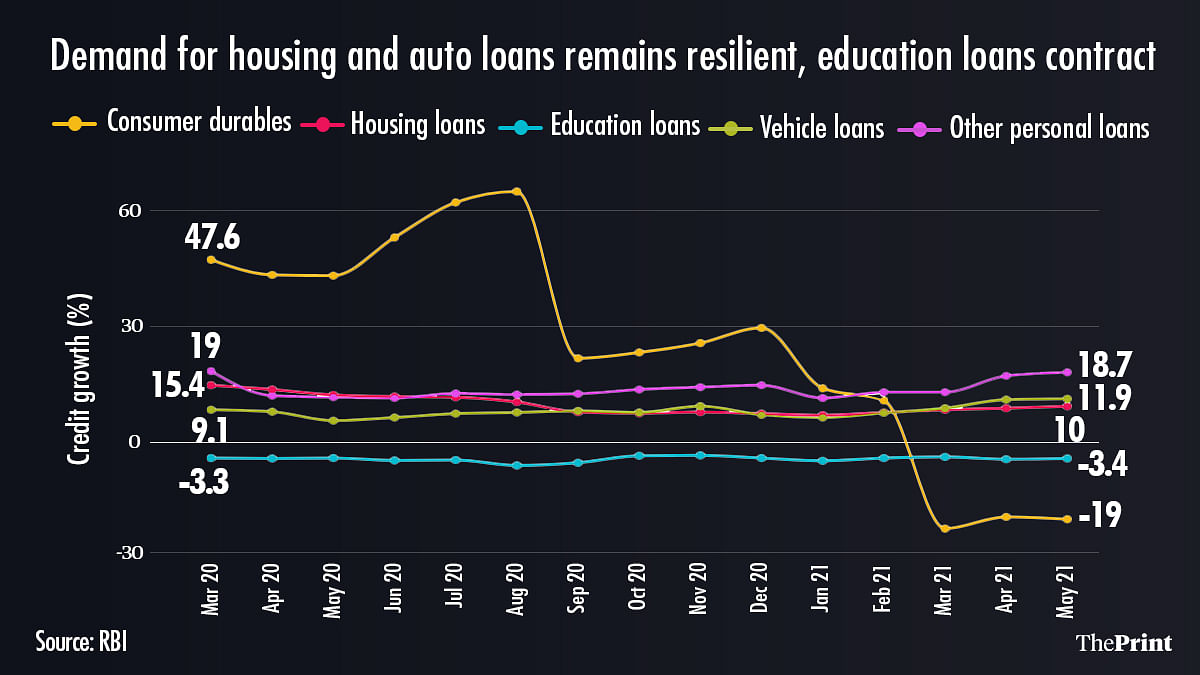

New Delhi: Indians continued to take bank loans to buy houses, vehicles and pledge gold to borrow funds for use during the pandemic, but loans to fund education saw a fall, data from the Reserve Bank of India (RBI) shows.

The only category of loans that consumers availed of during the first wave but not in the second wave was consumer durables, according to the RBI data on personal loans given by banks over the last 15 months.

