New Delhi: The government easing back on its disinvestment policy has helped create value for the public that holds stocks of government companies, whereas the previous policy had eroded that value, an analysis of stock market data shows.

The government has over the last few years realigned its disinvestment policy to focus on more than just the fiscal imperative of revenue generation, as Department of Investment and Public Asset Management (DIPAM) secretary Tuhin Kanta Pandey explained to ThePrint.

The previous policy was to focus single-mindedly on achieving high disinvestment targets, which actually led to the stock prices of the listed Central Public Sector Enterprises (CPSEs), also referred to as PSUs (public sector undertaking), falling even though the overall stock market was rising.

“If we have large disinvestment targets, the market will perceive that the government is going to do many more disinvestments to meet that target, and so the stock prices of CPSEs will remain low because investors believe that there will soon be a greater supply of those stocks,” Pandey explained in an interview to ThePrint.

“Not only that, but the existing holders of the stock will start selling them as the price remains low, which further moves the prices down,” he added.

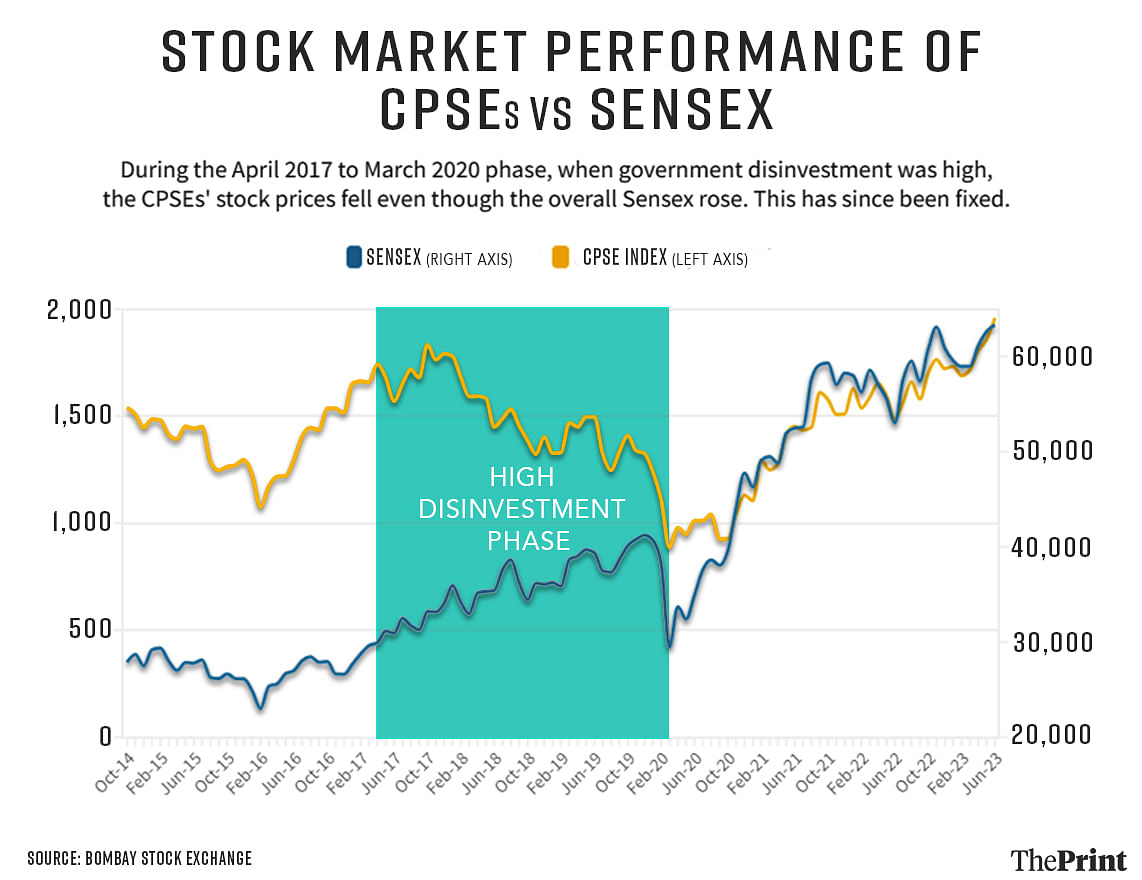

Pandey explained that this ‘price overhang’ effect was prevalent two to three years ago during the period when the government had undertaken significant disinvestment. An analysis of data from the Bombay Stock Exchange shows this to be true.

