New Delhi: India’s largest oil explorer, the Oil and Natural Gas Corporation, has sufficient funds to finance its current and future projects, and no plan or expense has been deferred because of paucity of resources, the company has said in a statement.

ThePrint reported last week that the state-owned ONGC’s cash reserves have fallen sharply while its borrowings have increased, turning its working capital negative for the first time in recent history. This has been mainly on account of its acquisition of another state-owned firm, Hindustan Petroleum Corporation Limited (HPCL), which exerted pressure on its balance sheet.

ONGC, in its statement dated 7 May, said mergers and acquisitions are business decisions which have been taken by companies to foster growth and true value accretion from such ventures gets reflected over a period of time.

“The acquisitions made by ONGC are going to strengthen company’s growth trajectory,” it said.

Key numbers

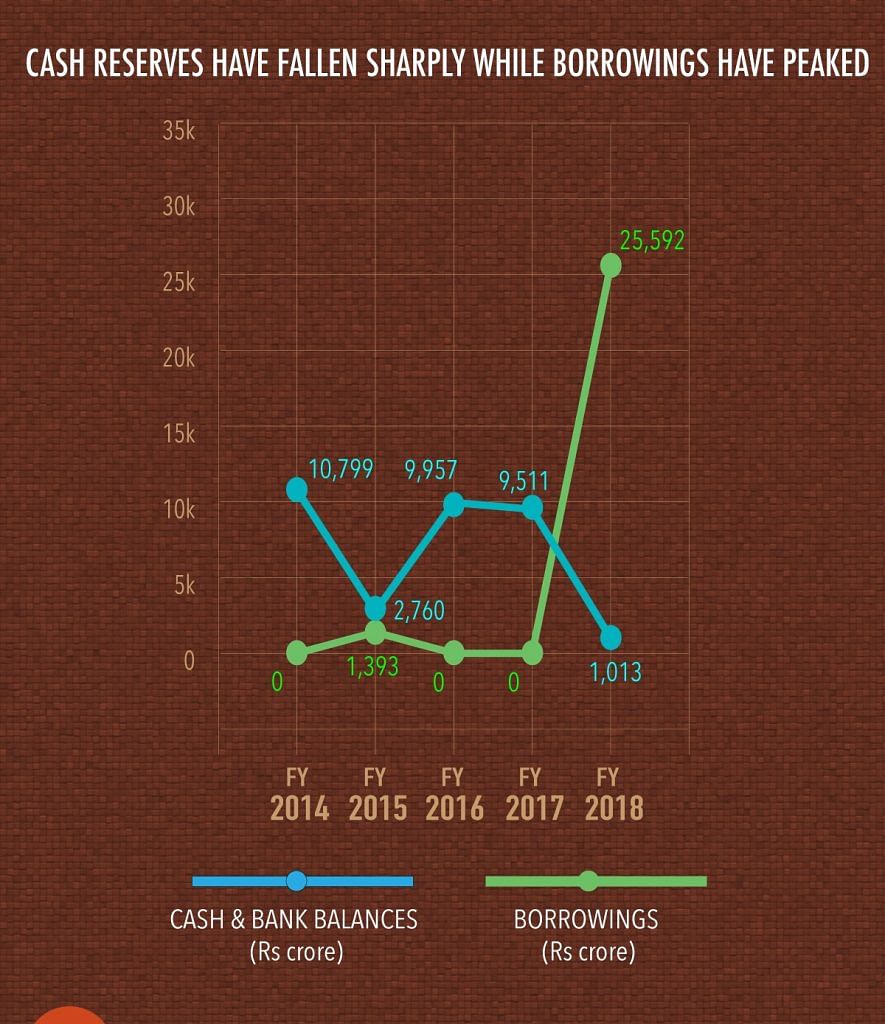

ONGC’s cash and bank balances were at Rs 9,511 crore in March 2017. They fell to Rs 1,013 crore by March 2018, and Rs 167 crore by the end of September last year.

At the same time, its borrowings increased from zero in March 2017 to Rs 25,592 crore by March 2018. The firm has pared the debt to Rs 13,994 crore as of September 2018-end, ONGC’s financial statements show.

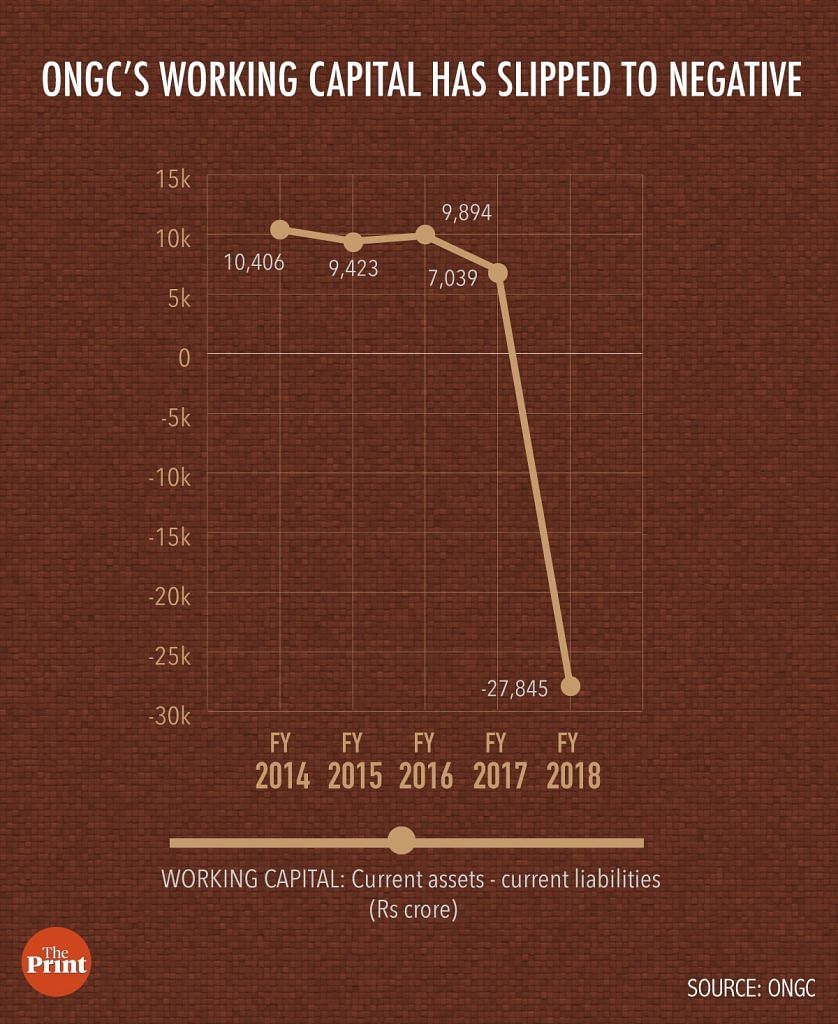

Working capital — calculated as the difference between current assets and current liabilities — was at a negative Rs 27,845 crore as of March 2018, as against a positive Rs 7,039 crore in March 2017. With the paring of the debt levels, this number has improved marginally, but continues to remain negative at Rs 13,465 crore as of September-end.

Oil explorers, due to the risky nature of the business, need sufficient cash balances to meet their working capital requirements.

ONGC said it has a very conservative debt-equity ratio, which compares favourably with global benchmarks. “The rating of the company is also very strong compared with its peers in the industry,” it added.

It also said that in the future, one could see strong performance of not only its upstream business but its downstream businesses as well, like its joint ventures in pipeline and petrochemicals.