In a recent paper, former Reserve Bank of India (RBI) Deputy Governor Viral Acharya has proposed that India’s top five industrial houses, including the Reliance Group, Tata Group, Adani Group, Aditya Birla Group and Bharti Telecom Group, should be dismantled. According to his paper, sharp rise in industrial concentration by companies in these groups since 2015 has allowed them to charge higher prices, leading to persistently elevated core inflation.

The paper measures concentration by the share of the “Top-5” industrial groups across the non-financial sector by assets or sales.

Industrial concentration in the pre-1991 period was led by public sector companies. Concentration fell in the post-liberalisation period as more and more industries were open for private sector participation. Public sector companies gave up their share to private companies. According to Dr Acharya, in recent years (particularly since 2015), concentration by the private “Top-5” industrial groups has increased across many segments of the non-financial sector, notably in metals, non-metal and minerals, chemicals, petroleum, retail trade and telecommunications.

Prior to 2015, these industrial groups increased their presence in more and more sectors and since 2015, they acquired larger shares in the sectors they were present.

The paper argues that greater dominance allows the “Top-5” industrial groups to charge prices much above the input costs. Measured in terms of “mark-up”, which shows the extent of rise in product prices in response to a 1 per cent rise in input costs, the paper shows that mark-ups by the Top-5 have risen significantly in the past few years.

While the paper raises some important questions and looks at a number of industries within the non-financial sector, we start by looking at one sector — metals — to gather evidence of growing concentration and consequent pricing power.

Has concentration increased in the metals segment

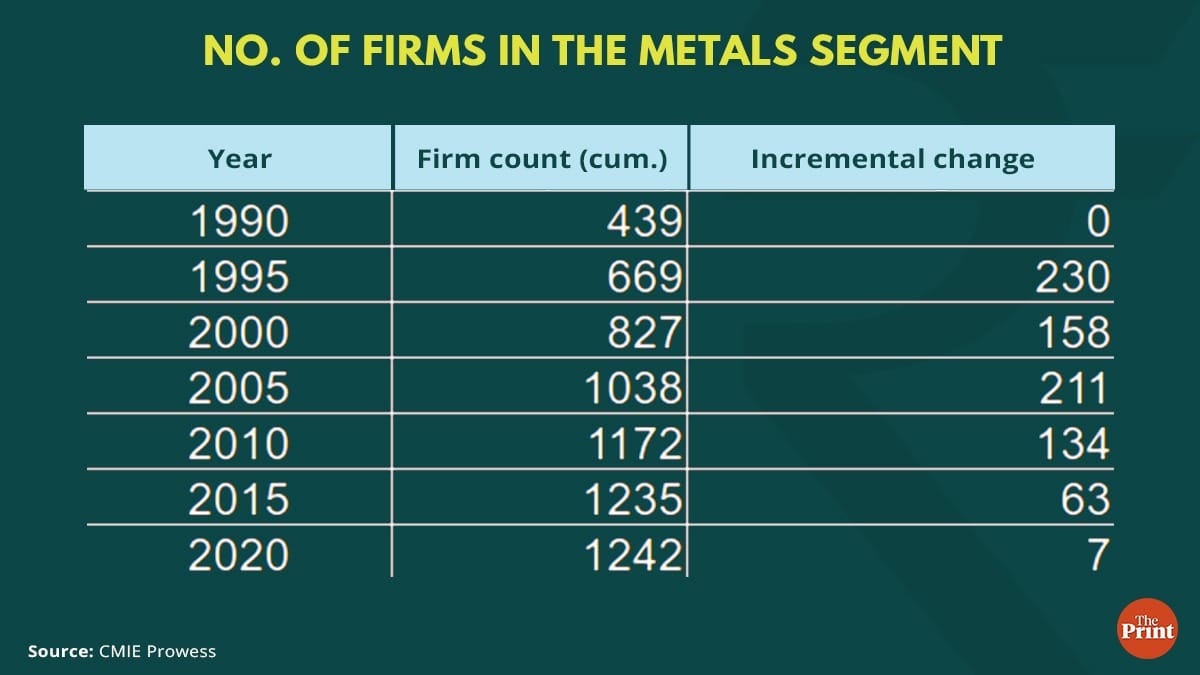

A simple measure to assess if the concentration in this sector has grown over time is to look at the number of firms in this segment from 1991 to the present period. Growing concentration should have resulted in entry barriers. However, the number of firms in this segment has grown over time. As of 1991, there were 439 firms in the metals segment. By 2020, the number rose to 1,242.

