New Delhi: India’s large state-owned enterprises are embroiled in tax disputes running into crores with the tax departments of the Union government and many state governments, data collated by ThePrint shows.

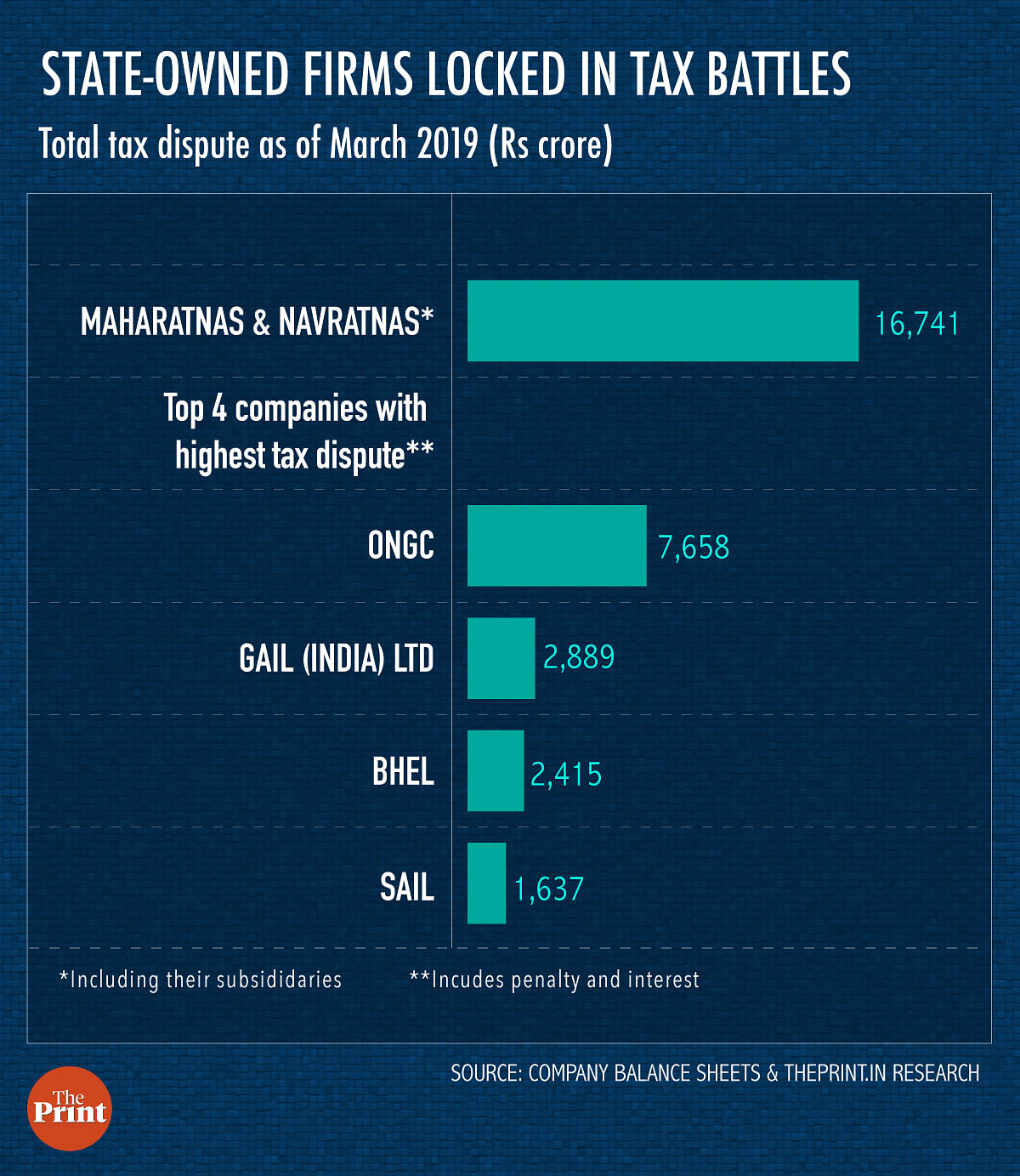

Around 20 large public sector enterprises, categorised as Maharatnas and Navratnas, have nearly Rs 17,000 crore of tax disputes with the authorities as of the end of March 2019. This number will increase substantially if one were to include the nearly 50 Miniratnas and their disputes with the tax authorities.

Be it disputes over levy of service tax, or the more recent goods and services tax (GST), or over the levy of income tax, or entry tax imposed by states, the disputes have been dragging on for years in different courts and appellate bodies.

In most cases, the firms have classified the dues as contingent liability. Some of the firms have also paid part of the disputed tax amount ‘under protest’, the balance sheets of these firms show.

The most recurring dispute is over royalty payments made by these firms. The indirect tax arm of the government contends that royalty is subject to service tax — a stand which the firms disagree with. This issue has continued even in the new GST regime, with many firms accounting for a possible GST levy by paying the dues under protest.

Another recurring issue with oil PSUs is the classification of output and the levy of excise duty. With petroleum products still not under the GST ambit, the central government levies excise duty on them.

Also read: Here’s how Modi govt can help make India a $5 trillion economy

Individual disputes

Among the large Maharatnas, Oil and Natural Gas Corporation Ltd (ONGC) had the highest amount of pending tax disputes with the central government at Rs 7,658 crore — Rs 3,862 crore service tax dispute and Rs 3,796 crore GST dispute, both over royalty. These disputes are pending in various courts.

In its annual balance sheet filing for 2018-19, ONGC said it had received demand orders from the service tax department at various work centres on account of service tax on royalty. Appeals against such orders have been filed before a tribunal. It also received a demand order on 1 January 2019 on account of GST on royalty.

“The company had also obtained legal opinion as per which the service tax/GST on royalty is not applicable,” it added.

ONGC said that pending litigation, it had deposited service tax and GST, along with interest, under protest, amounting to Rs 1,373 crore and Rs 2,807 crore respectively.

GAIL (India) Ltd, another Maharatna, had the next highest tax dispute at Rs 2,889 crore, over the levy of excise on naphtha manufactured by the company due to classification issues of the product.

In its order, the Customs Excise and Service Tax Appellate Tribunal (CESTAT) had confirmed the demand, forcing the company to approach the Supreme Court.

In its balance sheet for FY19, GAIL said the company filed an appeal before the Supreme Court “considering the merits of the case”. It also added that based on legal opinion, it does not see any “probable outflow in the matter”.

ThePrint reached ONGC and GAIL for comment but there was no response until the time of publishing this report.

Also read: ONGC says it’s not facing a fund crunch despite falling cash balance

‘No special benefits’

These are interpretative tax issues where the PSUs feel tax is not payable or lower tax is payable where the tax authorities feel otherwise and hence the recurring litigation, said Abhishek Jain, tax partner at advisory firm EY.

Earlier this month, Business Standard reported on how the tax department and oil marketing companies are locked in a dispute over the levy of excise on ethanol blended motor spirit.

“PSUs have as such not been granted any special benefits in terms of tax disputes/tax demands/settlement under the erstwhile indirect tax laws or the GST law. This entails similar litigations as applicable to other businesses and so for PSUs as well,” Jain said.

Also read: RBI to the rescue – Modi govt eyes bank’s Rs 9.6 trillion surplus to beat economy blues