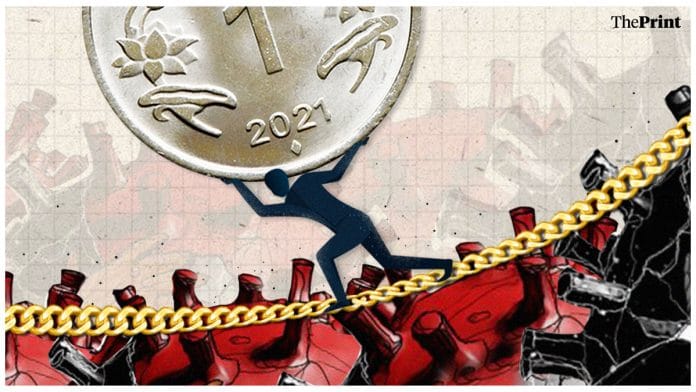

The second wave of the Covid-19 pandemic and the ensuing lockdown has hit household incomes sharply.

Households have survived to a large extent by borrowing. The Reserve Bank of India (RBI) data shows a sharp increase in households borrowing against gold. In addition to borrowing from the formal sector, there will have been borrowing, no doubt, from informal channels, for which there is no data.

The RBI data on credit shows a sharp increase in personal loans. In April, personal loans grew at 12.6 per cent. This double-digit growth in personal loans was driven by an 11.7 per cent rise in vehicle loans, 17 per cent higher borrowings through credit card and a sharp 86 per cent increase in loans against gold jewellery.

Outstanding loans against gold jewellery given by banks rose by 82 per cent to Rs 60,464 crore as of March. In the year-ago period, such loans were at Rs 33,303 crore. In April, the outstanding loans against gold jewellery rose further to Rs 62,238 crore.

The balance-sheet of Indian households is dominated by the presence of physical assets with a high composition of gold.

Also read: Gautam Adani’s has added $43 bn to his wealth this year but it is fraught with many risks

Pandemic distress

The economic distress caused by the pandemic has led to a rise in household indebtedness. Data for debt is only available for the first wave so far.

The RBI reports that household debt to GDP ratio rose to 37.1 per cent in the July-September quarter of 2020-21 from 35.4 per cent in the previous quarter of the fiscal.

Data for household debt for the second Covid wave will be available after a few quarters.

Household debt is estimated as households’ outstanding liabilities towards banks, housing finance companies and non-banking finance companies as a share of GDP. The monthly borrowing data suggests that indebtedness might show a significant increase in this period.

The personal loan data suggests that in the second wave, households are not spending on consumer durables as they did in the first wave.

So, for instance, in April, personal loans for consumer durables contracted by 18 per cent. The current data is in sharp contrast to the trend seen in the same period last year (April 2020) when loans for consumer durables witnessed a strong growth of almost 44 per cent.

This indicates distress borrowings by households amid a decline in their incomes. Many other households have resorted to borrowings against gold for meeting essential needs. This is in contrast to the pre-pandemic period when the motivation to borrow was for purchasing consumer durables for upgrading lifestyle.

Also read: Hit by Covid, cyclone & high fuel price, India’s fishing industry finds itself marooned

MSMEs are hit too

In addition to individuals and households, the small scale sector has also increased borrowing. Even though the lockdown led to a fall in demand, we find that credit to small and medium industries has seen a pick up.

While the overall non-food bank credit grew at merely 5.7 per cent, credit to medium industries registered a robust growth of 43.8 per cent as compared to a contraction of 6.4 per cent a year ago.

Credit to medium industries has seen a sustained double-digit growth since September 2020. This could be largely due to the government support to small industries during the pandemic.

To alleviate the distress caused by the pandemic, the government announced a Rs 3 lakh crore scheme called the Emergency Credit Line Guarantee Scheme (ECLGS) to address the working capital needs, operational liabilities and help in restarting businesses impacted due to the pandemic. Loans advanced to MSMEs under the scheme are fully guaranteed.

The objective of the scheme was to provide an incentive to banks to enable funding to MSME borrowers who were one of the hardest hit due to the pandemic.

As of February end, banks have sanctioned Rs 2.46 lakh crore of loans to 87 lakh MSME borrowers. The government recently eased the conditions for borrowings under the ECLGS scheme. The extension of loan restructuring scheme to MSMEs and other measures announced by the RBI is likely to further increase credit flows to MSMEs.

As the Covid second wave recedes and the lockdowns ease, households and small companies should be able to earn more and improve their balance sheets. The key is to open up slowly and carefully and vaccinate the population.

With already stretched balance sheets, these households and firms cannot afford more lockdowns. Their welfare will depend on the speed at which the population can be vaccinated.

Ila Patnaik is an economist and a professor at National Institute of Public Finance and Policy.

Radhika Pandey is a consultant at NIPFP.

Views are personal.

Also read: Global economy to rebound strongly but emerging, developing nations will struggle: World Bank