New Delhi: Government-run oil companies have now seen three consecutive quarters — or nine months — of profits, and international oil prices are also well below their peak levels. However, it is unlikely that these companies will cut the rates at which they sell fuel to the public, energy sector analysts have told ThePrint.

The pricing of fuel in India is plagued by three incongruities arising out of government policy.

The first is that fuel prices have not changed since 22 May, 2022, even though they should be changed daily, going by the dynamic pricing policy adopted by the Centre in 2017.

The second is that, while the government says the oil marketing companies (OMCs) set the price of petrol and diesel, the OMCs direct all pricing queries to the petroleum ministry, leading to lack of clarity on who is deciding the prices.

The third incongruity is that while OMCs were allowed to recover the losses they had incurred last year — when they had absorbed the brunt of high oil prices without passing them on to the public — they are still not reducing fuel prices even though they are all back in significant profits.

Also Read: You thought petrol, diesel prices would soar after UP polls? This is why they have not

What about ‘immediate relief to consumers’?

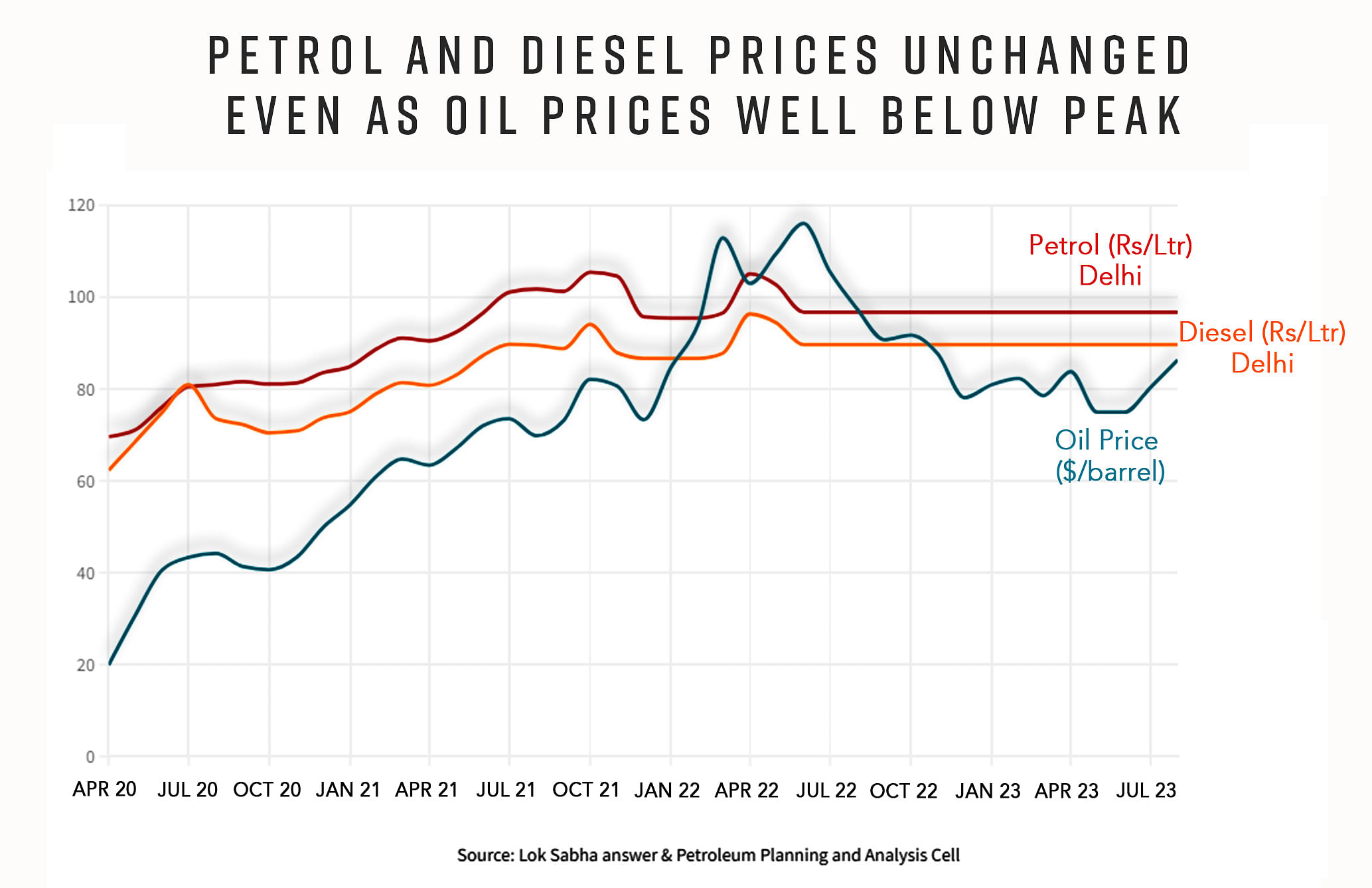

An analysis by ThePrint of fuel and oil price data from the Petroleum Planning and Analysis Cell (PPAC) of the central government shows that oil prices peaked at $116 a barrel in June 2022, at which point petrol was priced at Rs 96.7 a litre in New Delhi.

By June 2023, a year later, oil prices had dropped to $74.9 a barrel, and yet petrol prices were kept unchanged for this entire duration at Rs 96.7 a litre.

The latest data shows that oil in August cost $86.3 a barrel. While this is higher than the June 2023 level, it is still 25 per cent lower than the peak last year — and yet the price the public pays for fuel has changed zero per cent.

