New Delhi: The government’s policy towards disinvestment is undergoing a marked shift in priorities, ThePrint has learnt. This shift involves moving away from a single-minded focus on meeting an annual disinvestment target to a calibrated approach involving balancing fiscal requirements with the government’s responsibilities to other stakeholders, a top government official said.

In a candid and freewheeling interview with ThePrint, secretary in the Department of Investment and Public Asset Management (DIPAM), Tuhin Kanta Pandey, explained that, while the government is going ahead with its privatisation plans under the Public Sector Enterprises Policy, progress on this will be gradual.

He added that the government is also looking at disinvestment through a broader lens than just the fiscal necessities. However, in doing so, it is also realising that there is limited scope for further disinvestment that does not involve outright privatisation.

Even with outright privatisation, which Pandey said the government is moving ahead with, the reality is that the process will be a slow one.

In May 2020, Finance Minister Nirmala Sitharaman announced an ambitious Public Sector Enterprises policy. Under the policy, the government would ensure it retained a bare minimum presence in certain strategic sectors.

In all the other sectors, the government made it clear it would be exiting from its businesses by either selling its companies or closing them down.

This seems to have now changed significantly.

“We are sticking to the policy, but to see actual disinvestment, it will have to happen slowly,” Pandey said.

A key part of the government’s change in stance has to do with its approach to balancing what it can earn by selling its stake in a company versus what it can earn through dividends paid by companies it has a stake in.

“The disinvestment strategy should not be looked at only from the angle of fiscal receipts,” Pandey said.

“It has a lot of objectives, of which fiscal consideration is one. Even from the fiscal receipts viewpoint, both disinvestment and dividend from Central Public Sector Enterprises (CPSEs) are important. We are taking a balanced approach now. We are saying that disinvestment and dividends should be looked at together,” he said.

“Up till recently, the focus has been one-sided on disinvestment, out of these two,” he added. “However, disinvestment of shares also means that future receipts on account of dividends are sacrificed. Therefore, a holistic perspective on the issue is important.”

To put it simply, what Pandey was saying is that the government has to make a choice between eating a chicken now or eating its eggs over the subsequent years. Until recently, the focus was only on eating the chicken now.

Also Read: The pains and gains of Modi’s reforms are deferred—GST, banks to demonetisation

Dividends and disinvestment both

This refocus on dividends is not just in words. In November 2020, DIPAM issued an advisory to the CEOs and Managing Directors of all CPSEs on a “consistent dividend policy”.

According to guidelines issued in 2016, CPSEs were to pay 30 per cent of their profit after tax, or 5 per cent of their net worth, whichever was higher, as dividends to their shareholders.

In its November 2020 advisory, the government informed the heads of the CPSEs that it had noticed that the public sector companies were only paying the minimum levels of dividends, which needed to change.

“CPSEs are advised to strive to pay higher dividends taking into account relevant factors like profitability, capex requirements with due leveraging cash/reserves and net worth,” it added.

In other words, the government was asking the CPSEs to pay more attention to their finances so that they had enough profits to pay dividends, and that these dividend payments should be more than they had so far been.

The advisory paid off.

