Mumbai: As bond traders around the world rejoice in this year’s dizzying debt rally, the mood is more tempered in India.

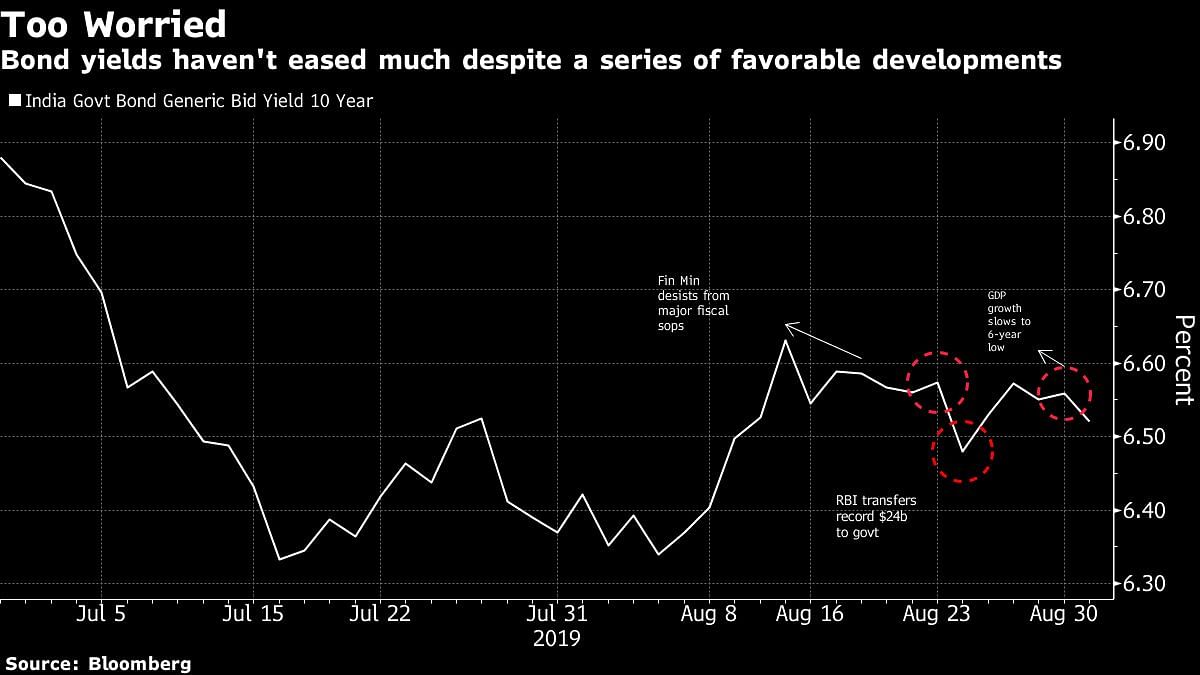

Yields have barely budged despite the government’s recent measures to lift Asia’s third-biggest economy. Even prediction of deeper interest-rate cuts by Goldman Sachs Group Inc. after Friday’s data showed growth hitting a six-year low didn’t push up bond prices a whole lot Tuesday.

The reason: traders are worried the weak GDP print may force the government to deliver a big revival package, which it has so far resisted. Fears of stimulus adding to already record borrowings led to benchmark sovereign notes capping their worst performance in 16 months in August.

“The deeper-than-expected slowdown in growth has raised hopes for rate cuts, but on the flip side, it also raises the risk of fiscal stimulus,” said Naveen Singh, head of fixed-income trading at ICICI Securities Primary Dealership in Mumbai. “Revenue collections may also continue to remain low as seen by the latest goods and service tax numbers.”

Skepticism over the government’s fiscal restraint has persisted even after Finance Minister Nirmala Sitharaman desisted from any major fiscal break in her package to boost growth. Bond gains sparked last week by a record fund transfer from the central bank to the exchequer didn’t last even one session as traders feared the cash may be used to pump-prime the economy instead of plugging the deficit.

On Tuesday, the benchmark 10-year yield fell four basis points at 6.52%. It rose 19 basis points in August, the most since April 2018. India’s fiscal gap has already reached 78% of the target for the full financial year in the first four months through July, data showed Friday.

“Overall, tax revenues will likely disappoint again, particularly with nominal GDP growth slowing down,” Kotak Mahindra Bank economists including Suvodeep Rakshit wrote in a note. “Room for a fiscal stimulus will be minimal without compromising on the fiscal deficit target.”

Also read: After Modi govt announcements, Indian stocks, bonds rally despite selloff in rest of Asia