New Delhi: Gujarat’s urban cooperative banks have emerged as the epicentre of financial irregularities relating to loans being given to related parties, an in-depth analysis of fines levied by the Reserve Bank of India (RBI) has shown.

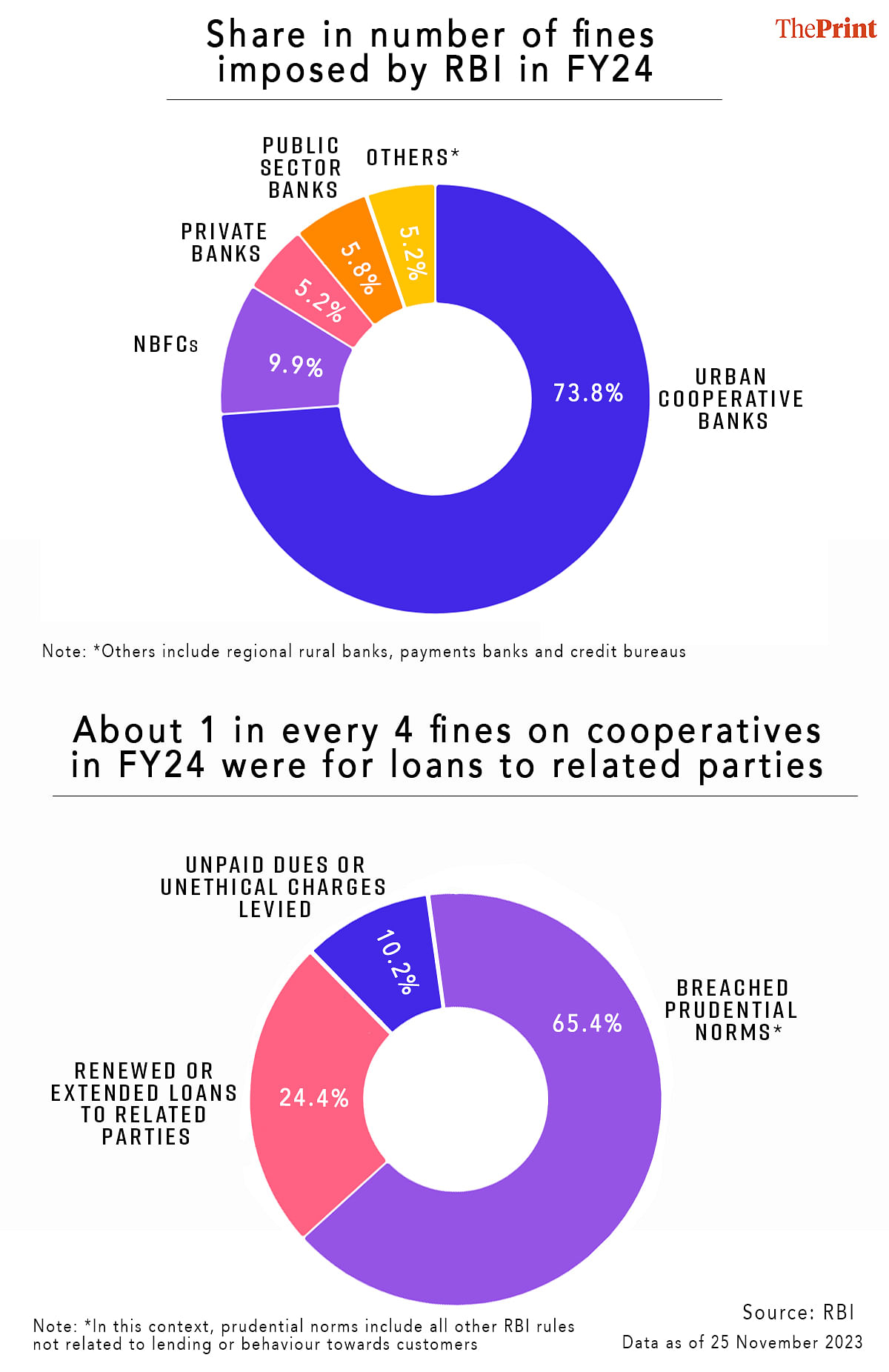

ThePrint analysed the 172 fines levied by the RBI in this financial year, up to 24 November, and categorised them according to the institution they were levied on and the reason for the fine.

What emerged was that urban cooperative banks accounted for nearly three-fourths (127 fines) of the fines levied by the RBI in this period, of which 25 percent were for loans given to related parties, the overwhelming majority of which were given by urban cooperative banks located in Gujarat.

Urban cooperative banks were followed by non-banking financial companies (NBFCs) in terms of the highest number of fines (17 fines or 10 percent) and public sector banks (PSBs) at about 6 percent (10 fines).

Loans to related parties

Among the urban cooperative banks, the category of offences that attracted the largest number of fines was breaching the RBI’s prudential norms.

This category included all offences that didn’t have to do with lending, recovery of loans, or behaviour with customers. Being the broadest, it stands to reason it would also account for the highest number of offences.

However, the second-largest category of offences among the urban cooperative banks — accounting for nearly one-fourth of all fines — was lending to their own directors, people related to the directors, companies where the directors had a financial interest, or where the directors have stood as guarantors for the loan.

This goes directly against the RBI’s directions, issued in February 2021, which are very clear on the matter.

“UCBs (urban cooperative banks) shall not make, provide or renew any loans and advances or extend any other financial accommodation to or on behalf of their directors or their relatives, or to the firms/companies/concerns in which the directors or their relatives are interested,” the RBI regulations say.

“Further, the directors or their relatives or the firms/companies/concerns in which the directors or their relatives are interested shall also not stand as surety/guarantor to the loans and advances or any other financial accommodation sanctioned by UCBs,” they add.