It is true that the pace of addition of new firms in this sector has slowed in the past five years. But this could be on account of a number of factors, such as the broad-based investment slowdown, and multiple shocks such as demonetisation, Covid pandemic and the Russia-Ukraine war.

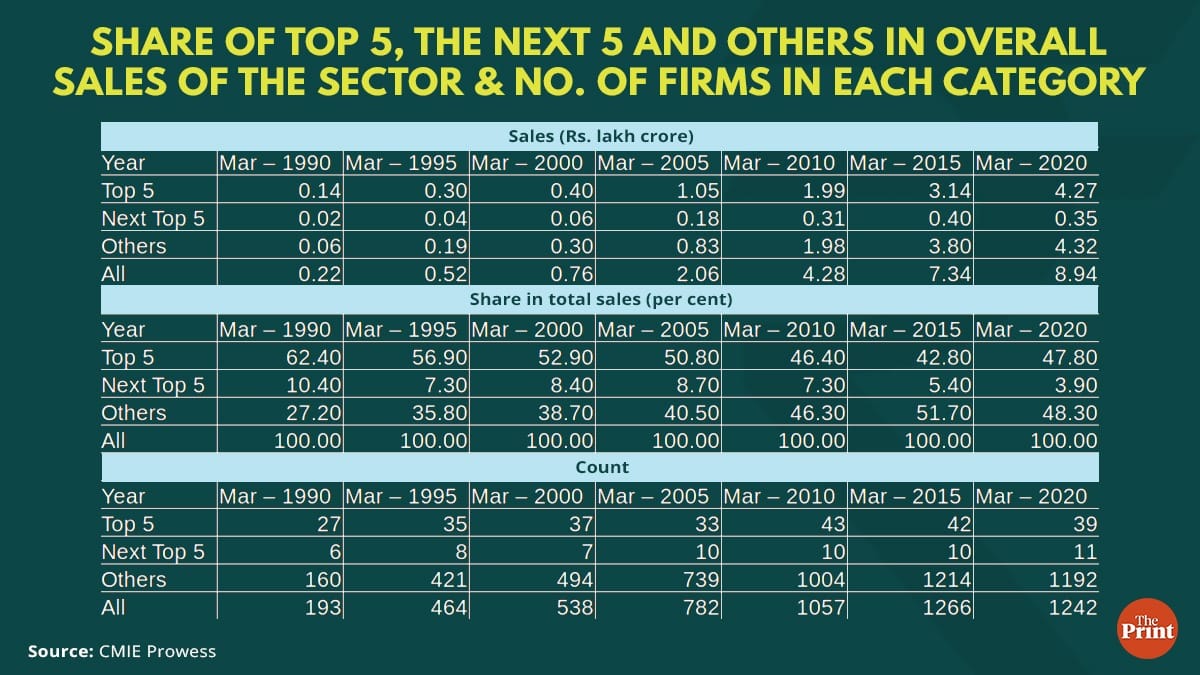

Next, we look at the metric that is used in the paper, i.e., the share of the top 5 in the total sales of the sector. More specifically, we analyse the share of the top 5 in the overall sales of the metals segment since 1991.

To present a more comprehensive picture, we analyse the share of the top 5, the next 5 and the remaining firms (“others”) in the segment. We find that the share of the top 5 firms in the overall sales of metals has fallen from 1991 till 2020. The share of the top 5 in the overall sales was 62 per cent in 1991. This fell to 47.8 per cent in 2020. In contrast, the share of “others” has risen to 48 per cent in 2020 from 27 per cent in 1991.

