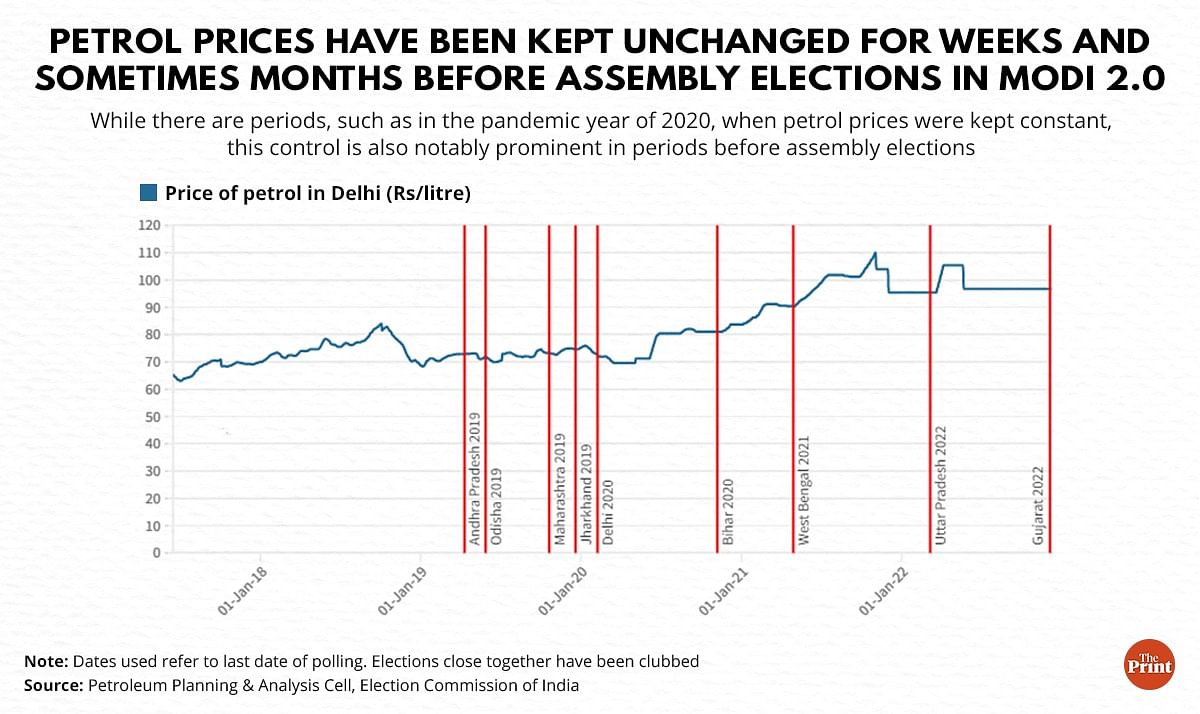

New Delhi: Rising oil prices have meant that the Modi government is increasingly abandoning a dynamic pricing reform it had adopted in 2017 and is now exerting more control over fuel prices. Troublingly, government data shows that fuel prices are being kept unchanged for weeks and sometimes months before assembly elections, only to be changed soon after.

Data from the oil ministry’s Petroleum Planning & Analysis Cell (PPAC) shows that petrol and diesel prices have increasingly been controlled recently. While some of these episodes coincide with periods of economic distress, such as in 2020 due to the Covid-19 pandemic and lockdown, the data clearly shows that most of the control is exerted in the months leading up to an assembly election, and relaxed once elections are over.

There also does not seem to be any clarity on who exactly is responsible for the setting of fuel prices. While ministers in the government say the pricing decisions lie with the oil marketing companies (OMCs), India’s largest public sector OMC — the Indian Oil Corporation — has told ThePrint that any questions related to pricing should be referred to the petroleum ministry.

Whoever is responsible for the pricing decisions, it is clear that it is the OMCs that are bearing the brunt, having to buy expensive oil and sell fuel at cheaper prices. This either poses a cost to the taxpayer in terms of bailouts that the government has to transfer to these companies, or it entails losses for the OMCs themselves.

Another fallout could be that, even with reducing oil prices now, fuel prices in India might remain high so these companies can recover their losses.

