As the economic carnage from the coronavirus pandemic continues, a long-forbidden word is starting to creep onto people’s lips: “depression.”

In the 19th and early 20th centuries, there was no commonly accepted word for a slowdown in the economy. “Panic” was the term typically used for financial crises, while long slumps were commonly called depressions. Presidents such as James Monroe and Calvin Coolidge used the d-word to describe downturns during their administrations. There was even a slump in the 1870s that many referred to as the “Great Depression” at the time.

But then 1929 came, and there was no longer any doubt as to which depression deserved the modifier “great.” The crash hit the entire world, reducing economic output 15%. And it ground on mercilessly for years — by 1933, unemployment in the U.S. was at 25%. The Great Depression was so severe that governments permanently expanded their role in the economy.

Since the 1930s, economists and commentators have used the word “recession” to describe economic slumps, and none of them have been nearly as severe as the Great Depression. The only time this convention was really challenged was after the financial crisis of 2008. The global nature of the downturn, sparked by troubles in the financial industry, led many to draw parallels with the Great Depression. In the end, the term “Great Recession” stuck.

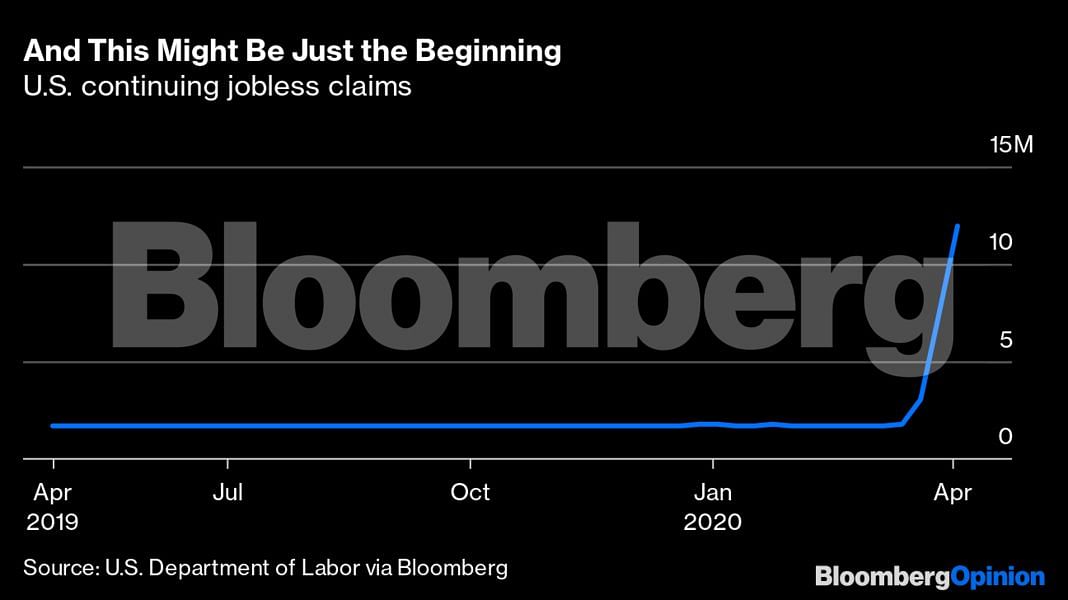

The economic damage from coronavirus, however, threatens to dwarf the 2008 downturn. More than 22 million people, or about 13% of the U.S. labor force, have already filed for unemployment:

Also read: IMF sees world economy in worst recession since Great Depression

Current forecasts are for the unemployment rate to reach 20% this month. Some predict it could go as high as 30% this year. That would eclipse even the Great Depression in severity.

So if severity alone is the criteria for a depression, this one will certainly deserve the moniker. President Ronald Reagan once quipped that “recession is when your neighbor loses his job; depression is when you lose yours.” There will be few people whose economic livelihoods are not hurt by the coronavirus.

But there are other possible criteria for deciding what gets labeled a depression. Besides severity, there’s duration; both the 1870s and the 1930s saw a decade of economic pain. Many hope that the economy will bounce back from the coronavirus in a so-called V-shaped recovery. It stands to reason that if the economy crashed because it was intentionally turned off by mandatory shutdowns, then letting people out of their houses will turn it back on.

Many of the economic relief measures now being implemented, such as the Paycheck Protection Program — which extends loans to small and medium-sized businesses that are forgiven if they retain their workers — have this sort of quick restart in mind. But while that’s a good idea, there are reasons to believe this downturn will not be over quickly.

First, there’s evidence that the main reason people are staying at home is not lockdowns but the threat of the virus itself. Data from online restaurant-reservation websites shows that in major cities, most of the decline in restaurant attendance happened before stay-at-home orders were issued. And polls indicate that most Americans are very wary of returning to their normal activities. This means that unless virus suppression regimes give people confidence that coronavirus isn’t a threat to their personal safety, they’re unlikely to come out and shop even if the government says there’s no need to worry. Because effective treatments probably won’t be available at least until the fall or later, that means many more months of business devastation except in the few competent and lucky places that get test-and-trace systems in place.

Next, there’s the global nature of the downturn. Gross domestic product is set to decline in almost every country. Some forecasters expect all economies to bounce back simultaneously, but a more likely scenario is that many countries will struggle to recover. That will hurt both U.S. export markets and international investors for years to come.

Finally, there’s the possibility of long-term financial market turmoil. In addition to severity and duration, a third common criterion for distinguishing depressions from recessions is that the former involves years of financial industry dysfunction and declines in lending.

The Federal Reserve is struggling mightily to preserve the solvency of U.S. banks and prop up asset markets, and so far it has succeeded. Interest rates are low, bank failures have not been widespread and stock markets have partly recovered:

But keeping banks on a government lifeline during years of business weakness, although better than the alternative of letting the financial system collapse, might still not equip the financial industry to do its traditional job of lending to productive enterprises. The threat of repeated coronavirus outbreaks, along with continued business failures, may make banks just as afraid to lend as they were after 2008.

Although the U.S. government can and should do its utmost to ensure that the coronavirus recession doesn’t check all the boxes for a depression, its powers to stop both the virus and the international slowdown are limited. Let’s hope this depression won’t last a decade, but an unprecedented slump followed by years of pain seems inevitable.

Also read: Will Modi cut a New Deal? Covid-infected economy can produce an Indian Roosevelt

This article is more hypothetical than Harry Potter. Complete absence of concrete facts which indicates the authors conclusion. Author’s speculative but without shred of proof except for partial, poor analogy.

It feels, this is not going to be a depression or a recession like to mean a long term slump just because demands are going to be less (the foremost indicator) but that the demands are going to be coming in a staggered way and this should create a wave of very likely shallow troughs or crests in the short term. The only sector which may get affected in the long term is probably the luxury side of consumption. Just because men and women are indoors, it should not imply their consumption habits will change overnight, if at all it will change, it will perhaps change the savings habit since the news-makers of epidemics and pandemics and wars are not going to disappear any time. People are going to come out fearful but not without hungry stomachs and as long as that hunger stays valid, we should probably be not overly pessimistic of economic recovery.

The uncertainity in the Financial markets will continue for the coming months until a vaccine for covid is developed. Even after that, pains of deglobalisation and relationship with Global suptspreader China will impact recovery. To be sure the rampant materialism of the past six decades or so will see a downwatd trend, meaning, Global GDP will settle at lower levels. GDP as a measure of success of a country will be replaced by other metrics.