New Delhi: A rescue mission is underway at cash-strapped lender Lakshmi Vilas Bank as it becomes the latest Indian private bank to face a crisis.

With its capital adequacy ratio falling much below the prescribed regulatory requirements, and its shareholders voting out the top management, the Chennai-based bank is presently exploring the option of raising capital through options like rights issue, follow-up on public offer, a qualified institutional placement, or other routes.

The bank is also continuing talks with the Clix group exploring a potential merger, said Shakti Sinha, one of the three members of a Reserve Bank of India (RBI)-approved committee of directors, which is running the bank currently.

Clix Capital is a non-banking finance company that has a lending book spanning many verticals like education, business and home loans.

Speaking to ThePrint, Sinha said due diligence between Clix Capital and Lakshmi Vilas Bank is nearly complete and a capital raising committee at the bank is proceeding with the talks with the group.

“We are also exploring the parallel option of raising capital for the bank. The shareholders have approved expanding the authorised capital of the bank (from Rs 650 crore to Rs 1,000 crore). They have also given their nod for the bank to raise capital through a rights issue, FPO, QIP or other modes,” he said. “Capital is needed to grow the bank as well.”

The shareholder revolt

Lakshmi Vilas Bank has been in talks with the Clix group for a possible merger for the last few months. Earlier this month, it informed the stock exchanges that it had completed the mutual due diligence and was in talks for the next steps.

However, the deal came under a cloud after the shareholders of the bank voted out the managing director and chief executive officer as well as six other directors on the bank’s board.

The shareholders also voted out two directors who were part of the promoter group — N. Saiprasad and K.R. Pradeep.

The shareholders reposed their confidence in only three independent directors — Meeta Makhan, Shakti Sinha and Satish Kumar Kalra. These three now run the bank after the RBI gave its nod for the proposal to have a three-member committee of directors.

“There was a shareholder revolt and they voted out the MD and other directors. Only three of us were elected,” Sinha said.

Also read: Modi govt to seek cabinet approval to sell 25% stake in LIC in tranches

Takeover by state-run bank?

The central bank is exploring all options to protect the interest of depositors of Lakshmi Vilas Bank, including possible takeover of the beleaguered private sector lender by a state-run bank.

However, this option is likely to be exercised only if the proposed merger with Clix Capital does not work out.

An RBI spokesperson declined to comment.

Business Standard reported that Punjab National Bank, one of the top three state-owned lenders in India, has been sounded out by the RBI to take over the Chennai headquartered bank.

In a statement to the stock exchanges, PNB denied receiving any instructions from the RBI.

Sinha also declined comment on whether the RBI was exploring other alternative options for the bank including a merger for the state-run bank. “That is for the RBI to decide and act,” he said.

The troubles at Lakshmi Vilas Bank come months after another private sector lender, Rana Kapoor-promoted Yes Bank, was rescued from the brink of collapse as RBI superseded Yes Bank’s board and placed it under a moratorium.

Subsequently, the RBI initiated a rescue move that saw public and private banks led by the State Bank of India picking up stakes in Yes Bank to save the bank, maintain financial stability and retain depositor confidence. The bank is run by Prashant Kumar, RBI-appointed administrator and now the MD and CEO of the bank.

Also read: MPC appointments delay is unusual, but vacancies at the top of RBI & banks almost a norm

Financials of the bank

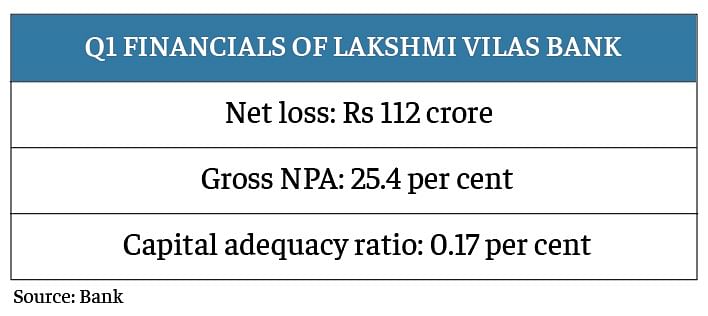

Lakshmi Vilas Bank has been consistently reporting losses. The bank reported a loss of Rs 836 crore in 2019-20. In the June-ended quarter of the current fiscal, it reported a loss of Rs 112 crore.

