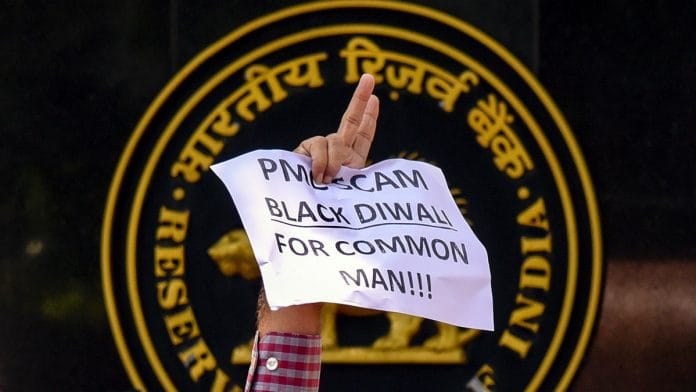

New Delhi: The Delhi High Court Tuesday pulled up the RBI for leaving it to scam-hit PMC Bank to decide which emergencies cited by its depositors were to be considered for disbursal of Rs 5 lakh to them, saying since the central bank imposed the restrictions it should have been the one taking the decision.

Punjab and Maharashtra Cooperative Bank has been put under restrictions, including limiting withdrawals, by the RBI, following the unearthing of a Rs 4,355-crore scam.

“The Reserve Bank of India (RBI) was to apply its mind and not act as a post office. If you (RBI) have imposed the restrictions, then you have to apply your mind. You cannot accept what PMC bank says as gospel truth. You cannot leave it to PMC bank to decide to whom it will disburse funds.” said a bench of Chief Justice D N Patel and Justice Prateek Jalan.

“This is not satisfactory. You cannot leave it to the PMC bank to decide. There has to be some way to monitor it. something independent of the administrator (appointed by RBI),” the bench added.

The court was hearing an application by consumer rights activist Bejon Kumar Misra seeking directions to the RBI to consider other needs of PMC bank depositors such as education, weddings and dire financial position, not just serious medical emergencies as being done at present.

The application was filed through advocate Shashank Deo Sudhi in Misra’s main PIL seeking directions to the RBI to ease the moratorium on withdrawals from PMC Bank during the coronavirus pandemic.

During the hearing on Tuesday, the bench told RBI that “there should be a valve open so that depositors can access their money” and asked it to consider gradually increasing the cap on withdrawals from its present limit of Rs 1 lakh per account.

The bench also told RBI that there should be a grievance redressal mechanism in place to address grievances of depositors who are not satisfied by the decision taken by PMC bank or the administrator appointed by the top bank.

The court also told Misra that while the depositors need to have some recourse, the restrictions on withdrawals cannot be removed as then PMC bank would go under and then no one will get any money.

“We have to strike a balance. There is limited corpus available with PMC bank. Therefore, there has to be a gradation of the difficulties being faced by the depositors,” the bench said.

The court gave RBI four weeks time to file its reply to the application and listed the matter for hearing on January 4, 2021.

The court on May 28 had asked the Centre, the RBI and PMC Bank to appreciate the difficulties faced by the depositors on withdrawals during COVID-19 pandemic.

Also read: RBI & Modi govt mustn’t let corporates into banking sector without improving supervision