Also Read: You think inflation is already high? Wait until petrol-diesel prices jump after elections

High oil prices driving petrol price control

In June 2017, the government adopted a dynamic pricing mechanism for petrol and diesel that saw prices being changed on a daily basis as opposed to the previous system of fortnightly revisions.

At the time, the move was hailed by several ministers, including then petroleum minister Dharmendra Pradhan, who tweeted: “Proud to share that India is the first country to switch to dynamic fuel pricing on such a large scale in one go.”

In response to a user’s reply to this tweet asking what the benefit would be, Pradhan explained that the benefits would include transparency, protection from sudden shocks when prices rise, and immediate relief to consumers in case prices fall.

What the 2017 move meant was that petrol and diesel prices would, in theory, change every day in response to the change in the price of oil globally. While this was largely followed in the remainder of 2017, and in 2018 and 2019, rising oil prices meant that the control of fuel prices became an important political consideration from 2020 onwards.

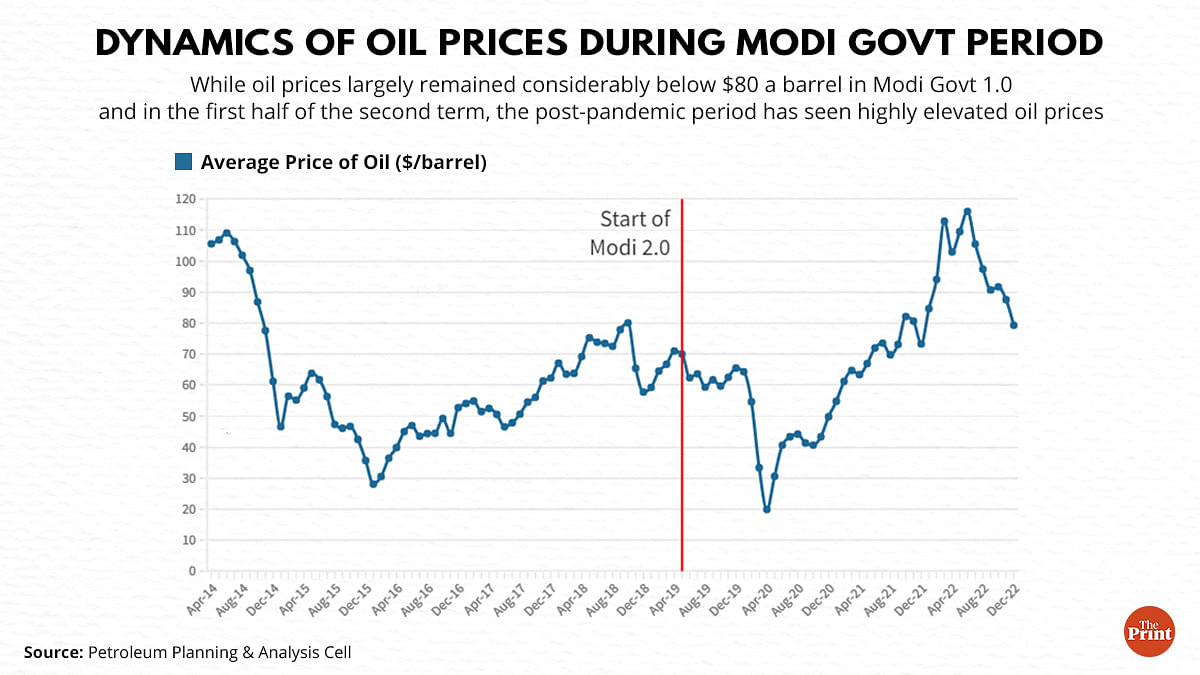

According to economists, there was no need for any sort of control over fuel prices — even on a fortnightly basis — during the first term of the Modi government because oil prices remained largely benign. PPAC data shows that the price of oil averaged about $60 a barrel over the five years of April 2014 to April 2019.

“Oil prices were low during Modi 1.0 and so the price of petrol was not a political tool, except when ministers used them to praise the management by the government,” a noted Delhi-based economist explained to ThePrint on the condition of anonymity, given the sensitivity of the issue. “It was only recently that petrol prices have become a tool they are using to influence voters.”

Indeed, the government data shows that the average price of oil fell even further to $53 a barrel in the April 2019 to April 2020 period. Thereafter, due to the pandemic-induced supply disruptions and the Russia-Ukraine war that started in February this year, the average price of oil shot up to $88 a barrel in April 2020 to December 2022.

