India’s Gross Domestic Product grew 6.2 percent in the quarter ending December 2024, up from 5.6 percent recorded in the previous quarter. The rebound in growth was largely on expected lines owing to improvement in government spending, festival-induced boost to consumption and a sharp increase in non-oil exports.

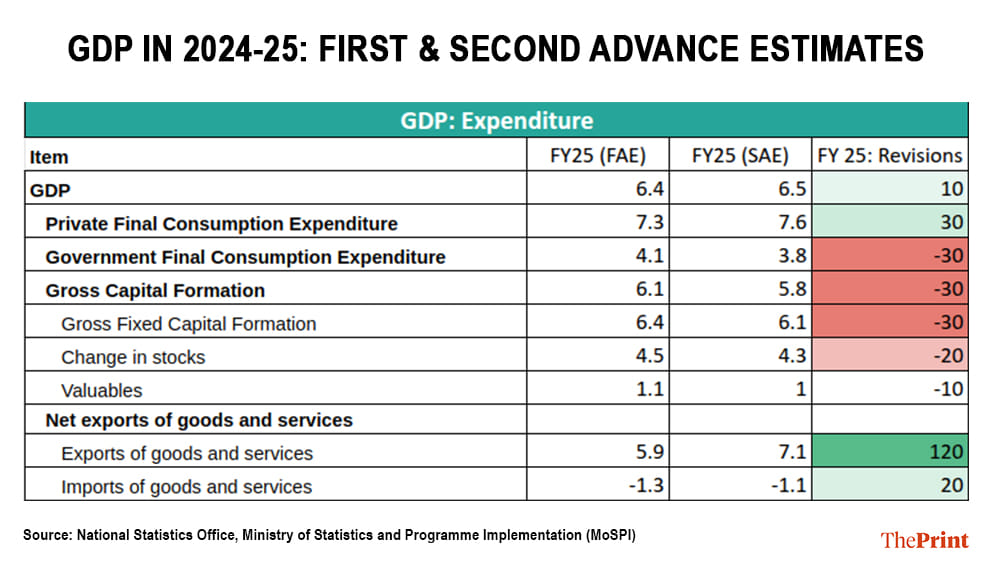

For the full financial year, growth is seen at 6.5 percent, according to the second advance estimates, marginally higher than 6.4 percent estimated in the first advance estimates. The 6.5 percent estimate for this year implicitly assumes that economy will grow at 7.6 percent in the fourth quarter.

This seems challenging and may be revised subsequently. There are revisions to growth estimates of previous two years as well. Large magnitude of revisions makes the assessment of economic conditions and formulation of policy responses a challenging task.

Agriculture a bright spot, marginal pick-up in manufacturing

Robust Kharif output led to an impressive 5.6 percent growth in agriculture. Rabi growth is also expected to be good, which should help sustain the sector’s performance and rural growth prospects in the coming year as well.

