New Delhi: The National Highways Authority of India (NHAI)’s borrowing spree to fund India’s massive highway expansion is set to force a sharp increase in its repayment burden over the next few years.

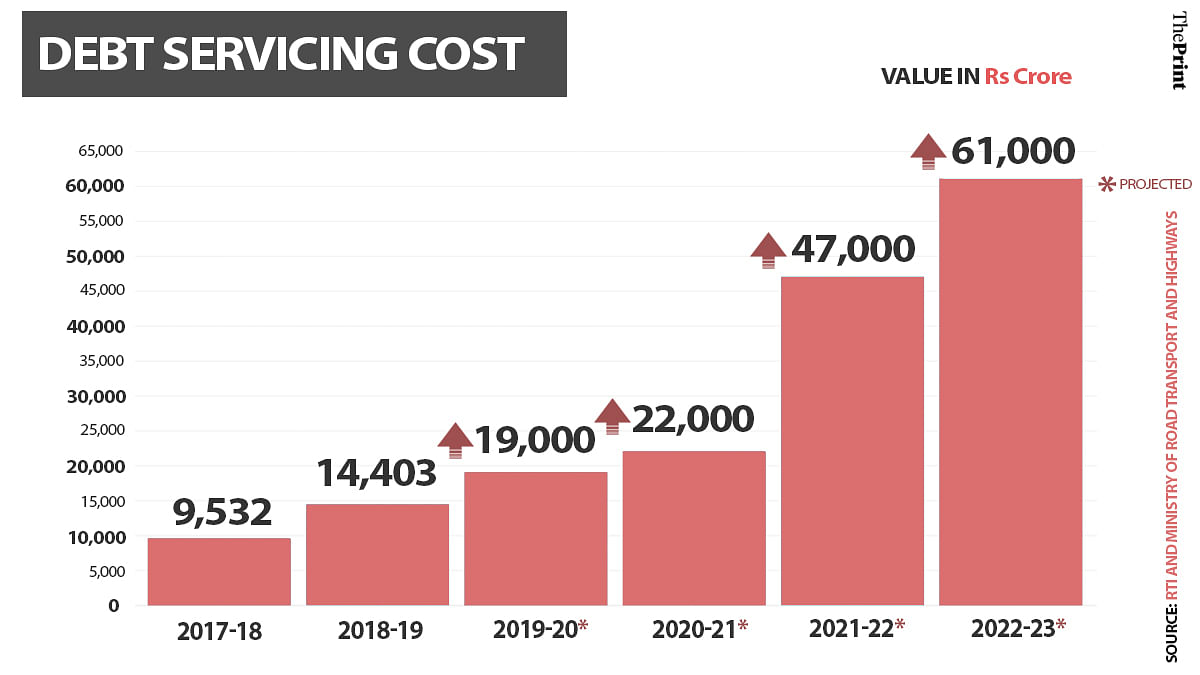

NHAI’s debt servicing cost is projected to shoot up nearly four times by 2022-23 — from Rs 14,443 crore (including Rs 4,281 crore principal repayment and Rs 10,122 crore interest) in 2018-19 to over Rs 61,000 crore then, according to data ThePrint accessed via RTI and the union road transport and highways ministry.

In the ongoing 2019-20 fiscal, the highways authority’s debt servicing will be over Rs 19,000 crore. With lower operational cash flow currently, the agency is using a part of its borrowing to service its debt.

