New Delhi: Petrol prices have breached the Rs 100-per-litre mark in several parts of the country, including the national capital, following a consistent rise since the assembly elections in March-April.

But if the prices are rising, shouldn’t there be an impact on fuel consumption?

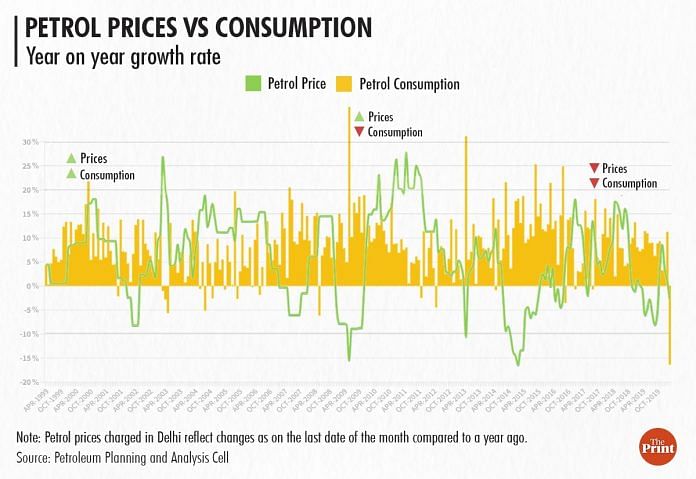

A look at the official 20-year data between the fiscals 1999-2000 and 2019-20 shows that prices of petrol and diesel and their demand are seemingly not correlated (Due to the pandemic, India’s oil consumption plummeted last year and so the fiscal 2020-21 was kept out of the report’s ambit).

ThePrint scanned the year-on-year growth of monthly petroleum prices (end-of-month figures taken) and compared it to the consumption in the respective month.

The data from the Petroleum Planning and Analysis Cell (PPAC) shows that a change in fuel prices doesn’t result in predictable shifts in consumption patterns.

For instance, in September 2000, when petrol price rose by 19.5 per cent — from Rs 23.8 in September 1999 to Rs 28.44 in September 2000 — its consumption increased by 22 per cent (from 4,74,000 tonnes to 5,77,500 tonnes).

However, in June 2009, when petrol price rose 37 per cent y-o-y, the consumption fell by 20 per cent.

Also read: 7-year record: UPA raised petrol, diesel prices more than BJP, but global story was different

Price-inelastic fuel, and factors at play right now

Fuel consumption doesn’t react to prices because it’s an essential good with no or low-grade substitutes. In the short run, the consumer neither has a choice nor can they stop or defer its use.

In economics, such goods are considered to be ‘price-inelastic goods’. Essential goods usually fall in this category.

Radhika Pandey, an economist and fellow at the National Institute of Public Finance and Policy, believes this “inelastic” nature of demand is one of the factors why the Union government has been able to cope with the losses it faced due to the pandemic.

“The pandemic has made India’s fiscal situation fragile. Direct tax collection has collapsed and at the same time the government has had to increase expenditure on account of healthcare and other welfare schemes. With no consistent rise of revenues in sight, maintaining fuel taxes remains the only option,” she said.

“In crisis times like these, this inelasticity is in fact helping the government to make up for its losses,” Pandey added.

However, it’s not as if the inflation in prices is totally irrelevant. During elections, as seen a couple of months ago, the prices are kept in check.

“Evidence from literature supports the argument that there is price inelasticity with fuel prices. However, it will not be appropriate to argue that price inelasticity becomes the motivation for not controlling fuel prices,” said Shubham Kumar, assistant professor in the economics department of Dehradun’s University of Petroleum and Energy Studies.

According to him, several global factors are at play behind the Narendra Modi government’s current reluctance in reducing the petroleum prices.

“India deregulated fuel prices after 2014 when those were very low in the international market. With reforms in queue and welfare schemes at disposal, India began to increase taxes to manage the budget. Now, with the price rise of crude oil and India’s economic slowdown, it becomes difficult to reduce higher prices,” he told ThePrint.

Kumar also explained how differences among the suppliers are at odds with managing fuel prices in India.

“UAE’s differences with Saudi Arabia against petroleum production have created uncertainties on the supply side. India is trying to seek fuel outside OPEC. India might be waiting for international prices to come down before it starts reducing the overall price — but any cut in taxes seems unlikely in the short run,” he added.

Also read: Indian economy showing signs of revival from second Covid wave, says finance ministry

The inflation consideration

There is, however, a limit to which the government can allow the petroleum prices to rise, said Kumar.

Petroleum products are input goods, which means a rise in their prices will cause an increase in the prices of goods and services. Hence, uncontrolled prices might push up inflation rates.

The WPI reached an all-time high of 10.49 per cent in May this year, majorly led by fuel and power indices. In May, retail inflation breached the 6 per cent limit set by the Reserve Bank of India.

“Fuel prices have high tax incidence for consumers and, thus, it contributes to inflation significantly. If the trends continue, perhaps there could be reinstating of subsidies on fuels, to reduce the tax burden on consumers and shift it towards other stakeholders,” added Kumar.

(Edited by Amit Upadhyaya)

Also read: Covid has undone years of gains India made after 1991 liberalisation