The wedge between the shares of the top 5 and others has fallen over time.

While the share of the Top-5 has increased from 42.8 per cent in 2015 to 47.8 per cent in 2020, it is important to take note of the shocks that rocked the economy during this period. Barring 2020, this was also a period when investment in infrastructure was subdued.

Understandably, the smaller firms would have been impacted disproportionately by these shocks. It is only in the post-Covid period, with economic recovery gaining momentum, that firms other than the top 5 can begin to see a rise in their share in overall sales. In a nutshell, the claim that concentration by the Top-5 has increased should not just be based on the recent five years. The trends of the previous 15 years should also be considered.

Do Indian companies have pricing power in all sectors?

Indian firms may not have pricing power in all the sectors. Particularly in sectors that involve production of tradables, Indian companies are price takers.

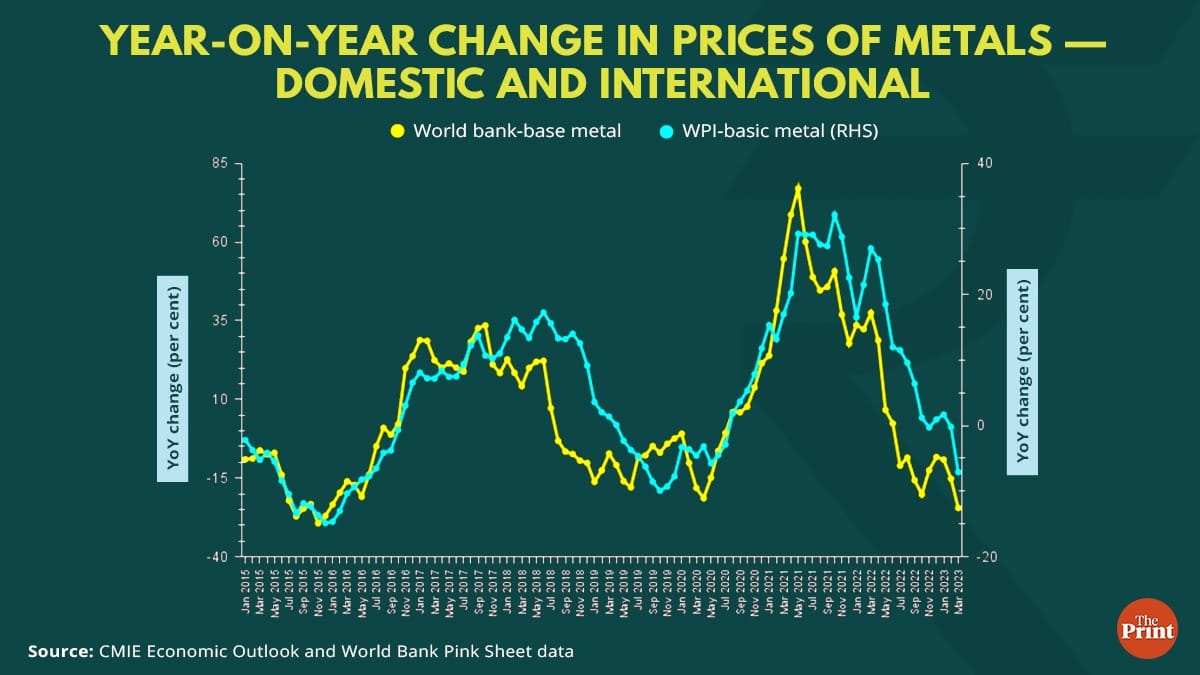

For instance, in metals, Indian companies may not have a strong pricing power as domestic prices are influenced by global prices. The graph below shows the year-on-year change in aluminium prices, using Hindalco’s prices as a proxy for the domestic market and data from the World Bank as a proxy for global aluminium prices. The two prices are seen to move in tandem. In fact, in some periods, it is the global price of aluminium that exceeded the domestic prices.

Pricing power in such sectors could emerge only if there are higher tariff barriers, but tariffs in this sector are between 2.5-10 per cent, which fall to 0 under a Free Trade Area (FTA). Thus, in sectors where domestic producers face stiff competition from imports, the scope of pricing power through higher mark-ups may be limited.

