New Delhi: The Reserve Bank of India (RBI) has unanimously decided to keep the policy repo rate unchanged at 6.5 per cent.

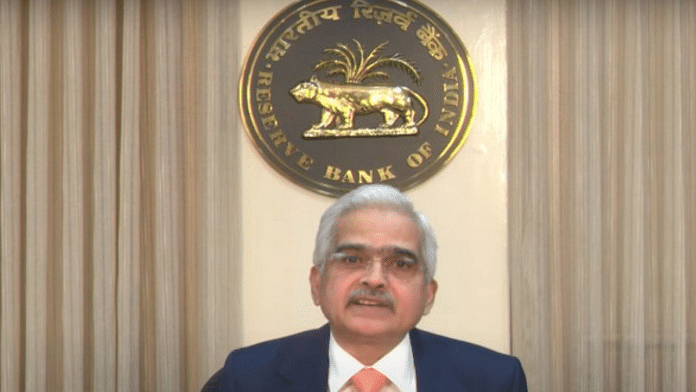

RBI Governor Shaktikanta Das announced the monetary policy committee’s decision Thursday, saying the key rate had been kept the same after detailed deliberations on all relevant aspects.

The MPC, which has three members from the central bank and three external members, decided to maintain the rates for the third consecutive time.

Das said the spike in tomato prices and rise in cereal and pulses have contributed to inflation in recent weeks, adding that vegetable prices may see “significant correction”.

The RBI, however, upped retail inflation projection to 5.4 per cent during the financial year 2024 from an earlier estimate of 5.1 per cent due to vegetable price shocks. For 2023-2024, the bank projected Q2 retail inflation at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent.

Das said crude oil prices have hardened in recent weeks and its outlook was clouded by demand supply uncertainties. He said the role of continued supply-side interventions were necessary in emerging trends and risks to price stability.

“I am happy to note that the Indian economy is exuding enhanced strength and stability despite the massive shocks to the global economy in recent years,” the Governor said after the MPC meeting Thursday.

He said the Indian financial sector has been stable and resilient “as is being reflected in sustained growth numbers”, adding the bank remained steadfast in its commitment to safeguard the financial system from emerging and potential challenges.

Das also said the level of surplus liquidity had gone up due to the withdrawal of Rs 2,000 banknotes, and dividends to the government.

“The flow of resources to the commercial sector has increased to Rs 7.5 lakh crore this year from Rs 5.7 lakh crore last year,” he said.

On the strength of the rupee, Das said it has been stable since January 2023 and that forex reserves had also crossed USD 600 billion.

He proposed to put in place a transparent system for the reset of interest rate on floating interest rate loans, citing a framework for allowing borrowers to switch to a fixed interest rate regime.

Also read: Who is Rao Inderjit Singh, ‘plain-speaking’ Union minister taking swipes at Khattar govt over Nuh