Its bad debts have also risen with the gross NPA ratio (bad debts as a percentage of the advances) at over 25 per cent. Its capital adequacy ratio also fell below 1 per cent to 0.17 per cent as of 30 June. This is substantially lower than the RBI’s minimum regulatory requirement of 9 per cent.

In addition, the bank’s return on assets — an indicator of the revenues earned by the bank through its assets — has been negative for three years.

In September last year, the RBI had placed the bank under the prompt corrective action (PCA) framework citing high levels of NPAs and inadequate capital. Curbs were also placed on the bank’s lending to corporate and other stressed and high risk sectors.

Any bank placed under the PCA framework faces restrictions on lending.

In a statement on 27 September, the committee of directors sought to assure depositors and shareholders of the bank about the health of the bank.

“The bank does not have an asset liability mismatch and is successfully fulfilling its commitments to deposit holders, bond holders, account holders and creditors,” it said. It added that the liquidity coverage ratio was as high as 262 per cent as against the RBI’s mandated 100 per cent.

Liquidity coverage ratio is an indicator of the bank’s ability to meet its short term outflows.

Who owns Lakshmi Vilas Bank?

Lakshmi Vilas Bank was founded in 1926 by seven businessmen, led by V.S.N. Ramalinga Chettiar in Karur, Tamil Nadu. The bank obtained its banking license from RBI in 1958.

As of 30 June, the promoter group held 6.8 per cent in the bank. The rest of the shares are held by the public, according to the shareholding pattern available on the website of the Bombay Stock Exchange (BSE).

The bank’s stock was down 6.45 per cent at Rs 18.80 on the BSE from its previous close of Rs 20.15 on Tuesday.

Also read: Tata vs Mistry fight will now be over the value of Tata Sons’ shares

Don’t merge LVB with PSB. All other old generation private sector banks are more or less in the same position.Today or tomorrow they may be another LVB.

Instead of merging with PSB, follow the Yes bank route.

Merger with INDIA BULL HOUSING could have resolved Working Capital problems of LVB. Now merger with CLIX CAPITAL is in the interest of share holders. When any commercial organization is closed, shareholder’s entire investment is eaten away. They don’t get a single Paisa. All the Agencies starts worrying for BANK’S LENDINGS only. In present days Share Price of many companies is rising especially PHARMACEUTICAL COMPANIES like VENUS REMEDIES, WANBURY, MARKSON PHARMA. Investors should now become cautious otherwise they will see their investment value as ZERO which has happened in the case of CONSTRUCTIONS COMPANIES, JEWELLERS COMPANIES like GITANJALI GEMS and AIRLINE

KINGFISHERS. WHY SEBI is not exercising proper control on the conducts of PROMOTERS/CEOS getting substantial salaries without actual increase in the profits of the COMPANY. The investors in our country are being looted because we have dishonest AUDITORS/CHARTERED ACCOUTANTS

How bank’s capital adequacy came down to 0.17% suddenly. It can’t happen overnight. It will take several years of loss to come to this level.

If a banks capital breaches 9 % mark RBI imposes PCA. Something is fishy. Why PCA was imposed so late – last year only. Many Public sector banks whose capital is just near 9% were put under PCA promptly.

MAY BE RBI FORGOT THAT THERE IS A BANK LIKE LVB IN INDIA. NOW ONLY THEY REALISED THAT LVB ALSO EXISTS AND IT HAS TO BE AUDITED.