Mumbai: Indiabulls Housing Finance Ltd. suffered the worst decline since its 2013 initial share sale after India’s central bank placed curbs on a lender it plans to acquire, extending Friday’s slide sparked by a court probe into allegations of fraud.

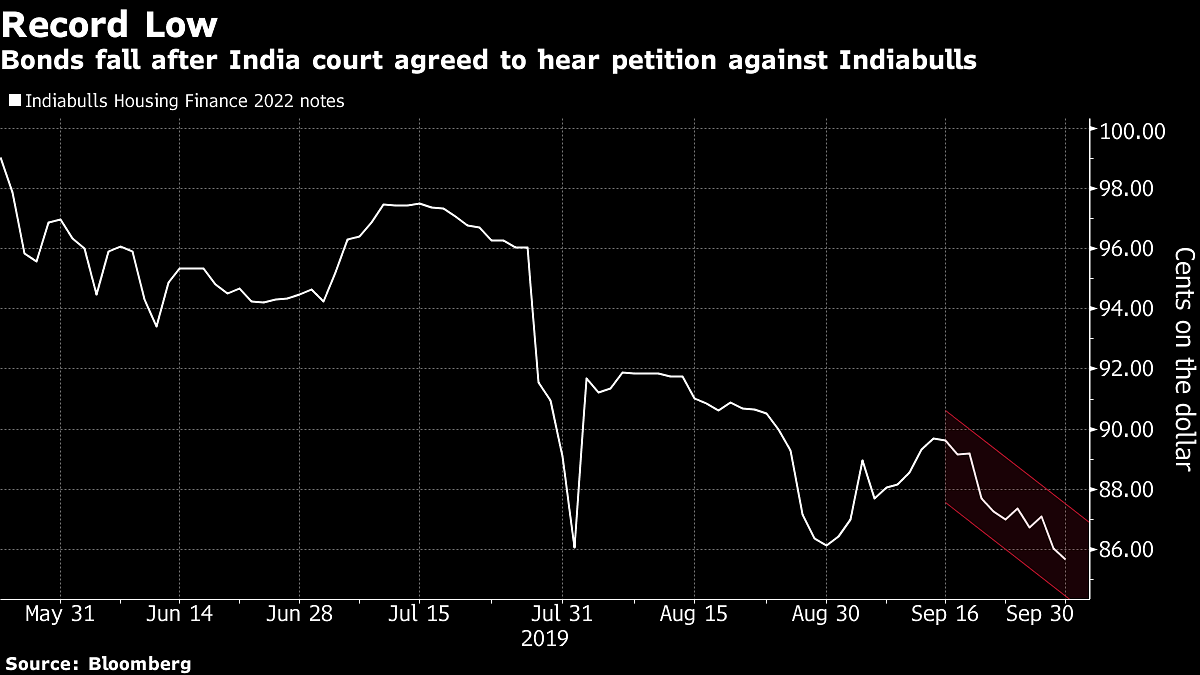

The stock crashed as much as 38% before closing 34% lower at 255.9 rupees, the lowest in five years and the worst performance on the MSCI Emerging Markets Index on Monday. The company’s $350m 6.375% notes due 2022 slid to a record low of 80 cents, according to prices compiled by Bloomberg.

India’s central bank placed lending restrictions on Lakshmi Vilas Bank Ltd., which was seeking a merger with Indiabulls, according to a filing on the weekend. Separately, the Delhi High Court Friday agreed to hear a petition to probe Indiabulls over allegations that it gave out “dubious loans.”

The merger is crucial for the two companies as they seek to revive profitability and bolster capital that’s been eroded by the yearlong crisis in the nation’s shadow banking sector. The combination was aimed at creating a diverse retail-asset book, the companies said in April.

“Until Indiabulls doesn’t come out of this murkiness, the merger will be at risk,” said Sanjiv Bhasin, executive vice president for markets and corporate affairs at Mumbai-based IIFL Securities Ltd. “We need more confidence from the management.”

Lakshmi Vilas shares dropped by the 5% limit for a second day, taking the year’s tumble to 60%, as the central bank cited high level of bad loans and insufficient capital as reasons for its restrictions.

“If asset quality at LVB is doubtful, and it’s not the kind of bank it was perceived to be, even if the merger goes through it would leave a sour taste,” Bhasin said.

Indiabulls’ shares have plunged 70% over the past year in the wake of the crisis at the now-bankrupt IL&FS Group, which soured the sentiment for the entire financial sector. The crash on Monday came after the Delhi High Court agreed to hear a plea seeking probe against the housing financier for allegedly advancing dubious loans and diversion of funds to the founders of the company.

The company has denied the allegations and its lawyer Mukul Rohatgi said the alleged loans were secured and most of them stand repaid. Vice Chairman Gagan Banga told CNBC-TV18 channel on Monday that the probe is an opportunity to settle the recurring allegations against the group.

Other market metrics:

- Trading volume was almost five times the 20-day average for this time of day.

- One-month implied volatility was 94%.

- The relative strength index on the stock was below 30, indicating it may be oversold.

- Of shares that were traded, 37% were at the ask price and 42% were at the bid.

- Shares of Indiabulls Real Estate Ltd. slumped 10%, taking the year-to-date loss to almost 50%.

– Bloomberg

Also read: Indiabulls and Lakshmi Vilas bank, in talks to merge, face investigation over alleged fraud