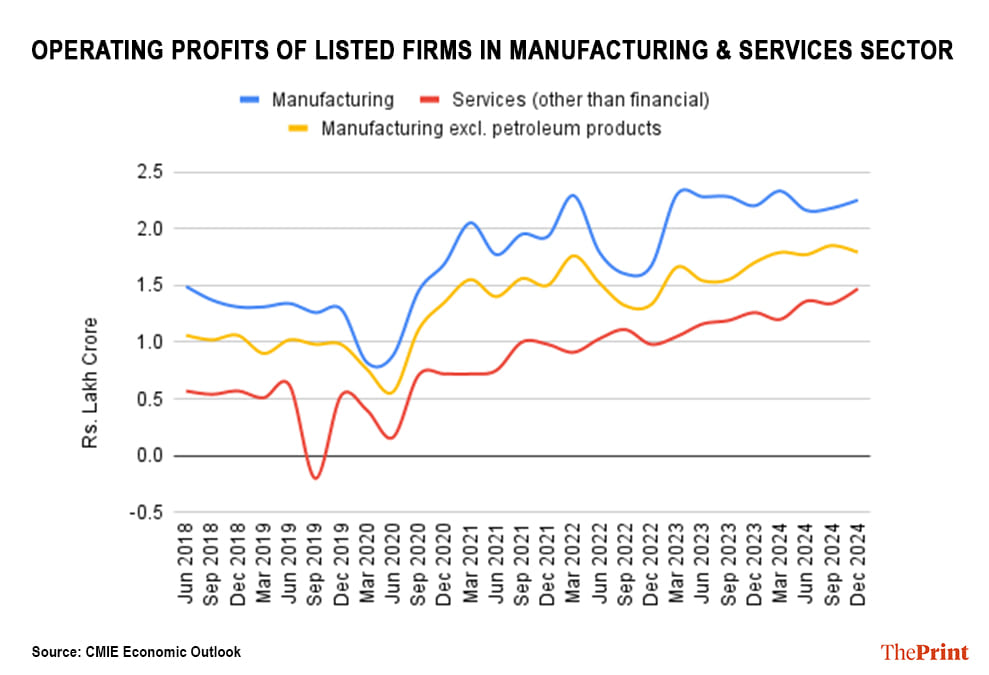

Manufacturing grew at 3.5 percent, marginally higher than the 2.1 percent growth recorded in the previous quarter. There is a base effect at play here. In level terms, the operating profits (a key input in the Gross Value Added calculation) of manufacturing sector firms registered a sharp surge in the December quarter of last year. The profit levels in subsequent quarters have been maintained at elevated levels. As a result, the profit growth numbers show little variation.

Notably, growth in the construction sector slowed to a nine-quarter low of seven percent in the December quarter. The sector was hit by weak prices of steel and cement. Even beyond the quarter, the sector, which has been one of the crucial drivers of growth, is likely to see a dip in activity due to fewer project awards for highway construction in FY24 and the current year.

Services sector, the biggest component of GVA, maintained its growth momentum and grew at 7.4 percent in the December quarter. The leading growth driver was public administration and other services, whose growth stood at 8.8 percent. Trade, hotels, transport and communication grew at 6.7 percent.

High frequency indicators capturing the trade, hotels, transport and communication, such as passengers and cargo handled at airports, witnessed double digit growth. Hotel occupancy is also seen to be at decadal high. Financial, real estate & professional services clocked a growth of 7.2 percent.

Also Read: India’s cautious approach to cryptos is in stark contrast to Trump’s open arms to digital assets

Pick-up in consumption, but investment worrying

Seen from the lens of expenditure, private consumption improved to 6.9 percent from 5.9 percent in the previous quarter. This was expected as this period was marked by festivals and weddings. However, the worrying aspect is the sluggish growth in investment, proxied by Gross Fixed Capital Formation.

Despite a pick-up in government’s capital formation in the quarter, private capital formation continues to remain in the slow lane. Capacity utilisation in the manufacturing sector has remained sticky at around 74 percent.

The Industry Outlook Survey by Reserve Bank of India reveals that only 33 percent and 36 percent of the respondents expect an increase in capacity utilisation in the December and March quarter, respectively. Further, the project finance data by banks reveals only a marginal pick-up in the total cost of projects sanctioned at around Rs 98,000 crore from 97,000 crore in the same quarter last year.

Revisions to annual growth numbers complicate policy-making

In addition to the quarterly growth estimates, the National Statistics Office (NSO) released revised annual growth numbers for the current year and previous two years. The NSO releases GDP estimates in a sequence—Advance Estimates (AE), Provisional Estimates (PE) and two rounds of Revised Estimates (RE).

For the current year, the second advance estimates were released. This is an update over the first advance estimates that were released on 7 January. In a span of less than two months, significant variations in growth projections are visible.

The NSO now estimates private consumption to be 7.6 percent, 30 basis points higher than the first advance estimates. Worryingly, the projection for investment is revised down by 30 basis points. Private investment is patchy and states’ capex contracted in April-January, despite central government’s efforts to encourage capex through front-loading devolution transfers.