For the metal sector as a whole, inflation as measured by the year-on-year change in Wholesale Price Index (WPI) is seen to co-move with global inflation.

When domestic prices show such a high correlation with international prices, the claim that the “Top-5” in the sector have higher pricing power and that has resulted in elevated core inflation may not be true. Core inflation has remained elevated for long and has little to do with the pricing power of the “Top-5”.

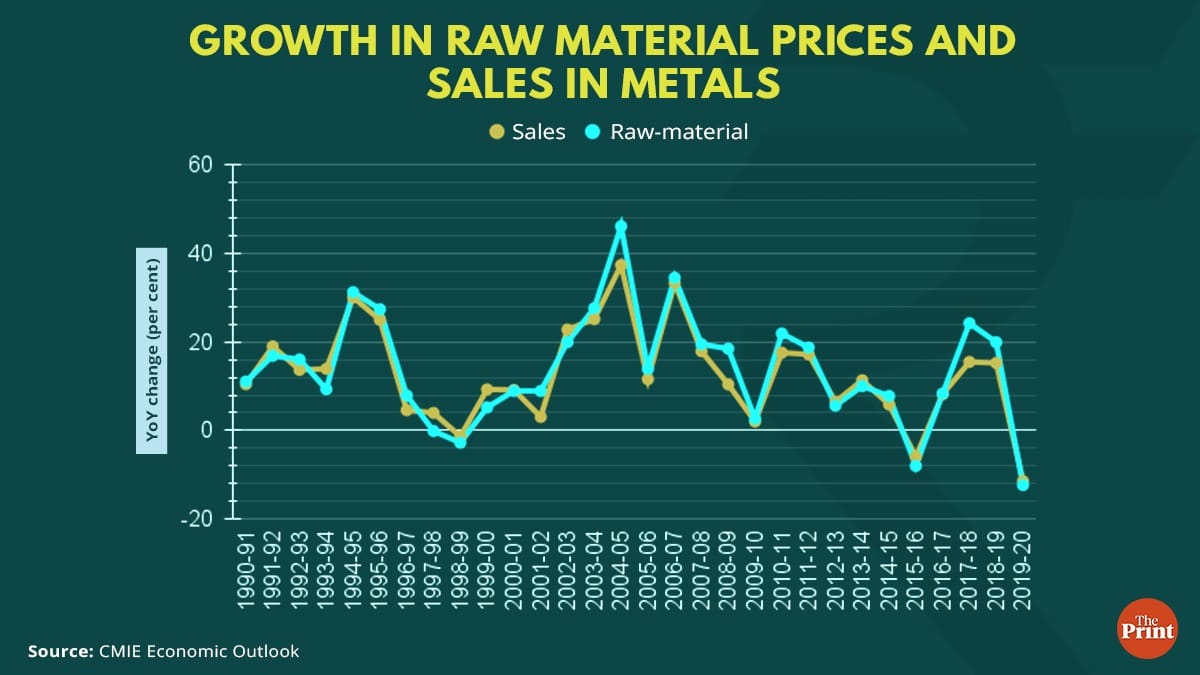

Overall, in the metal segment, the raw material prices and sales are seen to co-move. In fact, the growth in sales has been muted as compared to the growth in raw material prices.

The question of abuse of market dominance and pricing power should be left for consideration by the Competition Commission of India.

The Competition Act, 2002, prohibits anti-competitive agreements, abuse of dominant position by enterprises and regulates combinations (acquisition, acquiring of control and mergers & acquisitions), which causes or is likely to cause an appreciable adverse effect on competition within India.

In the past, the CCI has launched investigations and fined companies for anti-competitive conduct. Thus, any recommendation relating to the dismantling of the Top-5 should first be preceded by demonstration of appreciable adverse impact on competition.

Radhika Pandey is a Senior Fellow and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: IMF’s growth downgrade is noteworthy, but developing nations’ rising debt levels demand attention