Bankers are upset with Modi’s move to sanction loans of up to Rs 1 crore in less than an hour, call it an ‘election sop’ that could further increase their NPA level.

New Delhi: The country’s banking sector, already reeling under the pressure of bad assets and thinning profits, is not happy with Prime Minister Narendra Modi’s new sop for micro small and medium enterprises (MSMEs), which is to provide them with loans within 59 minutes.

Bankers also said that while the loan may be sanctioned in less than an hour, its disbursement will take longer.

The government’s support and outreach initiative will help MSMEs get loans of up to Rs 1 crore in less than an hour.

Although many have hailed the move, bankers say the decision is “politically driven,” just ahead of the crucial Lok Sabha elections, and could further increase their non-performing asset (NPA) level.

“At a time when banks should be focusing on recoveries and strengthening their other core activities, they have been now given another set of targets to fulfil,” said a senior official at a large Mumbai-based public sector bank. “This can dangerously push NPA levels further up.”

Ashvin Parekh, banking sector analyst and managing partner, APA Services, pointed out that various governments have pressurised banks to increase MSME lending but recovery in this sector has not been as impressive.

“In that backdrop, the government forcing the banking sector not only to provide credit but to do so in 59 minutes is certainly not a prudent move,” he said.

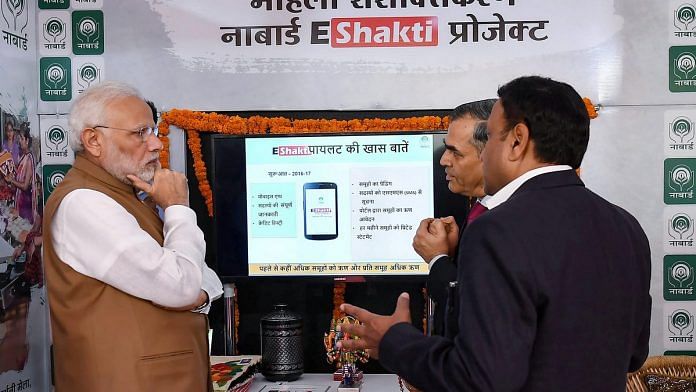

The Prime Minister announced the scheme Friday while launching the ‘MSME support and outreach’ programme at the Vigyan Bhawan in New Delhi.

“In the time taken for you to reach your office, you can now get a loan,” Modi had said. “We had run a pilot and I had set a target of 72,000 MSMEs under this. As of today, 72,680 are on board.”

The new scheme has once again put pressure on bankers who are already juggling with other critical errands, including recovery of loans, opening fresh no-frill accounts, monitoring loans accounts, extending loans under the Pradhan Mantri Mudra Yojana among others things.

Also read: RBI on its own cannot solve the NPA crisis in Indian banking sector

Disbursement will take longer

While banks have been mandated to sanction the loans in less than an hour, the disbursement process will likely take longer.

Insiders said that banks may adhere to the not-so-easy documentation process, including adhering to the stringent know-your-customer (KYC) norms and a thorough analysis of business plans, even after sanctioning loan amounts.

“This scheme is transformational but comes with ifs and buts… The loan amount will get sanctioned in 59 minutes but it has to be seen what kind of documentation is required for the actual disbursement,” Anil Bhardwaj, general secretary, Federation of Indian Micro and Small & Medium Enterprises (FISME), told The Print.

Also read: Section 7 of RBI Act — Modi govt’s ‘secret weapon’ against the central bank

MSMEs’ credit demand tepid

The MSME sector, which provides employment to over 11 crore people, has been one of the worst impacted by the demonetisation drive and the rough implementation of goods and services tax (GST).

For one, credit flow into MSMEs has slowed down. RBI data shows that credit deployment into this sector until August-end grew by just 1.9 per cent year-on-year.

The FISME said that the MSME credit appetite is still weak due to uncertain economic conditions within and outside the country.

“Most existing MSMEs are not in any mood to go in for expansion but this scheme can help new businesses,” FISME general secretary Bhardwaj said.

A lot of NPAs are piling up under the MUDRA scheme as well.