New Delhi: With all three Indian public sector oil marketing companies (OMCs) now comfortably back in profit, energy sector specialists feel it is time they restored the previous system where fuel prices were revised on a daily basis in response to oil prices. Fuel prices in India have now been unchanged for more than a year, according to government data.

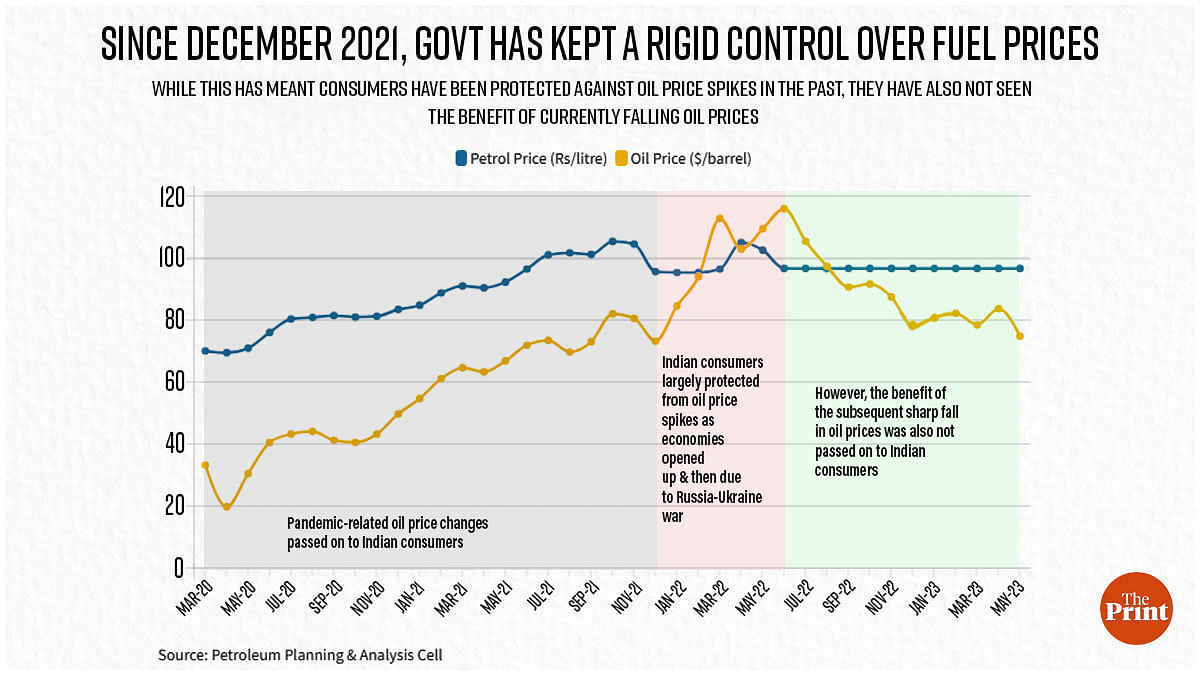

Analysis of fuel price data from the Petroleum Planning & Analysis Cell of the Ministry of Petroleum and Natural Gas shows that petrol and diesel prices were set at Rs 96.72 and Rs 89.62 per litre, respectively on 22 May, 2022. They have not been changed since. These prices are for Delhi, the reference market for the country.

This control over fuel prices has meant that Indian consumers were protected against surges in oil prices that took place in the first half of 2022, but have also not seen the benefits of the subsequent fall in oil prices.

“It is absolutely time for the OMCs and the government to move back to the dynamic and market-linked pricing policy they had introduced,” said Vibhuti Garg, energy economist and South Asia director of the Institute for Energy Economics and Financial Analysis.

The three OMCs in India are Indian Oil Corporation, Hindustan Petroleum Corporation Limited (HPCL) and Bharat Petroleum Corporation Limited (BPCL).

Also Read: Expect fewer power cuts this summer as govt ensures enough coal supply to power plants

Protecting the people

Oil prices have been rising consistently since the start of the Covid-19 pandemic, and OMCs in India were quite comfortable allowing the price of petrol to align with this upward trajectory.

However, in early 2022, oil prices surged uncomfortably high due to the opening up of economies as the pandemic eased, and also in the immediate aftermath of Russia’s invasion of Ukraine in February that year.

By June 2022, the average price of the Indian basket of crude oil jumped to $116 a barrel, up from $73.3 a barrel in December 2021. However, this surge in oil prices was not accompanied by a commensurate jump in petrol prices, thanks to the combined efforts of the OMCs and the government of India.

From December 2021 to March 2022, the OMCs left fuel prices largely unchanged. In April, they increased prices to pass on some of the costs to consumers. This, however, was soon offset by the government’s decision in May 2022 to cut the excise duty on petrol and diesel by Rs. 8 and Rs. 6 per litre, respectively.

By June 2022, petrol prices were averaging the same level they had been in December 2021 — despite oil prices having jumped nearly 60 per cent during that period. This was due to the initiative of the government and the OMCs to protect India’s people from facing even higher inflation than they were already experiencing.

“Last year, because of the very high oil prices, if the government had allowed OMCs to keep increasing prices, then inflation would have gone through the roof,” Garg explained.

“The CPI (consumer price index) was already higher than the RBI’s upper comfort limit of 6 per cent, and would have gone even higher. It became a critical thing for the government to control to ensure that prices of other essential goods in the economy remained within reach of the people,” she added.

Things have changed now

The government had in June 2017 adopted a dynamic pricing mechanism where fuel prices were changed on a daily basis instead of fortnightly, as had been the case earlier.

