Mumbai: The tables seem to be turning in India’s banking sector, as private banks are closing the huge lead held by those in the public sector.

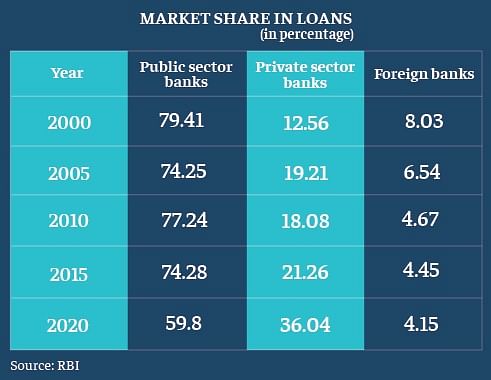

Public banks controlled over 70 per cent of the market till a few years ago, but according to the latest data released by the Reserve Bank of India, their market share in loans has dipped to 59.8 per cent in 2020 from 74.28 per cent in 2015, while private banks’ share has surged to 36.04 per cent from 21.26 per cent in the same period.

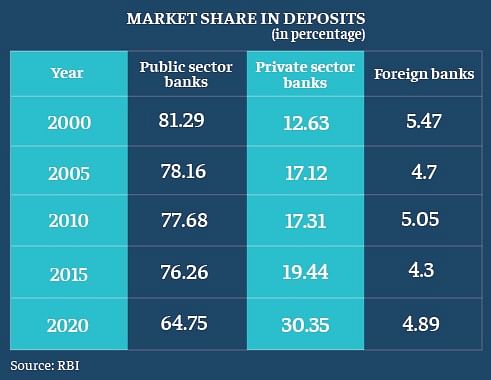

Deposits also tell a similar story — private banks’ market share has gone up to 30.35 per cent this year from 19.44 per cent in 2015, while public banks’ share saw a decline to 64.75 per cent from 76.26 per cent.

Also read: Rajan, Acharya hit out at idea of corporates in banking, say borrowers shouldn’t own banks

Why the gap has narrowed

The gap between public and private sector banks has narrowed sharply in the last five years, both in terms of loans and deposits. In this period, several new licences have been granted to private players — two new universal banks have started operation (Bandhan Bank and IDFC First Bank) while 10 small finance banks have also rolled out their services.

The RBI, meanwhile, has attributed the fall in the public sector banks’ market share to the ballooning of bad loans in the last five years.

“The PSBs have been consistently losing market share to the private banks, a process which has markedly hastened over the past five years. The primary reason for this has been the beleaguered balance sheets of PSBs on account of the non-performing asset (NPA) overhang of post-global financial crisis years,” stated a report prepared by a working group of the RBI, which was set up to review ownership guidelines and corporate structure for Indian private sector banks.

The dip in public sector banks’ market share is also reflective of risk-aversion. As more and more loans turned bad, these lenders became extremely cautious towards fresh lending — also because of fear of investigative agencies littering their premises even after retirement.

The bad state of public sector banks is also reflected on operational efficiency parameters. The staff expense-to-total income ratio for public sector banks zoomed between 2015 and 2020, while for new private sector banks, the ratio remained stable.

Raising capital

As a result, the market value of private banks was much higher than their public sector counterparts. Most of the big private banks enjoy a Price (P)/Book Value (BV) of more than 1, which indicates their attractiveness for fresh market raising.

As a result, public sector banks have been overly dependent on the government for fresh capital infusion. A massive Rs 3,18,997 crore of capital was infused by the government in the last five years in state-run lenders. Private banks were able to raise Rs 1.15 lakh crore of capital from the markets, as compared to Rs 70,823 crore by public sector banks. The public sector banks needed higher capital due to sharp increase in bad loans. Banks need to set aside capital — known as provision — for non-performing assets.

The report observed that the increasing share of private banks has provided the system with a requisite robustness.

“The recent merger of PSBs, as part of the government’s plan to have a few large banks, has given size to some of the PSBs. While private banks have had their share of problems, some of them have grown significantly,” the report said, adding that going forward, there may be space for both public as well as private banks, existing and new, to make space for themselves.

Despite some of the public sector banks being merged to gain size, there is only one Indian bank in the global list for top 100 banks, as on 31 December 2019 — State Bank of India, with assets of Rs 39.5 lakh crore.

The next biggest Indian bank is HDFC Bank, with an asset book of Rs 15.3 lakh crore. In comparison, the 100th entry in the worldwide list is Spain’s Banco de Sabadell, with assets of around Rs 18 lakh crore.

Also read: Two years back, RBI had rejected DBS Bank’s bid for 50% stake in Lakshmi Vilas Bank

It clearly shows that BJP govt wants to pvt banking sector.

PSB are over burden with government sponsor schemes

You are comparing the govt hospitals with private hospitals. Govt enterprises are taken into granted for anything. First, borrower thinks it is govt money and we need not pay. Second is the formalities .Third is the recovery mechanism and fear of non payment of loan. Are they equal ? Comparison must be with equal parameters and infrastructures.

Great article dear authkr. Why don’t you specify the real reason?

PSUs are overburdened by no profit Govt schemes.

Even during extremely busy days, we still respond to mails and calls at any levels. Try calling HDFC or Icici, you will be greeted with IVR stating that they are working with less staff and you will be left with unresolved Grevience.

Private banks can’t compare to workload handled at PSBs.

Great article dear print. Why don’t you specify the real reason?

Sitting at HO it’s painful to watch our branches overburdened by all government schemes with absolutely no profit. And yet you compare our profitability and efficiency to private sector?

Even during extremely busy days, we still respond to mails and calls at any levels. Try calling HDFC or Icici, you will be greeted with IVR stating that they are working with less staff and you will be left with unresolved Grevience.

Private banks can’t compare to workload handled at PSBs.

Bcoz in last 5-6 years public sector banks are over burdened with numerous government sponsored schemes. These schemes are not providing profit , even banks are occurring losses due to these schemes , man power and time are being consumed in these non profit activities . And at the end of the day these comparisons of public and private sector banks made.

Performence of BJP. Desh ko kese barbaad karna koi inse Sikhs.

Har har Modi Ghar Ghar Modi.

PSB are busy with APY, SHG, JLG, PMSBY, PMJJBY,

Sunkanya Yojana and many other very attractive highly profitable schemes.. expect loans and disbursements, and recovery.

They are enjoying acute staff shortage and soft action on defaulters….

They are real worker of political games and propaganda. And are happily disbursing old age pensions of rs 500 or 700.

Haha