Exports are projected to grow by 7.1 percent, 120 basis points higher than the first advance estimate. This seems optimistic in light of the multiple headwinds to international trade and may be revised downwards in subsequent revisions.

On the activity front, manufacturing growth is revised downwards, partly on account of the larger revised base of the previous year.

However, it is the revisions to the previous two years that raise concern due to their magnitude. The growth for FY 2023-24 has been revised upwards from 8.2 percent (Provisional Estimates) to 9.2 percent (First Revised Estimates), a significant change attributed to the incorporation of more reliable data sources, like the MCA-21 dataset and budget documents of departmental enterprises.

Even though the actual sources are used for compiling the revised estimates, the revision from First Revised Estimates to Second Revised Estimates for FY 2022-23 are baffling.

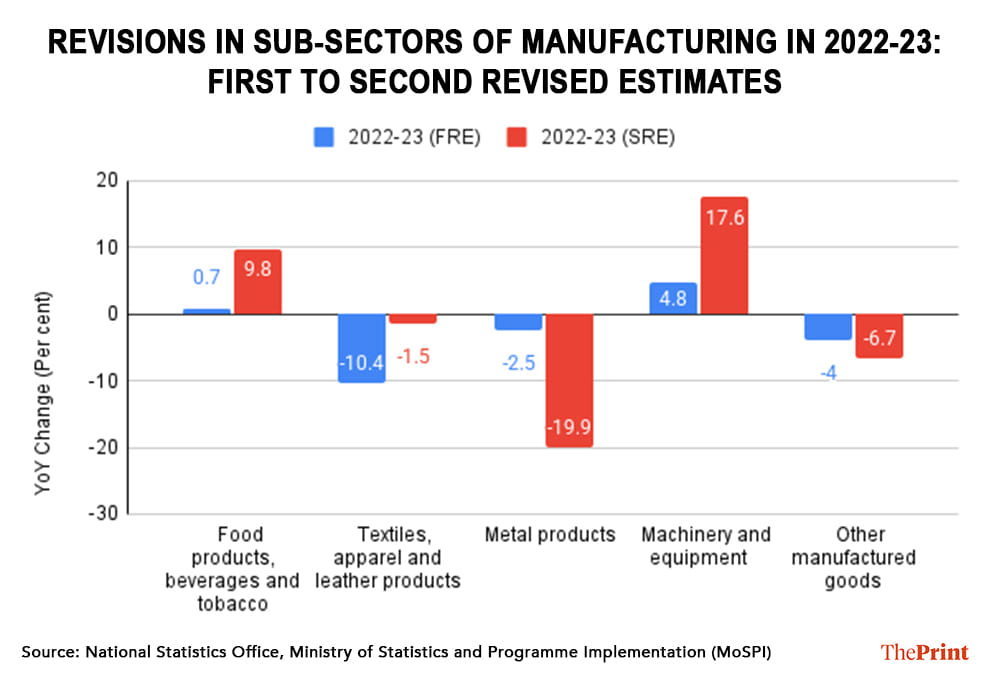

As an example to demonstrate the scale of revisions between the First and Second Revised Estimates for FY 2022-23, sub-sectoral revisions within the manufacturing sector are compared in the chart below.

Food & Beverages, which in the First Revised Estimates showed a meagre growth of below ~1 percent, jumped to 10 percent in the Second Revised Estimates. Similarly, metal products, which were estimated to contract by 2.5 percent in First Revised Estimates, is estimated to have contracted by 20 percent in Second Revised Estimates.

While revisions to data is a standard practice, large adjustments can undermine data credibility and complicate policy-making. These underscore the need for improving data quality and the choice of indicators used for initial estimates to minimise discrepancies, and enhance predictability over the revision cycle.

Radhika Pandey is an associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy.

Views are personal.

Also Read: In Trump 2.0 era, tariffs emerge as the go-to fix for US’s economic woes