Investors, fund managers are concerned with effects of govt pricing policies on ONGC’s share price, reimposition of subsidies and lower state-set prices.

New Delhi: India’s efforts to sell a $1.6 billion stake in Oil & Natural Gas Corp. (ONGC) has run into concerns that government policies on fuel pricing would weigh on the state-run explorer’s share price, according to people with knowledge of the situation.

Investors and fund managers that met with Indian government officials during a United States (US) roadshow last month voiced concern that the government may reimpose fuel subsidies and that the nation’s state-set natural gas prices are too low, said the people, who asked not to be identified as the discussions were private.

The tepid response may further set back Prime Minister Narendra Modi’s plans to raise 800 billion rupees ($11 billion) by selling holdings in state-run companies during the fiscal year ending in March. His government has only been able to pull in about 92 billion rupees as of July 5. The 5 per cent ONGC stake being marketed would be worth about 112 billion rupees as of Tuesday’s closing price.

Finance ministry spokesman D.S. Malik didn’t answer a call to his mobile phone, while an ONGC spokesman declined to comment.

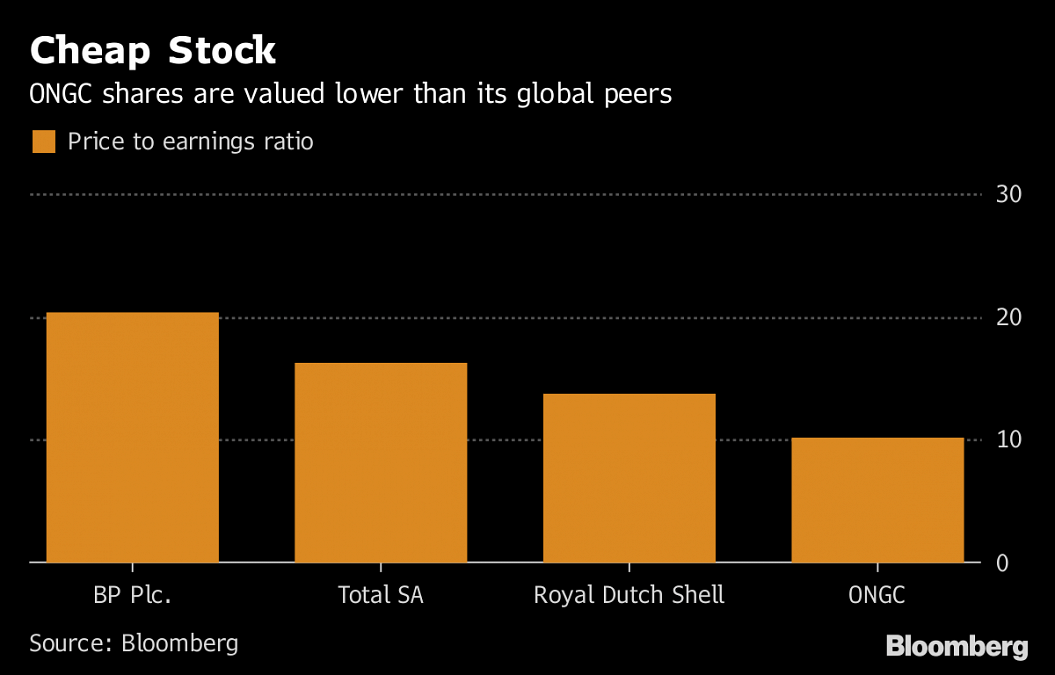

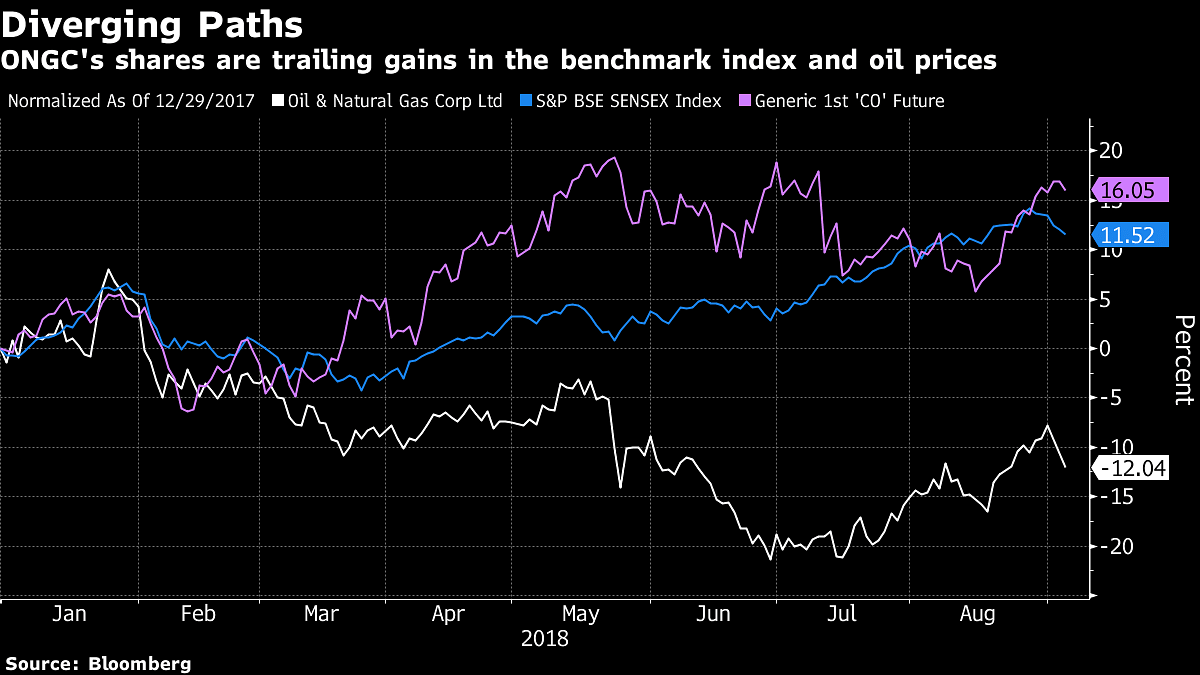

Shares in the company have declined about 10 per cent so far this year, while cash reserves have shrunk after it paid a record dividend and bought the administration’s stake in a refiner. In contrast, the benchmark index has rallied about 12 per cent, making it Asia’s best performer, while Brent, the benchmark for half the world’s crude, has climbed about 16 per cent. ONGC’s price-earnings ratio lag that of global peers such as BP Plc.

