New York/Budapest: It wasn’t that long ago that U.S. markets felt simple. The rules were so straightforward they’d become cliches: Don’t fight the Fed. Don’t try to catch a falling knife. Buy — when there’s blood in the streets — and hold.

But in the era of Donald Trump, the aphorism isn’t as catchy and it discourages always caring about what’s true and what isn’t: Don’t bet against the tweet or off-the-cuff remark from the president of the world’s largest economy.

Stocks rose and havens like the yen sold off Monday after Trump said China badly wants a trade deal and prospects for an end to the fight are greatly improved. Investors are suddenly ebullient again even though a Chinese journalist widely viewed as a mouthpiece for the government sowed doubt about the U.S. president’s version of things.

Traders are probably nursing a terrible case of whiplash. On Friday, stocks suffered one of their worst losses of the year, driving investors into the safe embrace of Treasuries and gold. Trump’s Twitter account was the main culprit, as the president labeled China’s Xi Jinping a potential enemy and announced he’d retaliate against the Asian nation’s latest tariffs. And then there was confusion on Sunday regarding media reports that Trump regretted his aggressive stance.

Financial markets should expect prices to keep veering up and down at tweet-speed. Asked Monday about his back-and-forth negotiating style when dealing with China, Trump replied: “Sorry, it’s the way I negotiate.”

For investment professionals, there’s little choice but to follow along.

“It’s very hard to ignore the tweets that are coming out, unfortunately, and, yes, they can overwhelm the fundamentals,” said Gennadiy Goldberg, a senior U.S. rates strategist at TD Securities. “We’re trying to step back and look at the big picture and realize the volatility is still far from over.”

Over at SVB Asset Management, a $41 billion investment firm, there’s normally a weekly strategy meeting to review the landscape and sort out where to put clients’ money. “But now we’re talking about the markets daily,” said Eric Souza, a senior portfolio manager at the company. “Hourly, there’s just so much volatility and news coming out.”

Also read: Thanks to Trump, G-7 summit is a fiasco for world economy

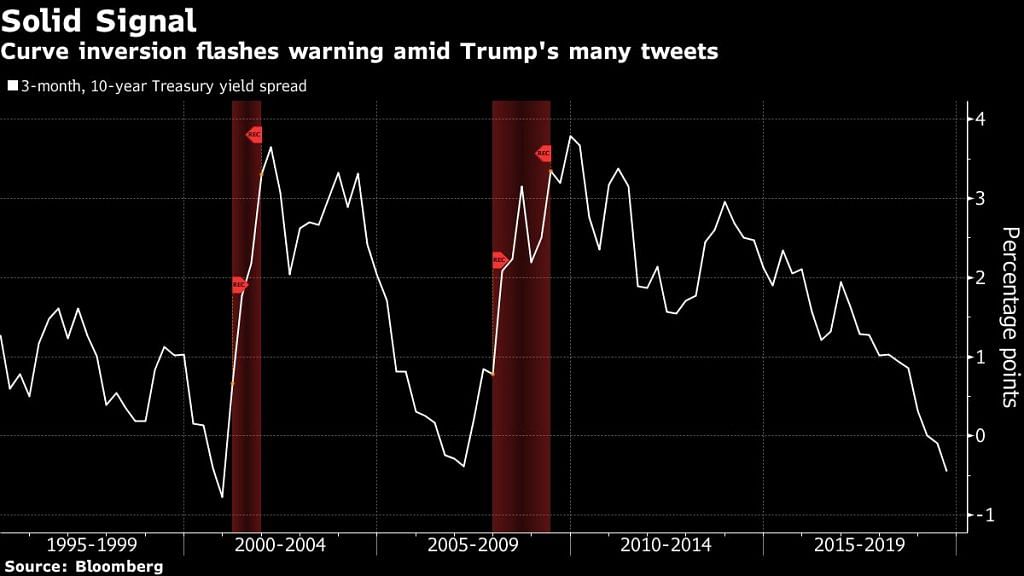

But something has been steadfast: the bond market, which continues to worry about the trade war’s impact. Amid the wild fluctuations elsewhere in markets, Treasuries have for months said a U.S. recession looks likely. Three-month bills have yielded more than 10-year notes for most of the past five months, aka the dreaded yield-curve inversion. The yield difference widened on Monday to as much as minus 53.8 basis points, the most negative since March 2007.

Odds of a U.S. recession in the next 12 months are about 80%, according to Ann-Katrin Petersen, investment strategist at Allianz Global Investors. Columbia Threadneedle Investments is worried, too.

“We see a U.S. recession as increasingly likely in 2021,” said Colin Moore, global chief investment officer at Columbia, which has about $500 billion in assets under management. “We expect it to be a fairly shallow recession. In this environment, long-term Treasury yields could fall to new lows.”

Nonetheless, over the past few weeks, risky assets have been hell-bent on trading on hope, with shares rising when Trump or his team drop any crumbs through tweets and otherwise that the rift with China is near ending. That’s how John Briggs and his colleagues at NatWest sum it up. What follows, he says, is failure of the trends to hold as facts prove ultimately to be “in the wrong direction.”

The S&P 500 has tumbled since late July, but only sunk to levels seen in early June. Futures on the index turned higher during the European morning Monday after Trump said China was willing to resume trade talks.

Treasuries aren’t so sanguine. With the trade outlook dimming, yields plunged Friday as traders lifted the degree of Federal Reserve easing they were pricing in. And that trend continued Monday, with the 10-year falling to 1.44%, close to the all-time low of 1.318% reached in 2016, though yields rebounded to 1.54%.

Big swings have become the norm across equity markets. The S&P 500 has closed above or below the 1% threshold nine times in August, a rate not seen since December.

“Tariffs in general, you can see that’s an overhang on this market and a key driver right now,” said Keith Lerner, chief market strategist at SunTrust Private Wealth Management. “Every time those headlines are suggesting things are getting better, people jump on to those. And when there’s headlines suggesting things are deteriorating, people jump on those. I don’t see how you have an edge on trading this right now.”

Treasuries investors could seek advice from their seasoned emerging-market colleagues, long accustomed to erratic communication from government officials. Traders dealing with riskier developing-nation assets have faced a rich legacy of politicians mentioning default or championing the populist rhetoric that defies market rationale.

Also read: US-China trade war, Russia inclusion make G7 summit a sinkhole for global governance

The illiquid nature of these emerging markets and reliance on informal lines of communication with investors make traders think twice before immediately acting on unexpected news.

“Irrespective of Trump tweets, the trade conflict is getting worse,” said Peter Schottmueller, who helps manage about $330 billion as the head of multi-asset allocation at Deka Investment GmbH in Frankfurt. “Developed-market investors are not used to handling political shocks and erratic government policy.”

The impact of Trump’s trade tweets isn’t dissimilar from the deluge of Brexit headlines that have taken the pound’s volatility to emerging-market levels.

“If you trade out of fear, there is always an element of exaggeration,” said Lutz Roehmeyer, an emerging-market investor and the Berlin-based chief investment officer at Capitulum Asset Management GmbH. “Not everything that can go wrong will go wrong at the same time. Keep calm and carry on.”

Nevertheless, it’s hard to imagine @realDonaldTrump will stop being a catalyst anytime soon.

“We continue to look at all the tweets and so forth, even as many times — like Yogi Berra used to say — it ends up being, ‘Déjà vu all over again,’” said Andrew Brenner, the head of international fixed-income at Natalliance Securities. – Bloomberg

Also read: Trump’s trade war gives new life to China’s Belt and Road programme