These static fuel prices are significant because the government had in June 2017 adopted a dynamic pricing mechanism where fuel prices were to be changed on a daily basis in response to oil prices.

At the time, this move was praised by then petroleum minister Dharmendra Pradhan, who said it would ensure that there would be “no sudden shock when (oil) prices rise” and would also provide “immediate relief to consumers in case prices fall”.

The control of fuel prices over the last year shows that the pricing authorities are trying to achieve at least half of these goals — of protecting consumers against upward spikes in oil prices — by keeping fuel rates unchanged rather than allowing them to be adjusted daily.

The other aim of the dynamic pricing policy, of providing “immediate relief to consumers” in case oil prices fall, is not being achieved since the decrease in oil rates is not being passed on to the public.

There has also been no official announcement that the dynamic pricing mechanism has been abandoned.

Apart from this, the government has repeatedly told the public, and even informed Parliament this July, that prices of petrol and diesel are set by OMCs. However, when contacted, the oil marketing companies direct all queries on pricing back to the petroleum ministry.

ThePrint reached out once again to the three state-run oil marketing companies — Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation — for a comment on the subject, to no avail.

ThePrint has over the last year also repeatedly reached out via phone and email to the Ministry of Petroleum and Natural Gas for a comment on the fuel price issue, but received no response. This article will be updated if and when a response is received.