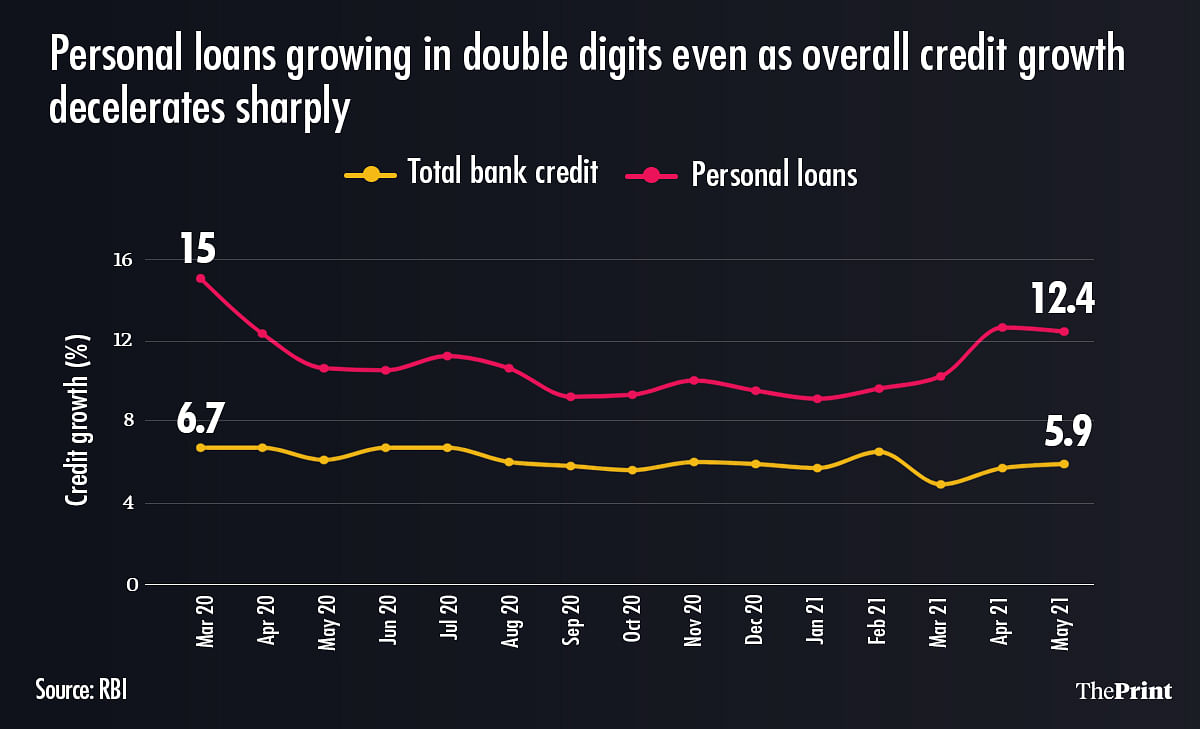

Bank credit data between March 2020 and May 2021 also shows that overall loans given by banks decelerated in the second wave (March to May). However, the category of personal loans grew at an average of around 12 per cent in the second wave as compared to around 11 per cent in the first wave (April to September 2020).

The central bank is hopeful that its announced relief measures, steps taken by the government, and the pick-up in the pace of vaccinations across the country could aid economic recovery to revive overall demand for bank loans.

The growth in the personal loan portfolio comes at a time interest rates have fallen by as much as one percentage point since March 2020 for housing loans and education loans and by around 50-70 basis points for vehicle loans, according to RBI’s annual report.

Also read: GST revenue collection drops below Rs 1 lakh crore in June after 8 months

Personal loans found takers through pandemic

Personal loans comprises housing loans, education loans, vehicle loans, credit card outstanding, loans against gold jewellery and consumer durable loans, among others.

Growth in housing loans hit double digits in May after a gap of over eight months, the data shows. However, housing loan growth remained subdued compared to last year, indicating that borrowers continue to remain risk averse amid the uncertainty due to the pandemic.

Vehicle loans have bounced back sharply, growing faster than last year. Loans against jewellery have also been a preferred option among borrowers who are looking for funds amid loss of jobs and livelihoods.

The category of “other personal loans” mainly comprising loans without collateral but at substantially higher interest rates have also been growing steadily, indicating that many borrowers may have used this route to meet their emergency fund requirements during the pandemic.

Madan Sabnavis, chief economist at Care Ratings, pointed out that banks are more willing to give personal loans as they are small-ticket and comparatively less risky. This is the reason that housing loans are growing. He added that the auto loan segment may be benefiting from an increase in rural demand.

“The rise in loans against gold jewellery reflects the despair among lower income groups where people have been affected by the pandemic,” he said.

Education loans contract

RBI data shows that education loan is the only category that has seen a consistent decline over both the first and second Covid-19 wave.

“The contraction in education loans would be mainly on account of the restrictions on educational institutions and travel. Many students who got through foreign universities may have opted to defer their courses. This may have played a major role in the contraction in education loans,” said Sabnavis.

A banker with a Delhi headquartered bank agreed. “Students who opt for foreign universities opt to take loans to fund their courses. But this came to a standstill last year. There has been some pick up this year as universities gradually reopen,” the banker said on condition of anonymity.

(Edited by Amit Upadhyaya)

Also read: Kabuli chana price set to rise, could cost Rs 130/kg ahead of festive season as states unlock