New Delhi: India’s government is increasingly relying on one-time revenue measures to plug its budget gap, raising questions about how it will finance spending pledges further out.

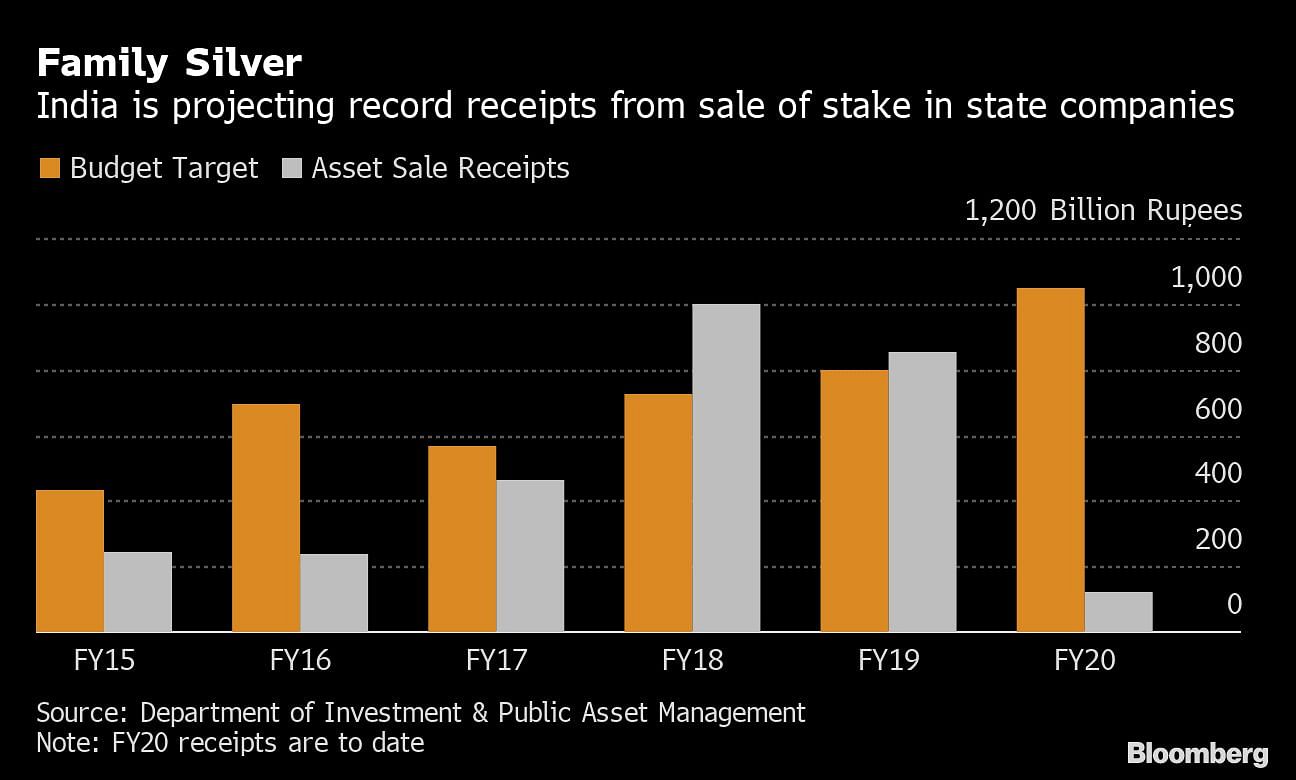

Finance Minister Nirmala Sitharaman is counting on a record $24 billion windfall from the Reserve Bank of India and a budgeted 1.05 trillion-rupee ($15 billion) income from asset sales to fund the fiscal deficit of 3.3% of gross domestic product in the year through March 2020.

She’ll need more revenue next year to narrow that gap to 3% — as mandated by law — without compromising on spending. That may prove difficult since slower economic growth has made it harder for the government to improve tax collections and the boost from the central bank and assets sale program are unlikely to be repeated.

The RBI bonanza appears to be a “one-time” measure and does not necessarily bode well in the medium term from a fiscal stand point, said Madhavi Arora, an economist with Edelweiss Securities Pvt. in Mumbai. “It would be crucial for the government to meet or outdo divestment targets amid falling tax revenues.”

The government’s revenue was $24 billion short of its target last year.

While Sitharaman has so far resisted calls for any significant fiscal stimulus to revive the economy, bond traders fear the weak economic print last Friday may force the government to give in. Speculation it may then push up its planned borrowing from a record 7.1 trillion rupees helped benchmark sovereign notes cap their worst performance in 16 months in August.

Sitharaman has said she hasn’t decided yet on how the RBI funds will be used. The cash is more than enough to pay income support to farmers and recapitalize troubled state banks this year.