Also Read: Why the BSNL bailout is consistent with Modi govt’s unstated policy

Diverging paths

Prior to 2017, the index of the listed CPSEs was moving in tandem with the movement of the overall Sensex. That is, the stock prices of the listed CPSEs followed the same trajectory as the benchmark stock market index.

However, the financial year 2017-18 marked a shift in the government’s disinvestment strategy. It started setting high disinvestment targets and commensurately started selling more of its stock in CPSEs.

So, in 2017-18, it set a disinvestment target of Rs 72,500 crore and overshot it by earning more than Rs 1 lakh crore through disinvestments that year.

The next year, it set a target of Rs 80,000 crore and again overshot it by earning Rs 94,727 crore.

In 2019-20, the government set a target of Rs 1.05 lakh crore. It earned only half of this that year but then set an even higher target of Rs 2.1 lakh crore for 2020-21.

The Covid-19 pandemic in 2020 certainly impeded the government’s ability to earn through disinvestment, but this was also a period when the government itself realised it must change its disinvestment strategy.

What had been happening during the high disinvestment years, Pandey explained, was that people were expecting the government to sell its stake in various companies, and so were expecting a resultant increase in the supply of the stocks of those companies. When supply increases, prices fall.

The Bombay Stock Exchange data show that this indeed happened.

During the high disinvestment phase of 2017-20, the index of CPSE companies started falling even though the Sensex was rising. It was only after this phase, once the government eased back on disinvestments, that the two indices started moving in tandem again.

“Now we have corrected that (price overhang),” Pandex explained. “We received a lot of market feedback that people were voting with their feet, that they were getting out of CPSE stocks.”

“We have arrested that trend, and the CPSE index is now rising again, and for the last two years, it has grown more than the NIFTY and Sensex, but it is still only catching up,” he added.

The key to this turnaround, according to Pandey, was the government’s communication with the markets. Where earlier the communication was that the government was keen to sell its stake in CPSEs, the communication subsequently was that this would be done with greater care, regardless of what targets have been set.

“During this recovery period, we communicated effectively to the market that we would disinvest only when it was the right time,” Pandey explained. “Just because we have a target, we wouldn’t disinvest come what may.”

Credibility of numbers returned

Another step the government took was to improve the credibility of its disinvestment process. A major criticism of several of its past big-ticket disinvestments was that these were possible only because government-owned companies were buying up the stock that the government was selling.

For example, in 2018, the government-owned Oil and Natural Gas Corporation (ONGC) bought the government’s entire 51.11 per cent stake in Hindustan Petroleum Corporation Limited (HPCL). Similarly, there have been several reports of Life Insurance Corporation stepping in to buy the government’s stake in various companies it has tried to disinvest in over the years.

This, critics have said, does not amount to real disinvestment since the stake is still owned by a government-owned entity.

The government in April 2022 acknowledged that this was a problem and issued a memorandum prohibiting government-owned companies from buying the stakes in other government companies.

In its memorandum to all ministries and departments of the central government, DIPAM said that the government’s Public Sector Enterprises (PSEs) policy was aimed at minimising the government’s presence in the public sector companies across the economy.

“Therefore, transfer of management control from the Government of India to any other Government Organisation/State Government may continue the inherent inefficiencies of the PSEs and this will defeat the very purpose of the new PSE policy,” DIPAM said in its memorandum.

“As a general policy, PSEs are not permitted to participate in the strategic disinvestment/privatisation of other PSUs as bidders unless otherwise specifically approved by the central government in the public interest,” the memorandum added.

In this regard, a PSE is defined as where 51 per cent or more of the ownership is by the central government, state governments, or jointly by the central and state governments.

(Edited by Richa Mishra)

Also Read: India’s economic indicators telling a story—of growth, recovery, robustness