Recent manipulation of fuel prices

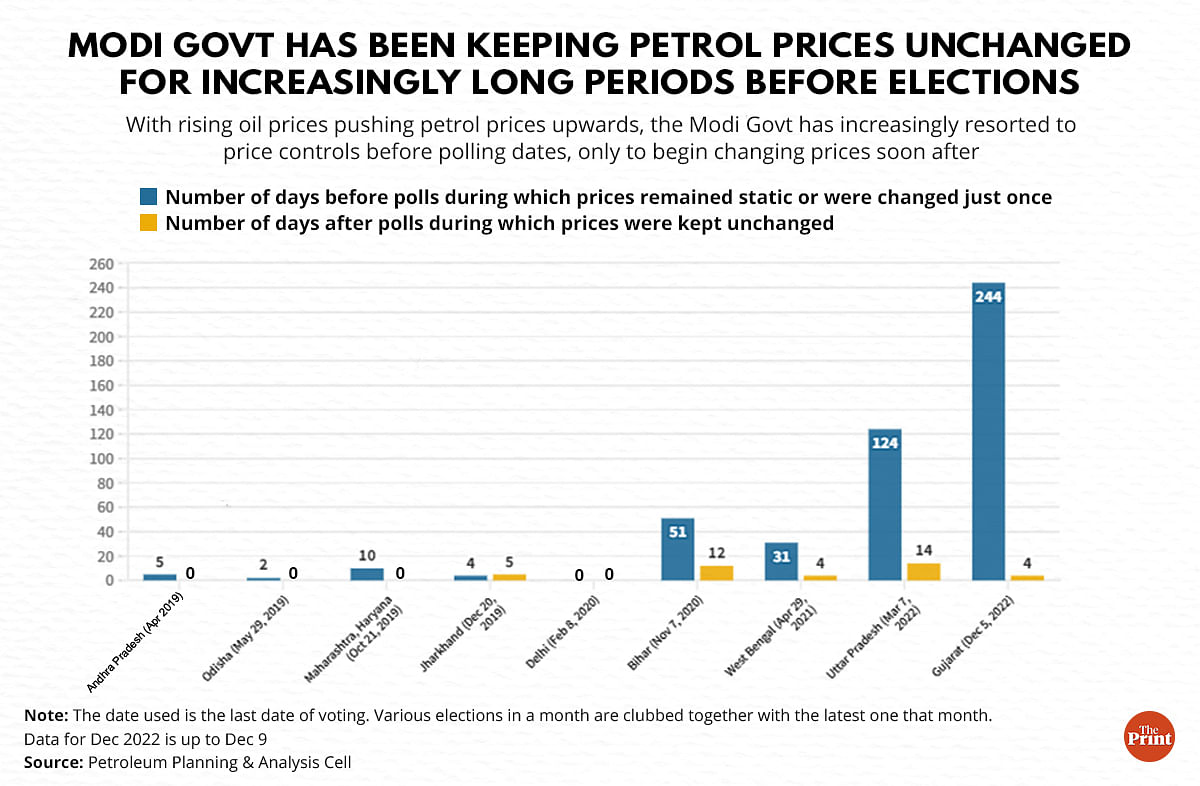

Data shows that fuel prices have been highly controlled recently, and that too for political purposes. For example, prices were kept unchanged for just five days before the assembly elections in Arunachal Pradesh, Andhra Pradesh and Sikkim in April 2019.

However, by the time the Bihar elections were held in November 2020, prices were kept unchanged for 51 days before the last date of polling, and began to be changed less than two weeks after.

Before the West Bengal elections in 2021, fuel prices were kept unchanged for 31 days before the last date of polling, and were changed just five days after.

This year, the duration of unchanged fuel prices rose sharply, in keeping with rising oil prices. Before the five assembly elections (Uttar Pradesh, Goa, Manipur, Punjab, and Uttarakhand) in February-March 2022, the last of which was in UP, prices were kept unchanged for a whopping four months prior to the last day of polling. Notably, the revision of prices resumed just two weeks after the elections got over.

The recently-concluded Gujarat elections saw a similar trend. The fuel prices were kept unchanged for more than eight months before the last day of voting (5 December). It remains to be seen for how long the prices will remain unchanged now that the elections are over.