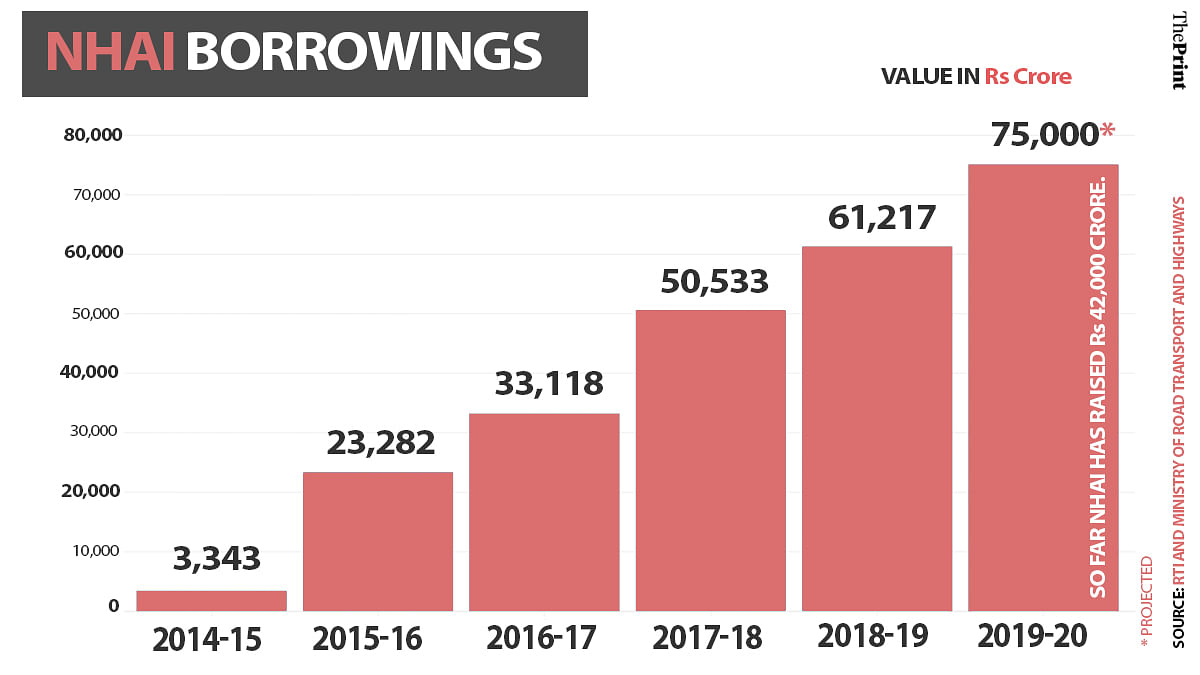

The central government’s main highway building authority has been forced to increasingly rely on market borrowings — up to Rs 61,217 crore in 2018-19 from Rs 3,343 crore in 2014-15, an increase of nearly 1800 per cent.

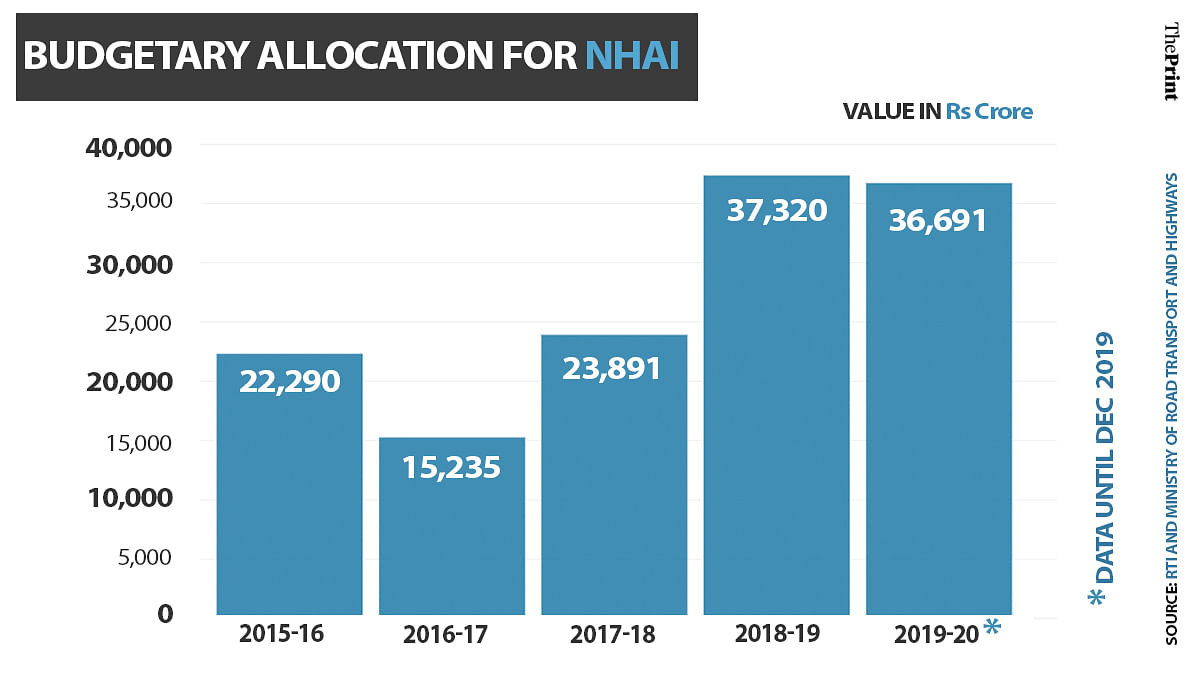

This, even as budget allocations rose by 67 per cent since 2015-16 amid an ambitious highway expansion programme.

