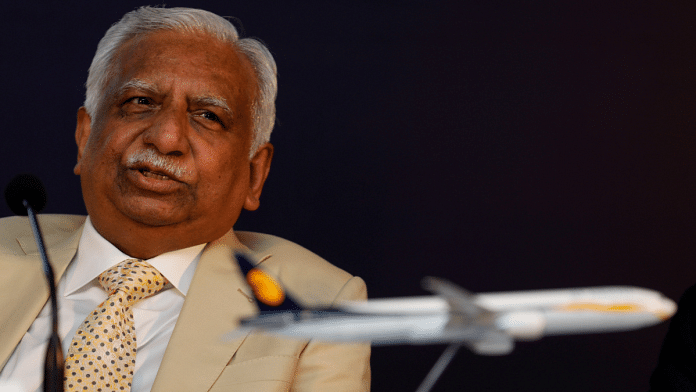

New Delhi: Diversion, misappropriation and siphoning off funds, defrauding Canara Bank of Rs 538.62 crore — these are the allegations the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED) are probing against Jet Airways India founder chairman Naresh Goyal and others, ThePrint has learnt.

The ED Friday arrested Goyal in connection with the bank fraud case after recording his statement.

The ED’s probe is based on a case registered by the CBI in May after a written complaint by the chief general manager of Canara Bank, Recovery and Legal Section, Mumbai accusing Jet Airways, Naresh Jagdishrai Goyal, his wife Anita Naresh Goyal, Gaurang Ananda Shetty and unknown public servants of causing wrongful loss of Rs 538.62 crore to the bank.

Following a preliminary inquiry, an FIR was registered under sections of cheating, criminal conspiracy, criminal breach of trust and criminal misconduct. ThePrint has a copy of the FIR. The ED, on the other hand, is investigating a case of alleged money laundering.

Goyal has previously denied any allegations of wrongdoing.

According to sources in the CBI, the matter came to the fore after the State Bank of India (SBI) on behalf of a consortium (a group of lenders from which JIL had taken loans), mandated Ernest and Young to conduct a forensic audit of JIL for the period from 1 April 2011 to 19 June 2019.

Canara Bank alleged that it had sanctioned credit limits and loans to Jet Airways India Ltd (JIL) to the tune of Rs 848 crore, of which Rs 538 crore was outstanding.

According to the CBI, the company was sanctioned a working capital of Rs 126 crore and an inland letter of credit or financial bank guarantee limit of Rs 100 crore for various purposes.

It also got a term loan of Rs 400 crore for meeting operational expenditure and Rs 200 crore for aircraft reconfiguration, introduction of new routes, business promotion, brand building and other related exercises of business expansion.

But from August 2018, the company allegedly started claiming that it was facing liquidity and operational issues and was not able to service its payment or repayment obligations.

According to investigators, the forensic audit of Jet Airways’ accounts revealed fraudulent features such as diversion and siphoning of funds to related parties, general selling agents and a subsidiary company.

The company’s account was declared as fraud and reported to the Reserve Bank of India (RBI) on 29 July 2021 for defrauding Canara Bank and e-Syndicate Bank together of Rs 728.66 crore. Of the 728.66 crore, Rs 538 crore pertains to Canara bank and Rs 190 crore to erstwhile e-Syndicate bank, the FIR says.

Also Read: BJP, AIADMK demand TN minister Balaji’s removal as I-T dept raids 40 properties linked to him

Diversions, siphoning off funds

According to investigators, the forensic audit found that the related parties, as disclosed in the financials by JIL, were paid Rs 1,410.41, crore out of total commission expenses, which amounted to siphoning of funds from JIL.

The FIR says the company also paid Rs 403 crore to some agents for things that the latter should have paid themselves. The company also paid for the personal expenses of the Goyal family, it adds.

“As per the sample agreement of JIL, it was noted that the expense of General Selling Agents (GSA) was to be borne by GSA itself and not by JIL. But still, JIL paid various expenses amounting to Rs 403 crore to GSA, which is not in tune with the agreement. Moreover, personal expenses such as salaries of staff, phone and vehicle expenses of the Goel family were also paid by JIL,” a CBI source told ThePrint.

The FIR also accused the company of siphoning funds through Jet Lite India Limited (JLL), by way of making “advance and investing and subsequently writing off of the same by making provisions”.

This, sources said, was to maintain the books “in a certain way”.

“The company has diverted the funds for making transfers to the subsidiary JLL in the form of loans and advances and investments extended to the company,” the FIR says.

“It is observed that from 2011 to 2018, Rs 14,552 crore was given as loan to JLL and in return, Rs 13,529 crore was received from JLL,” it adds.

According to the FIR, provision was created for the loans given to JLL on a year-on-year basis. tte closing balance of loan amount was Rs 1,283.39 crore in FY 2011-12, AND by FY 2019-20 IT was Rs 2,547.83 crore, including the principal amount along with interest charged by JIL to JLL.

“No funds have been received by JIL from JLL post provision being made in their financials for 2017-2018 for loans and advances granted to JLL amounting to Rs 2,547.83 crore. The provisions were made by JIL mainly due to continued losses by JLL and JLL’s inability to turn around with its business operations,” the FIR says.

According to investigators, the stated reason in the agreement with JLL for extending the loan was to run the day-to-day operations of JLL smoothly without mentioning any specific purpose.

This, sources said, shows that JIL was transferring borrowed funds to subsidiary companies by any modalities and not utilising funds for the intended purpose.

“This is how they misappropriated the funds that they received as loans. They did not utilise it for the purpose they were borrowed for, and instead diverted,” a source said.

Also Read: ‘No plans to file for insolvency’: SpiceJet starts process to revive grounded fleet with $50 million

‘Suspicious transactions’

According to the FIR, the company also siphoned off funds through payments made for professional and consultancy expenses.

“It was noted that Rs 1,153.62 crore was incurred towards professional and consultancy expenses during the review period of 1 April 2011 to 30 June 2019. Out of these expenses, suspicious transactions to the tune of Rs 197.57 crore were identified in case of entities which were linked to JIL,” the FIR says.

According to the FIR, it was also observed that professional and consultancy expenses to the extent of Rs 420.43 crore out of Rs 1,152.62 crore were paid to entities whose nature of business was different from the service description in their invoices raised on JIL.

According to an ED officer, several transactions flagged by the bank point towards “cheating and misappropriation of funds by the borrower.”

“Siphoning of funds borrowed from banks and then utilising them for another purpose not related to the operations of the borrower is a violation of the terms of the loan agreement. Moreover, it is important to look at the money trail,” the ED officer told ThePrint.

(Edited by Richa Mishra)