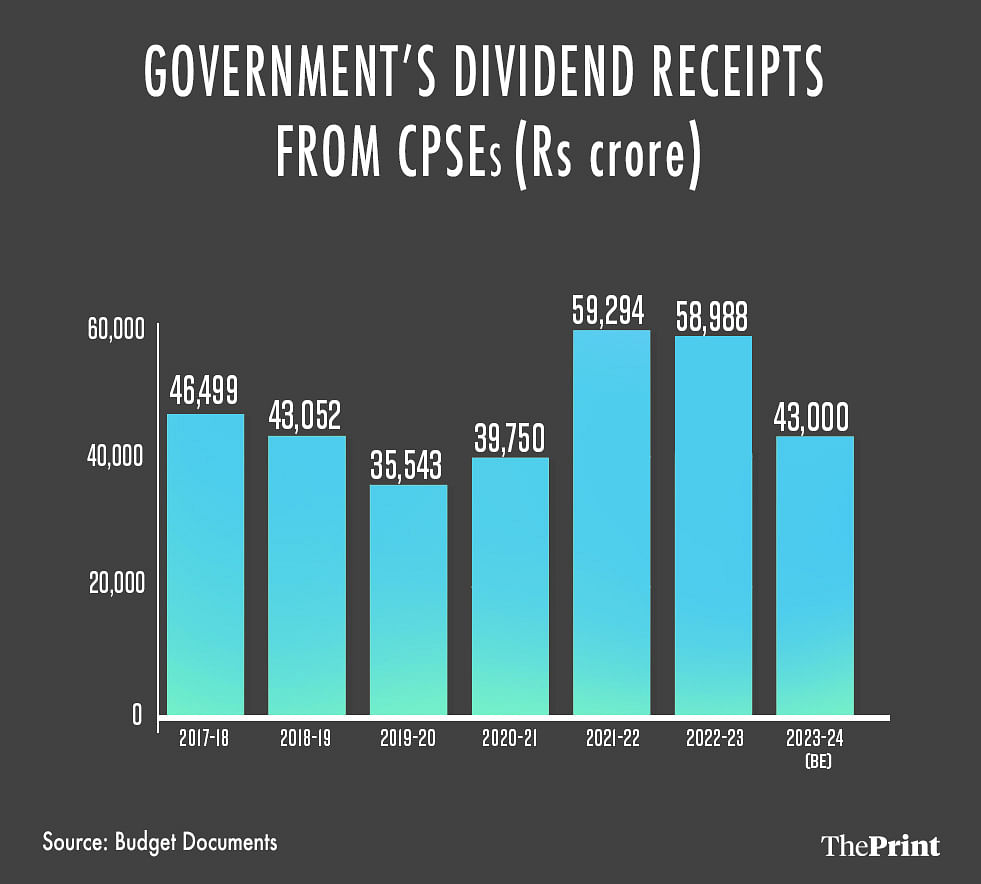

According to annual budget data, dividends to the government from CPSEs had been falling in the 2017-20 period. Since the advisory came in the second half of the financial year 2020-21, its impact on dividends was limited that year — the government received only about 12 per cent higher dividends from CPSEs than it did in 2019-20.

The next year, however, when the CPSEs had a full year to comply with the advisory, dividends paid to the government jumped to nearly Rs 60,000 crore— a nearly 50 per cent increase over 2020-21 and a 67 per cent increase over the pre-advisory year of 2019-20.

