New Delhi: Since 2016, the government has been able to sell its holdings in just 10 of the 36 central public sector enterprises (CPSEs) it had approved for strategic disinvestment, and even of these 10, eight were sold to other public sector enterprises. In addition, the disinvestment process is in progress in only eight of the remaining 26 cases.

In other words, progress on disinvestment has stalled in half the cases approved for privatisation, the Ministry of Finance informed the Lok Sabha Monday in reply to a question.

The only two successful privatisation efforts over this period were the sale of Air India and Neelachal Ispat Nigam. The government also said it had stopped providing estimates in the budget for how much it would receive from disinvestment in any given year.

“The Government, since 2016, has given ‘in-principle’ approval for strategic disinvestment of 36 cases of PSEs and/or subsidiaries/units/joint ventures of PSEs/banks,” Minister of State for Finance Pankaj Chaudhary said in his written reply.

Of these 36 disinvestment cases, 33 fall under the Department of Investment and Public Asset Management (DIPAM) in the Ministry of Finance. The other three are being handled by the respective nodal ministries.

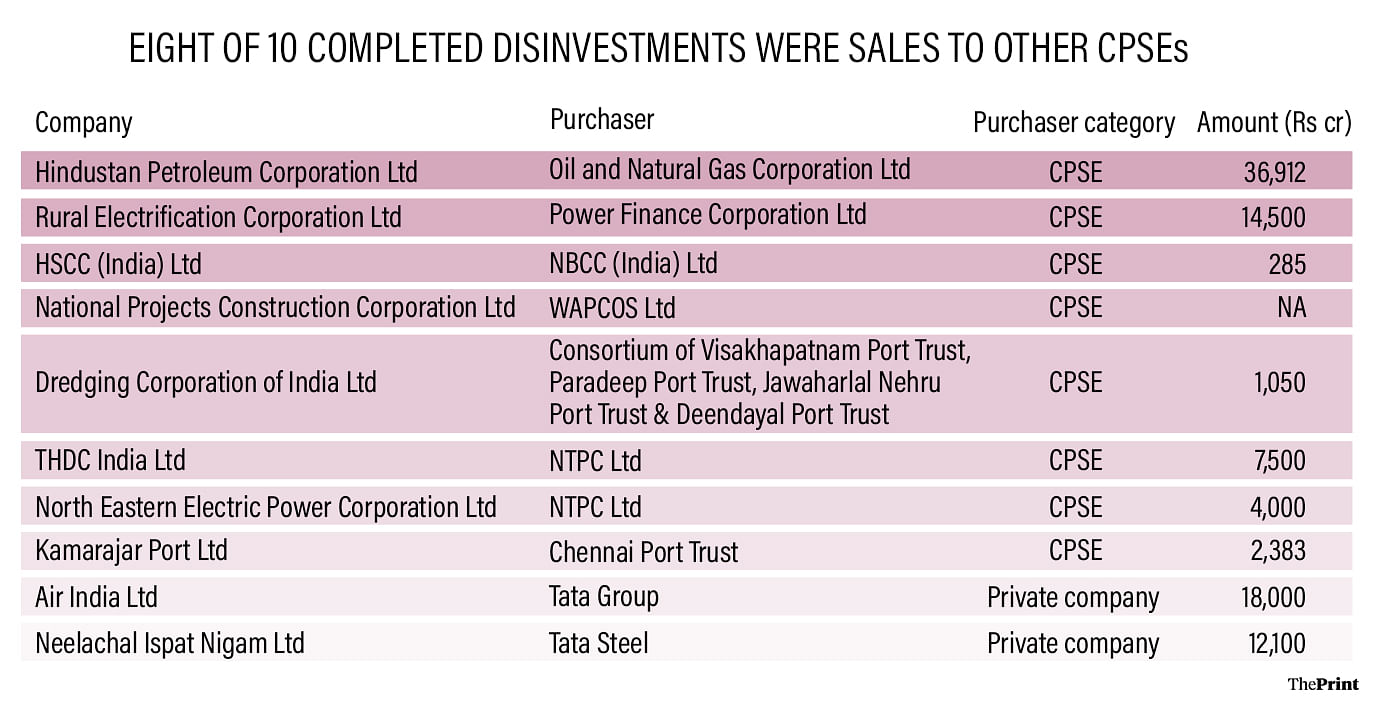

The reply went on to say that of these 33 cases under DIPAM, strategic disinvestment had been completed in 10, of which eight were “in CPSE to CPSE space”, meaning that the government’s stake in these companies was sold to another public sector company.

The largest of these was the sale of a 51 percent stake in Hindustan Petroleum Corporation to Oil and Natural Gas Corporation in 2018 for Rs 36,912 crore. The next year, the government sold its 52.6 percent stake in Rural Electrification Corporation to Power Finance Corporation for Rs 14,500 crore.

Another five CPSEs out of the 33 are no longer being considered for a stake sale—they’re being shut down. These are Hindustan Fluorocarbons, Scooters India, Bharat Pumps & Compressors, Hindustan Prefab, and units of Cement Corporation of India.

Of these, Hindustan Fluorocarbons and Bharat Pumps & Compressors have been approved for closure, Scooters India has been delisted from the stock exchanges, Hindustan Prefab is currently under closure, and the units of Cement Corporation of India are seeing their mines being returned to the respective state governments.

Also Read: Reaping literal dividends — why Indian govt is reworking its disinvestment strategy

Litigation, insolvency & unviable transactions

The disinvestment of Karnataka Antibiotics & Pharmaceuticals is being “held up due to litigation”, according to the reply, and one case—of Hindustan Newsprint (HNL)—is under a corporate insolvency resolution process in the National Company Law Tribunal.

“In January 2021, National Company Law Tribunal approved a Rs 146-crore bid of the Kerala Industrial Infrastructure Development Corporation (KINFRA), Government of Kerala, to acquire Hindustan Newsprint,” the reply said. “HNL was renamed as Kerala Paper Products Ltd (KPPL) in 2021.”

The disinvestment transactions in two cases—of Engineering Project (India) and Bridge and Roof Company (India)—were judged by the government to be “not feasible”. However, the government did not specify what happens in such cases.

The remaining 14 companies have also not seen much success so far in their disinvestment journey. Of these, requests for Expressions of Interest (EOIs) have not been issued, or transactions have been called off after the EOIs were issued in six cases.

Eight companies have cleared the EOI stage and are “at various stages of the strategic disinvestment process”. These are BEML, Shipping Corporation of India, HLL Lifecare, Project & Development India, Ferro Scrap Nigam, Indian Medicines Pharmaceutical Corporation, NMDC Steel, and IDBI Bank.

No more estimates for disinvestment proceeds

The reply to the Lok Sabha also noted that the government no longer provides data on how much it expects to earn from disinvestments.

“Separate disinvestment target/estimate has been discontinued since the revised estimate (RE) stage of FY2023-24,” Chaudhary said in his reply. “During FY2023-24, Rs 51,000 crore was estimated for disinvestment and Rs 10,000 crore for other capital receipts at BE (budget estimate) stage.”

“However, at the RE stage, Rs 30,000 crore was kept under ‘Miscellaneous Capital Receipts – Receipts’ which accounted for the receipts under erstwhile categories of disinvestment and other capital receipts such as asset monetisation,” the reply added.

As a result of this process, the ministry said that there is no specific estimate or target for disinvestment receipts in FY2024-25. However, it did add that the government has so far earned Rs 8,625 crore through various minority stake sales in this financial year.

(Edited by Nida Fatima Siddiqui)

Also Read: Previous target-based disinvestment policy was hurting PSU stocks. How govt is fixing this