In this fiscal, the NHAI’s total capital expenditure will be about Rs 1.4 lakh crore against a budgetary allocation of Rs 36,691 crore. While the authority was allowed to raise Rs 75,000 crore from the market, it has raised Rs 42,000 crore so far.

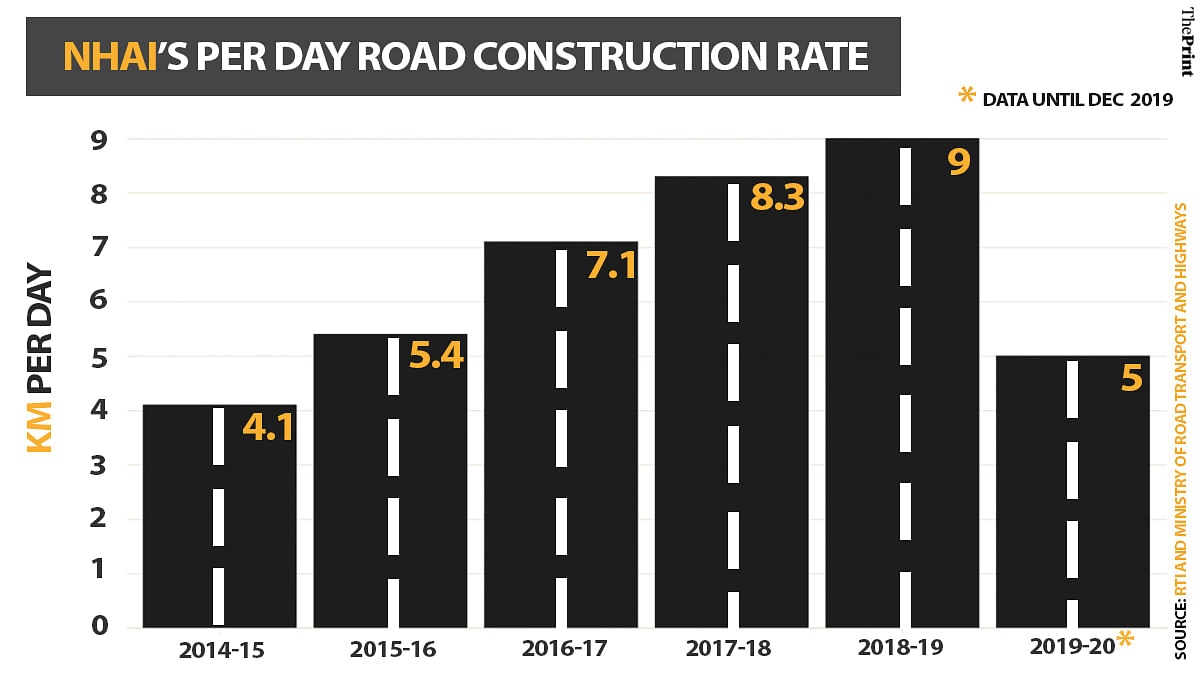

The increase in fund requirements, however, isn’t reflected in output with NHAI’s road construction hovering between 4.1 km per day in 2014-15 to 9 km per day in 2018-19.

In the current fiscal, NHAI has constructed a little over 1,900 km or 5 km a day against a target of 4,462 km or 12 km daily, according to road ministry data.

Sources said the authority has sought about Rs 61,000 crore in this week’s Union Budget 2020-21, but it’s uncertain if the finance ministry will agree to the demand. It has also sought lowering of its borrowing limit to Rs 65,000 crore in the next fiscal from Rs 75,000 crore this time.

Speaking to ThePrint on the risks, a senior road ministry official said, “NHAI’s borrowings have increased as more highways are getting constructed. Under the Bharatmala programme launched in 2017, over 34,000 km of highways have to be constructed by 2022. Budgetary allocations are merely not enough to meet the demand.”