Bringing targets back to reality

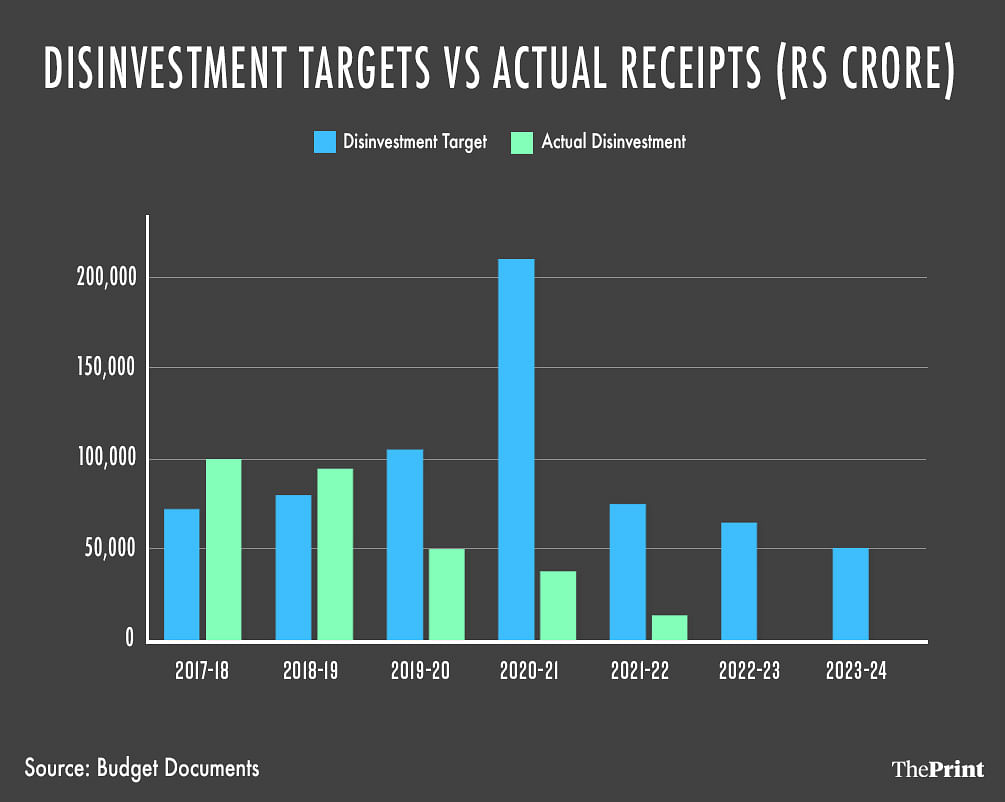

According to Pandey, a few years ago, the government had been setting disinvestment targets far in excess of what was realistically possible. The approach now is more pragmatic, he said.

“Initially, there was a push in the Ministry of Finance about setting high targets for disinvestment,” Pandey said. “These sums are possible only if one privatises very large organisations. Assuming even if we were to privatise 10 mid-cap companies, we would earn only about Rs 20,000 crore in equity value.”

The budget data does show that there were a few years when the government had set disinvestment targets that seemed at odds with the actual disinvestment that had taken place in the preceding years.

For example, in 2020-21, the target was set at Rs 2.1 lakh crore, while it earned just a little more than Rs 50,000 crore in the preceding year. In 2021-22, the target was set at Rs 75,000 crore, nearly double the actual disinvestment of Rs 37,896 seen in the previous year.

These high targets were at odds with the actual potential for disinvestment, Pandey explained.

The government can reduce its stake in a company to 51 per cent and still retain control. Less than 51 per cent would involve privatisation. This means that the potential revenue it can earn from selling stakes in companies, without resorting to wholesale privatisation, is limited, he said.

“Since 2014, disinvestment receipts of more than Rs 4.3 lakh crore have been raised,” he said. “As per tentative calculations, the government is left with about Rs 1.6-1.8 lakh crore of market value in companies over and above the level of 51 per cent.”

“The other point is that even if we were to fully privatise a big company, such a process takes no less than 1.5 years,” Pandey added. “The procedures in a mergers and acquisitions (M&A) transaction are such.”

Also Read: Why the BSNL bailout is consistent with Modi govt’s unstated policy

Not just about earning money

Yet another factor contributing to the slower and more considered approach the government is taking is that it is keeping the interests of the lay shareholders in mind, Pandey said.

“So, even for the Rs 1.8 lakh crore of realisable value, the government has to do it in a calibrated manner so that the minority shareholders are protected,” he explained.

“The government, after having encouraged people to invest in CPSE stock, cannot allow those investments to become worthless because the government suddenly increases the supply of that stock by selling its stake,” he added.

Finally, many of the large companies the government can, in theory, privatise fall in the strategic sectors the government has said it would retain a presence in, which means that the scope of selling stakes in these is limited.

Earlier this month, the government offered for sale 3 per cent of its stake in Coal India, for which it received Rs 4,185.31 crore, according to the DIPAM website.

“We have calibrated the disinvestment target keeping in view all these factors,” Pandey said. “People say it is very low, but I believe even this target of Rs 50,000 crore is ambitious. The easy disinvestment is done. What’s left is about Rs 1.8 lakh crore, if we manage to reduce our stake to 51 per cent in all the remaining CPSEs. That itself is a tall order.”

The secretary also said that there are several companies the government owns that are not in good shape, and so, if the government even tries to sell its stake in them, it might find no buyers.

Pandey further explained that there are some sector-specific issues that slow down the disinvestment process. For example, the government has repeatedly been saying it will privatise two banks. However, for this to happen, it will have to first approach Parliament.

“The thing with disinvestment of the banks is that first, the legislation has to be done,” he said.

“The banks were nationalised, and so to privatise them, an enabling provision has to be passed in Parliament before the process can even start. The Department of Financial Services (DFS) deals with the issue, not DIPAM,” he added.

(Edited by Richa Mishra)

Also Read: India’s economic indicators telling a story—of growth, recovery, robustness