Mumbai: The Reserve Bank of India (RBI) has clarified that retail loans will not be within the purview of the K.V. Kamath committee, which was set up earlier this month to prepare the contours for the one-time loan restructuring scheme.

Banking industry sources told ThePrint that the RBI issued the clarification in a communication to the committee earlier this week.

“They (RBI) have modified the terms and conditions by excluding retail; it is only for corporate loans now. It has said personal loans are not covered,” said a source privy to the development.

An email sent by ThePrint to the RBI for comment remained unanswered until the time of publishing this report.

Also read: Why RBI has picked KV Kamath to restructure loans and kick the can down the road

Confusion in the plan

Following the spread of the Covid-19 pandemic and the nationwide lockdown which impacted economic activity, the RBI in March had allowed banks to extend the benefit of a moratorium on repayment on term loans for both corporate and retail customers for three months, which later extended by three more months.

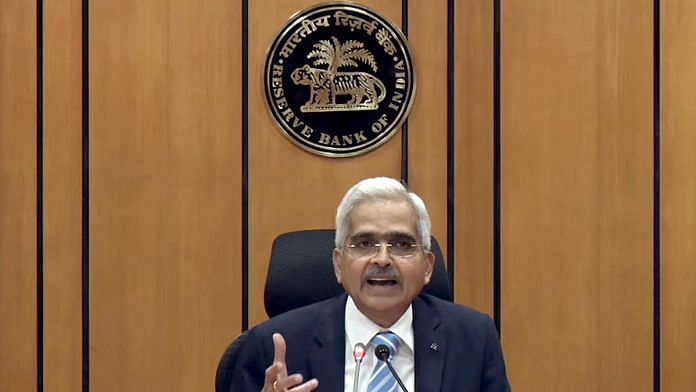

With the moratorium period ending in August, the banking regulator announced a loan restructuring for both retail and corporate loans. A five-member committee was set up under the chairmanship of K.V. Kamath, former chairman of Infosys and the New Development Bank of the BRICS countries as well as the former non-executive chairman of ICICI Bank, to outline the contours of the debt recast plan.

When the committee was announced, banks were under the impression that the panel would suggest norms for both retail and corporate loans. As a result, bankers felt a need to expedite the process since the moratorium would expire by the end of the month, and customers who were looking to restructure their debt would need to be informed soon.

However, with this clarification, banks and non-banking finance companies will now form their own norms for restructuring retail loans and seek the board’s approval before implementation, as mandated by the banking regulator.

What RBI had said on retail loans

While announcing the debt recast scheme, the central bank had said that for retail loans, the resolution plan must be invoked until 31 December 2020, and needs to be implemented within 90 days thereafter. Only accounts that were classified as standard but not in default for more than 30 days as on 1 March 2020 will be eligible for resolution.

“The lending institutions are, however, encouraged to strive for early invocation in eligible cases,” the RBI had said while allowing lenders to extend repayment moratorium as part of the resolution.

“The contours of the plan may be decided based on the board-approved policies of the lenders subject to extension of the residual tenor of the loan, with or without payment moratorium, by a period not more than two years,” it said.

The resolution plan for individual loans includes rescheduling of payments, conversion of any interest accrued, or to be accrued, or granting of moratorium, based on an assessment of income streams of the borrower, subject to a maximum of two years.

“The moratorium period, if granted, shall come into force immediately upon implementation of the resolution plan,” RBI had added.

Also read: Why loan restructuring is a welcome move from RBI, and what govt now needs to do for borrowers

but most banks are making their own rules and insisting on the retail accounts being standard one as on today to get benefit of restructuring benefits. they do not care for accounts on 29 feb 2020, trying to collect as much possible with the help of collection depts. hdfc in particular,

First they came late with the plan and now they insist first pay all till today and then talk, however sbi came up with the plan on time and did restructuring on time.

the eligibility date for restructuring must be 29feb 2020 otherwise it s being manipulated by banks to avoid restructuring.

thanks

It for all ad rbi has not replied the print email.

Haha