At the time, this move was praised by then petroleum minister Dharmendra Pradhan since it would mean “no sudden shock when (oil) prices rise” and “immediate relief to consumers in case price falls”.

By controlling fuel prices so rigidly, the government has continued to ensure that consumers are protected from surges in oil prices, but it has also meant that they have been deprived of the benefits of falling prices. This is something that needs to be rectified, according to energy analysts.

The government’s rationale for keeping fuel prices unchanged, despite a favourable shift in oil prices, was that OMCs had suffered significant losses when oil prices were high even as consumers were protected. Now, the OMCs could use the falling oil prices to recover the losses they had suffered.

“Because of this price control, OMCs started suffering losses for some months when the oil prices were high,” Garg said. “Then the global situation started improving and supply started improving, and so the prices started declining. That’s when OMCs, instead of reducing fuel prices, started making up for some of the losses they had incurred.”

Oil prices have indeed fallen significantly over the last year or so, from $116 a barrel in June 2022, they are averaging about $75 a barrel in May 2023 so far.

Back in the green

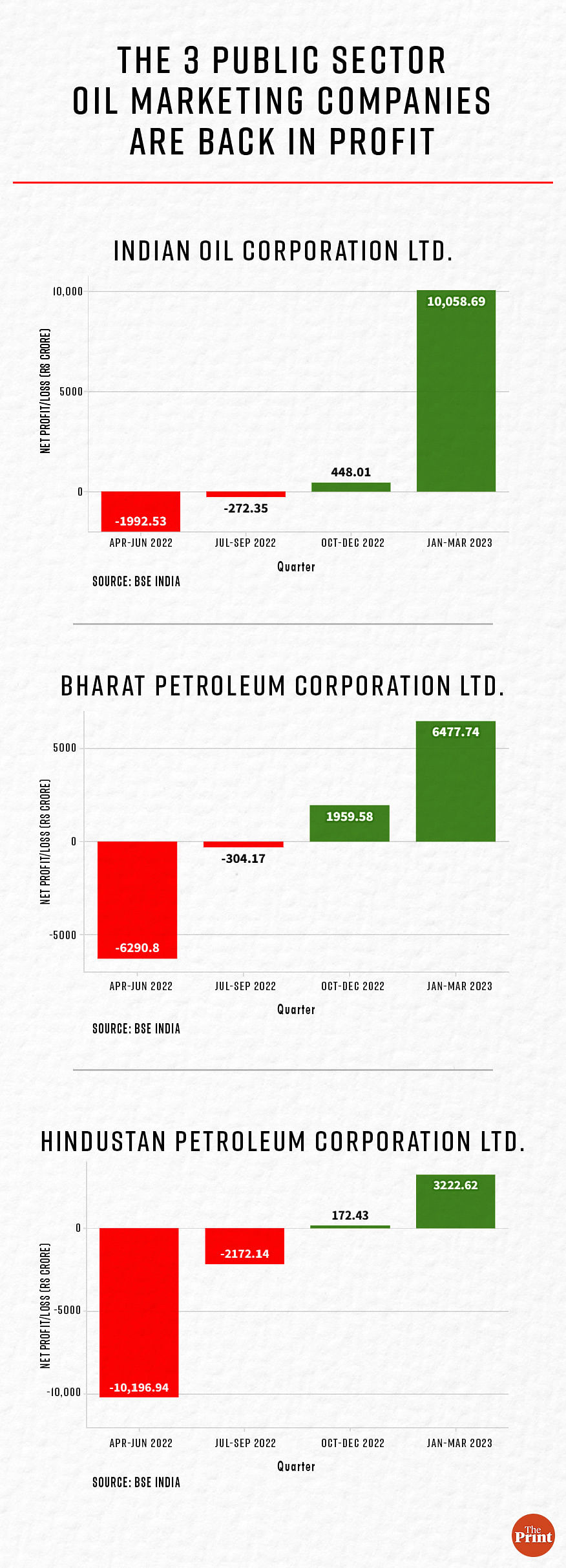

The financial results of the three public sector OMCs for the financial year 2022-23 show that they did indeed suffer losses in the first two quarters (April-September 2022).

However, since then, they have been making profits. In fact, in the case of Indian Oil Corporation and Bharat Petroleum Corporation, the profits have exceeded the losses, meaning they have finished the year with a net profit.

Energy sector analysts agree that the OMCs should have now recovered the losses they had borne at the start of the financial year and that they are now in a position to restore the daily-revision dynamic pricing mechanism.

D.K. Srivastava, chief policy advisor at consulting company EY India, however, pointed out that it might be premature right now to move back to the market-linked daily revisions of fuel prices, given that the global environment is still uncertain.

“Eventually, they should move back to the dynamic daily pricing mechanism, but because the global market is still characterised by considerable uncertainties, as a first step the fuel prices should be reduced, taking into account the current global oil prices,” he said.

“And then, once the market stabilises, the OMCs can formally move back to the old system,” Srivastava added.

The OMCs, however, have been reticent about commenting on this.

Queries posed to each of the three — Indian Oil Corporation, HPCL, and BPCL — were acknowledged by the companies, but no response was received as of the time of publishing.

In December 2022, when ThePrint had reported a link between fuel prices remaining unchanged and impending assembly elections, the Indian Oil Corporation had redirected all queries to the Ministry of Petroleum and Natural Gas

(Edited by Asavari Singh)

Also Read: No TCS on foreign debit & credit card transactions up to Rs 7 lakh, clarifies Union govt