OMCs’ surging profits

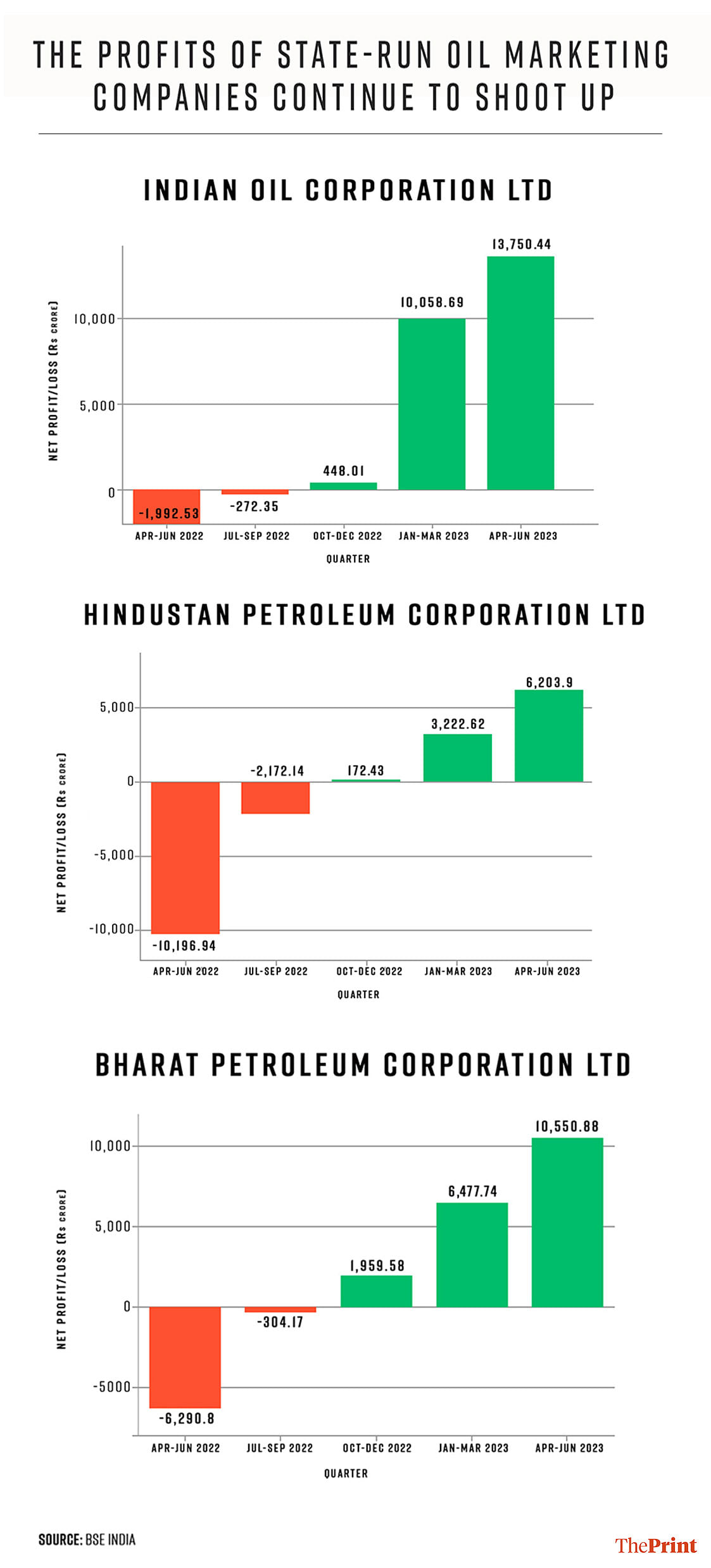

Petroleum minister Hardeep Singh Puri has previously defended the static fuel prices in India by saying that they would be reduced once oil companies make up the losses they had incurred last year.

In January this year, he was reported as saying: “I request the oil companies that, if international oil prices are in control and their under-recoveries have stopped, then reduce the oil (fuel) prices in India also.”

However, an analysis by ThePrint of the financials of the three state-run oil marketing companies shows that all three are now earning robust profits, and have been increasing their profits for the last two quarters.

Indian Oil Corporation earned a net profit of Rs 13,750 crore in the three-month period of April-June 2023. This is higher than the profit it earned in the entire financial year 2022-23.

Similarly, Bharat Petroleum earned a net profit of Rs 10,550 crore in the April-June 2023 quarter.

Only Hindustan Petroleum has not yet made up the losses it incurred in the last fiscal, and this is because it usually earns higher losses than the other two state-run OMCs.

“HPCL is the one oil company that usually takes more losses because it is the only one of the state-owned companies that sells more than it produces,” Deepak Mahurkar, partner at consulting firm PwC India, told ThePrint. “The difference is made up by buying from the other two companies, and so it makes more losses than them.”

Fuel price change ‘unlikely till 2024 elections’

Oil sector analysts ThePrint spoke to, both on and off the record, said that it is unlikely that the government or the OMCs will change fuel prices in the near future.

“Even though the oil companies have made up or are on track to make up their losses from last year, there is unlikely to be any major change in fuel prices in the near future,” Mahurkar said. “Looking into the affordability aspects of some parts of society, and inflationary containment, oil companies may not pass on the cost gain or loss to consumers, unless it’s significant.”

Other analysts believe that oil companies have made up their losses and are in a position to reduce fuel prices. However, they won’t because the government views fuel prices as a political tool.

“The OMCs are all back in strong profits, and even HPCL, which is yet to make up its losses from last year, will make them up soon,” a sector analyst from a leading consultancy firm told ThePrint on the condition of anonymity as he was not allowed to speak on politics.

“But fuel prices are political and the government wants to be able to suddenly slash prices just before the (2024 Lok Sabha) elections if it so chooses, like it did with LPG prices recently,” the analyst said. “Till then, the public will pay more for fuel than it needs to.”

(Edited by Nida Fatima Siddiqui)

Also Read: You think inflation is already high? Wait until petrol-diesel prices jump after elections