“If the issue was providing relief to the consumers then what is the reason behind the prices being changed so soon after the elections are over,” the Delhi-based economist said. “The pattern of price changes makes it clear that the focus is elections and on influencing voters.”

“India does not have a full market pricing mechanism, there is still some administrative pricing,” Praveen Chakravarty, chairman of the data analytics wing of the Congress told ThePrint. “If it is administered to some extent, then when is it being administered?”

“Is it being administered for political purposes?” he asked. “In a democracy, I’m not sure that’s a surprise. If something is administered, ruling parties will tend to use it to their advantage.”

Also Read: Battling inflation & high fuel prices, 7 in 10 Indians against hike in GST rates, survey finds

Who is controlling the prices?

There is, however, some confusion over who is in charge of changing the price of fuel in India — the government, or the oil marketing companies.

The ministries have time and again said that the government itself does not have any control over the price of fuel. That is the domain of the oil marketing companies such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL), Hindustan Petroleum Corporation Limited (HPCL) and several others, they have said.

Back when he was petroluem minister, Pradhan had in 2018 said: “The government has no business to interfere in pricing mechanism of petroleum products which has been left to the oil companies to decide on a daily basis.”

More recently, in February 2021, Union Finance Minister Nirmala Sitharaman said that “technically, the oil prices have been freed” and that “the government has nothing to do, no control over it”.

She added that “it’s the marketing companies which import the crude, refine it then distribute it, put the cost for logistics and everything”.

This stand has been confirmed by the government this year as well. Petroleum Minister Hardeep Singh Puri in March this year asserted that “the oil companies will themselves determine the prices”.

However, when contacted by ThePrint, the spokesperson for Indian Oil Corporation said: “We have no comment on pricing. If you want to ask about pricing and other sensitive issues, please refer your questions to the petroleum ministry.”

ThePrint wrote to Puri’s office seeking comment, but did not get a response till the time of publishing this report. This report will be updated if a response is received.

Economic fallout of price control

When oil prices are high but fuel prices are kept low, the difference between them is borne by the oil marketing companies. That is, they are forced to buy expensive oil and sell fuel at lower prices, and so have to bear the brunt of that loss. This difference in the input cost and the selling price is referred to as ‘under-recoveries’.

If the government does not make fund transfers to OMCs — which is paid for using taxpayers’ money — then the OMCs themselves have to bear the brunt of these under-recoveries, which pushes them into losses.

“When we keep retail prices relatively constant, it works well for the consumers, but not for the taxpayers or the oil marketing companies because as long as the cost of procurement is not fully covered by the retail prices, the subsidy burden would increase, which would eventually have to be paid or else the oil companies bear losses,” explained DK Srivastava, chief policy advisor at consulting firm, EY.

“The government, sometimes, attempts to keep the prices stable either to protect the consumers or just before some election is due,” Srivastava added. “This compromises the efficacy of the dynamic pricing mechanism.”

OMCs reported consolidated losses of Rs 3,805.73 crore in the September quarter of this financial year.

The Union cabinet in October approved a proposal by the ministry of petroleum & natural gas to give a one-time grant of Rs 22,000 crore to three Public Sector Undertaking Oil Marketing Companies (PSU OMCs) — IOC, BPCL and HPCL.

While that grant was to help OMCs recoup under-recoveries made on the sale of LPG, the petroleum ministry is reportedly seeking additional funds for the OMCs to make up for the under-recoveries on the sale of petrol and diesel.

Another fallout of these under-recoveries is that fuel prices are unlikely to be lowered even though the price of oil is falling, since the OMCs will now use this period to make up for their previous losses.

“Keeping fuel prices unchanged for a while has meant that the oil marketing companies are suffering under-recoveries,” Deepak Mahurkar, partner at consulting firm PwC India, told ThePrint.

“Companies may also have gone into losses. However, the oil prices’ trend is looking benign now. Companies would expectedly recover costs first before allowing the trend to reflect in prices. In any case, in upward as well as downward crude price trends, it takes months for refiners to utilise the inventory bought,” he added. “That induces phase lag in price corrections.”

(Edited by Anumeha Saxena)

Also Read: You thought petrol, diesel prices would soar after UP polls? This is why they have not