Rising crude prices coupled with the depreciation of the rupee is straining the government’s subsidy budget, ICICI Direct Research analysts said in a 3 August note. The government’s lower provisions for subsidies could lead to the possibility of ONGC sharing that burden, limiting the benefits of higher crude prices.

When fuel prices were set by the government, the explorer would share a portion of the subsidy burden by selling crude to refiners at a discount to compensate them partially for the loss in revenue. That ended when the government freed up retail prices of gasoline in 2010, followed by diesel in 2014. It continues to control prices of kerosene and liquefied petroleum gas.

The government’s 208 billion rupees provision for kerosene and LPG subsidies is “clearly inadequate,” Jefferies India analysts led by Somshankar Sinha said in a note last month.

The pattern of price changes by state-run refiners have also led to speculations that they may be influenced by political issues. Earlier this year, refiners didn’t change retail fuel prices for three weeks, despite higher international crude costs, and increased them only after elections in a southern state key to Modi’s coalition ended.

The government holds about 67.7 per cent in the explorer followed by state-owned Life Insurance Corp.’s 9.2 per cent stake. Two other government-owned companies Indian Oil Corp. and GAIL India Ltd. own about a combined 10 per cent stake in ONGC. The government last sold a 5 per cent stake in the company in 2012, most of which was bought by Life Insurance Corp. after interest from other buyers failed to materialize.- Bloomberg