ThePrint has emailed questions to RBI Deputy Governor Swaminathan J., who heads the central bank’s Department of Supervision, RBI Executive Director S.C. Murmu, who is also a part of the Department of Supervision, and the spokesperson of the Ministry of Cooperation. This report will be updated as and when their responses are received.

Gujarat is the epicentre

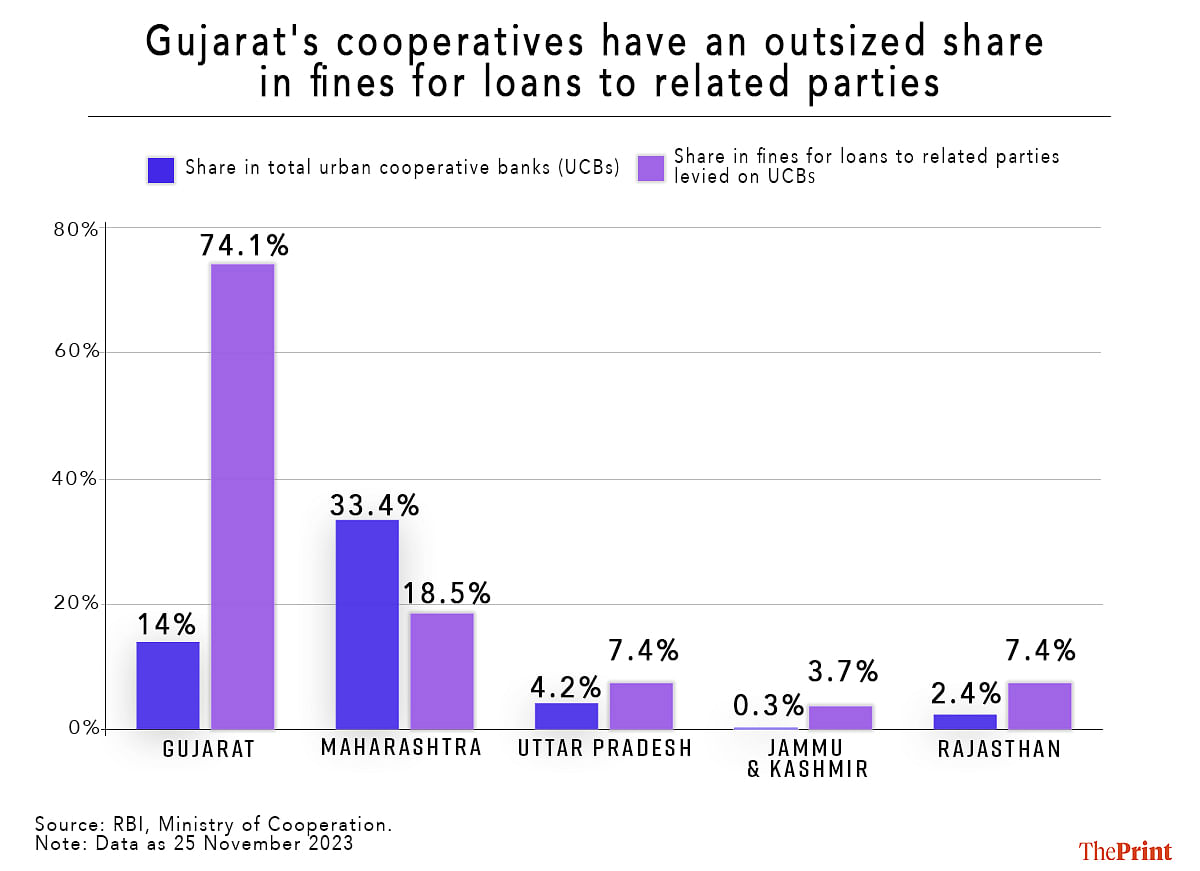

Data from the Ministry of Cooperation shows that Gujarat has 200 urban cooperative banks, 14 percent of the 1,430 such institutions in the country.

However, the RBI data shows urban cooperative banks in Gujarat account for a whopping 74 percent of fines the central bank has levied for loans to related parties.

In other words, nearly three out of every four fines the RBI has levied for loans given to related parties have been levied on Gujarat-based urban cooperative banks.

Maharashtra’s urban cooperative banks have the second-highest share in such fines, at 18.5 percent, but this is lower than the state’s share in the total number of such banks across the country.

“Gujarat and Maharashtra have been the centre of these unethical practices among cooperatives not just for years but for decades now,” an official in the RBI told ThePrint, wishing to remain unnamed given the political sensitivity of the issue. “However, Gujarat seems to have emerged as the front-runner in this regard.”

Cooperatives getting cleaned up

In 2020, the government amended the Banking Regulation Act, 1949, to bring urban cooperative banks and multi-city cooperatives within the direct jurisdiction of the RBI.

This increased the scrutiny on these institutions, which has led to an inordinate number of fines being levied on them for varied offences.

Urban cooperative banks accounted for 175 out of the 211 fines levied by the RBI in 2022-23, making up 83 percent of the total. This has since fallen to 74 percent so far in 2023-24, but is likely to remain elevated for some time, according to a senior official in a prominent public sector bank.

“There was a dire need for the cooperative banks to be regulated properly,” the official said on the condition of anonymity. “With the urban cooperatives coming under the RBI, the issues there are slowly being cleaned up. But as more and more categories of cooperatives begin to be regulated better, more and more of such offences will come to light.”

(Edited by Sunanda Ranjan)

Also Read: How Modi govt’s ordinance on cooperative banks can prevent PMC-like scams, protect depositors