Besides NHAI, the union road ministry, state Public Works Departments (on behalf of road ministry), and National Highways & Infrastructure Development Corp. Ltd (NHIDCL), another agency under the ministry, contribute to highway construction.

Also read: Modi govt built 1.5 km of highway per day in Northeast, up from 0.6 km per day by UPA

Risk of debt trap

As the NHAI’s debt-servicing costs balloon, the spike has caused concern among highway sector experts.

“If the trend continues and budgetary support does not increase, NHAI could run the risk of getting into a debt trap,” said a sectoral expert who didn’t wish to be named.

Road ministry officials, however, said NHAI finances are a bit stretched now but the burden will ease once private developers complete projects and hand it over to NHAI after 15-20 years when the concession period gets over. Private developers take up highway projects for a concession period during which they construct the road and recover their investment through toll collection.

“The borrowings will go down automatically. One must remember that NHAI does not build roads for profit. Also, the government is the sovereign guarantee for the borrowings. It will not let the NHAI default on its debt,” a road ministry official said on condition of anonymity.

Former NHAI chairman Brijeshwar Singh said the issue has aggravated as the highways sector has shown a slowdown.

“The traffic, which is basically dependent on industrial growth, has gone down. Also with the opening of the freight corridor, more freight will move from road to rail further shrinking the traffic,” he said.

Also read: Slowdown hits the road sector — toll revenues set to fall, Bharatmala costs could shoot up

Increase in borrowings

The Narendra Modi government has been ambitious about highway expansion, launching programmes like the flagship Bharatmala. But its allocation for NHAI hasn’t kept pace — from Rs 22,290 crore in 2015-16, budgetary support has increased only to Rs 37,320 crore in 2018-19. This fiscal, there was a 1.6 per cent reduction in allocation.

The cess on fuel, a part of which comes to NHAI for road construction, and toll revenue have fallen short to cover the capex, well over Rs 1 lakh crore. A massive jump in land acquisition costs has also increased expenditure.

Further, the authority’s finances have been hit by a large number of ongoing arbitration cases. As of December 2019, 318 arbitration cases with a claim amount of about Rs 78,653 crore are ongoing. In a few cases, the amount of claim raised by the contractor/concessionaire is more than the total project cost.

To meet its capex, the highways authority has had to rely on market borrowings, including issuance of capital gains tax exemption bonds and loans from the National Small Savings Fund.

“Private investment in highways sector is yet to pick pace. Also, NHAI has not been able to get the returns it expected from auctioning its completed projects to private players for operation and maintenance,” a second road ministry official said on condition of anonymity.

Singh told ThePrint that NHAI has limited operational cash flow to service the debt currently. “Instead of going for short-term borrowing, NHAI should try and tap the market for long-term bond. It should go for 10-15-year bond. Short-term borrowings for financing infrastructure don’t work very much.”

Crisil Infrastructure Advisory director Jagannarayan Padmanabhan feels that although NHAI’s finances are getting stretched, there is a need for the national highway expansion.

“The per km highway building cost is somewhere around Rs 6-8 crore but the commensurate revenue that NHAI gets through tolling is not in line with the capex.

“But once the highway network that is getting built touches, say, 2 lakh km and reaches the optimum mix, the capex will automatically go down. So will the borrowings,” he said.

Also read: Modi govt has done better than UPA on infrastructure but delays, cost overruns persist

Funny that the author hasn’t mentioned a word about resources other than budgetary allocation like the TOT model. Author seems to be either ignorant of the sector or has deliberately hidden facts just to show the Govt in bad light.

Small example here is giving where there is no necessity also constructing 4 lane ,service roads and underpasses.NH361 Tuljapur Ausa project spent around 1500 crores including land acquisition.Traffic is only maximum 5000 vehicles per day getting 3.5 lakhs per day income as toll.such uneconomical projects fraud assessments of construction causing increasing more debt in NHAI and ministry of transport.It is HAM project 60%fund beared by concessionair and 40% paid by NHAI.60% will be released in 15 years for concessinair with interest.900 croes project cost 600 crores land acquisition cost.initial cost for NHAI 600 +40% of 900 crores

Even spending that much quality work is poor.cracks are developing over PQC and drainage system failed.

Before three days transport minister said that there is no fund crises than how the officials are saying that there is debt

Minister Nitin Gadkari is always smiling.