increased by 74.3 percent in 2022-23. GST compensation grants made up a significant part of the grants from the central government.

The last two years have seen a deceleration in the revenue surplus. In 2023-24, the surplus was almost 14 percent lower than the budget estimate. In 2024-25, the surplus on the revenue account was budgeted at Rs 3,231 crore, a whopping 35 percent lower than the revenue surplus in 2023-24 (revised estimate).

The decline in revenue surplus is on account of an increase in revenue expenditure in the last two years. Revenue expenditure increased by 17 percent in 2023-24 and is budgeted to increase by another 8 percent in 2024-25.

To ensure that the spurt in revenue expenditure does not impinge on the overall fiscal health of National Capital Territory of Delhi, the capital outlay has been slashed significantly in the last two years. In 2023-24, capital outlay at Rs 8,338 crore was 25 percent lower than budgeted outlay. In 2024-25, the budgeted capital outlay at Rs 5,919 crore is 29 percent lower than the revised estimate of 2023-24.

On the revenue front, Delhi’s own tax revenues account for 91 percent of the revenue receipts. Notably, Delhi’s share of its own tax revenue to GSDP fell from 5.4 percent in 2014-15 to 4.9 percent in 2023-24, and is expected to remain below 5 percent in 2024-25.

In 2024-25, Delhi’s revenue receipts at Rs 64,142 crore are projected to increase by four percent over the revised estimates of 2023-24. Delhi’s total own tax revenue, at Rs 58,750 crore in 2024-25, is projected to increase by 6 percent over the revised estimate for 2023-24.

State Goods and Services Tax (GST) is the largest component, accounting for almost 60 percent of its own tax revenue. While the revenues from GST have risen since 2017-18, with the growing demand for rationalisation of GST to prop up demand, it is unclear if state GST will see a significant increase in the coming years.

Also Read: Budget tries to balance growth with fiscal prudence, but relies on spending cuts over revenue boost

Subsidy bill set to rise

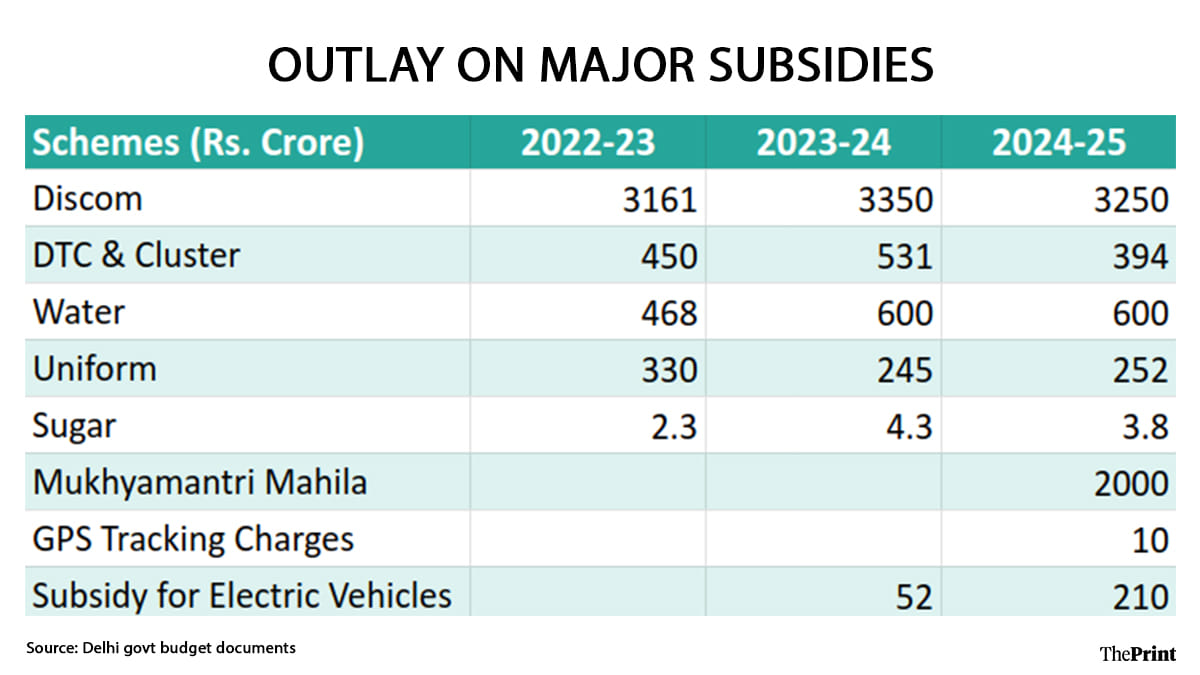

The most notable subsidies of the Aam Aadmi Party government were free electricity and water, cash transfers and free transport for women. These have substantial allocations in the budget for FY25.

The scope and coverage of freebies have risen, resulting in a consistent rise in the subsidy allocation over the last 10 years. The scale of subsidies promised in the run-up to the election will lead to further escalation in the subsidy bill, and could have adverse implications for the fiscal health of Delhi.

All parties guaranteed cash transfers to women of lower income households. In the budget for FY25, the AAP government announced a cash transfer of Rs 1,000 per month and budgeted Rs 2,000 crore. Under the poll promises, the AAP government promised to increase this amount to Rs 2,100 per month.

The Bharatiya Janata Party promised an even higher monthly transfer of Rs 2,500 to women of lower income households with an additional Rs 21,000 to pregnant women. This transfer alone would lead to an additional spending of Rs 11,500 crore. The BJP has promised a pension of Rs 2,500 for those between 60 and 70 years. Those above 70 will receive a monthly pension of Rs 3,000.

Delhi’s electricity subsidy scheme, the most generous in India, could see further allocations. Similar to the previous government, the BJP has promised up to 200 units of free electricity. It has gone a step further by promising 50 percent subsidy beyond that. This would lead to an additional thousand crore over and above the existing power subsidy allocation.

The BJP has promised LPG subsidy for underprivileged women. In addition, Ayushman Bharat Yojana is proposed to be implemented with a total health cover of Rs 10 lakh (Rs 5 lakh under the scheme and Rs 5 lakh additional cover along with free OPD and diagnostic services to all 70+ senior citizens). This scheme is likely to involve an additional spending of at least Rs 500 crore.

In total, the various poll promises are likely to involve an additional spending of Rs 13,000-Rs 14,000 crore, resulting in higher deficits and increased borrowings in the coming years.

Radhika Pandey is an associate professor and Pramod Sinha is a fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: Why India’s liquidity management framework requires a thorough review