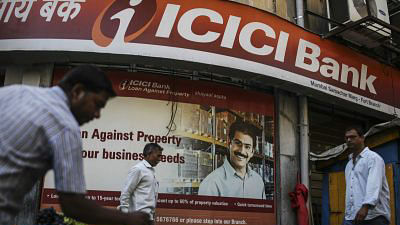

Mumbai/Hong Kong: ICICI Bank Ltd. is considering raising as much as $3 billion in a share sale as the lender seeks to bolster its capital ratios, according to people familiar with the matter.

The Mumbai-based bank plans to start discussions with potential advisers for the offering soon, said the people, who asked not to be identified as the information is private. ICICI Bank is currently targeting a shale sale as soon as September, though the timing could still change depending on market conditions, the people said.

Shares of ICICI Bank extended losses to as much as 8.3% on Wednesday after the Bloomberg News report. The stock is down 35% this year, mirroring a 34% slump in the 10-member Bankex index.

India’s second-largest private sector bank will be joining its peers in seeking capital to expand lending business, betting on an economic recovery once the coronavirus pandemic subsides. The country’s lenders may have to raise $20 billion of cash over the next year, according to Credit Suisse Group AG. Of that amount in expected fundraising, state-run banks are estimated to need $13 billion from the government to recapitalize.

ICICI Bank had raised about 31 billion rupees ($409 million) by paring stakes in its publicly-traded units including ICICI Prudential Life Insurance Co. and ICICI Lombard General Insurance Co., according to exchange filings. The lender had a capital adequacy ratio of 16.1% as of March 31, compared with 18.5% at its larger peer HDFC Bank Ltd.

Considerations of the shale sale are at an early stage and details could still change, the people said. A spokesman for ICICI Bank didn’t respond to an email seeking comment.- Bloomberg

Also read: India’s richest states will have biggest income losses, SBI says

ICICI Bank is considering a huge amount to raise through share sales.