Also read: Modi’s bank mergers have come too late to avoid an economic crisis

Below Average

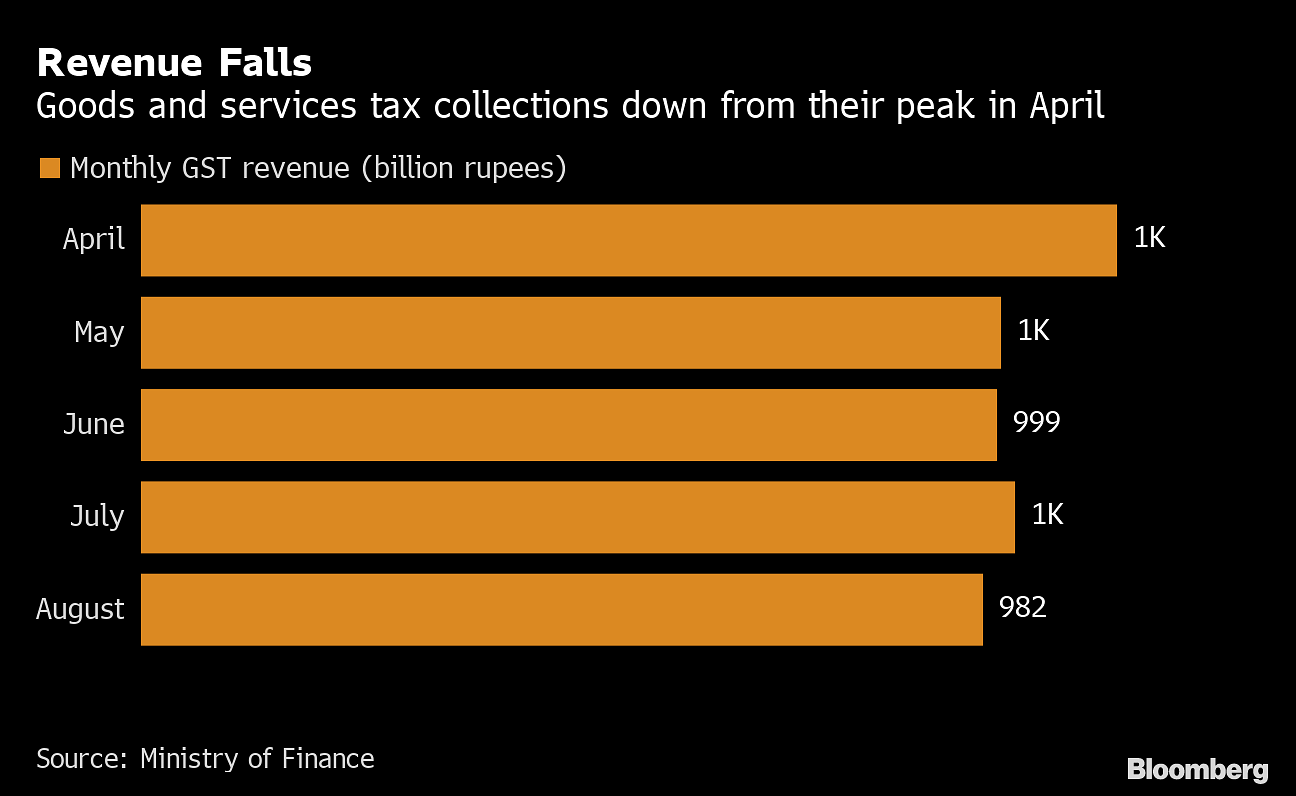

Countries traditionally fund their large expenditure programs from taxes. India’s tax collection in the four months through July was only a fifth of the budget target of 16.5 trillion rupees. The shortfall last year forced the government to slash expenditure to meet the fiscal gap goal.

The country’s tax-to-GDP ratio of about 11% ranks lower than the global average and has fallen despite an amnesty program in 2016, which was followed by a surprise clampdown on cash to nab tax evaders.

The government is penciling in a 12% increase in collections this year, based on economic expansion of 7%. That may be over-optimistic, given that GDP growth in the June quarter slowed to 5%.

In the run-up to elections earlier this year, Prime Minister Narendra Modi announced a flurry of ambitious programs to win over voters. Since returning to power with a bigger margin, he now has to find resources to fund recurring expenses for farm income, employment guarantees and health access.

The success of the assets sale program is also uncertain, given declining investor appetite and volatile financial markets.

The government will need to reduce its dependence on RBI transfers to bridge fiscal gaps and re-look at asset sales and improving tax compliance, said analysts led by Suvodeep Rakshit at Kotak Institutional Equities.

Also read: Don’t bet on India’s new mega banks but on their rivals, investors told

The five hundred rupees per month transfer to farm families should be discontinued. It costs a trillion and affords them hardly any relief.