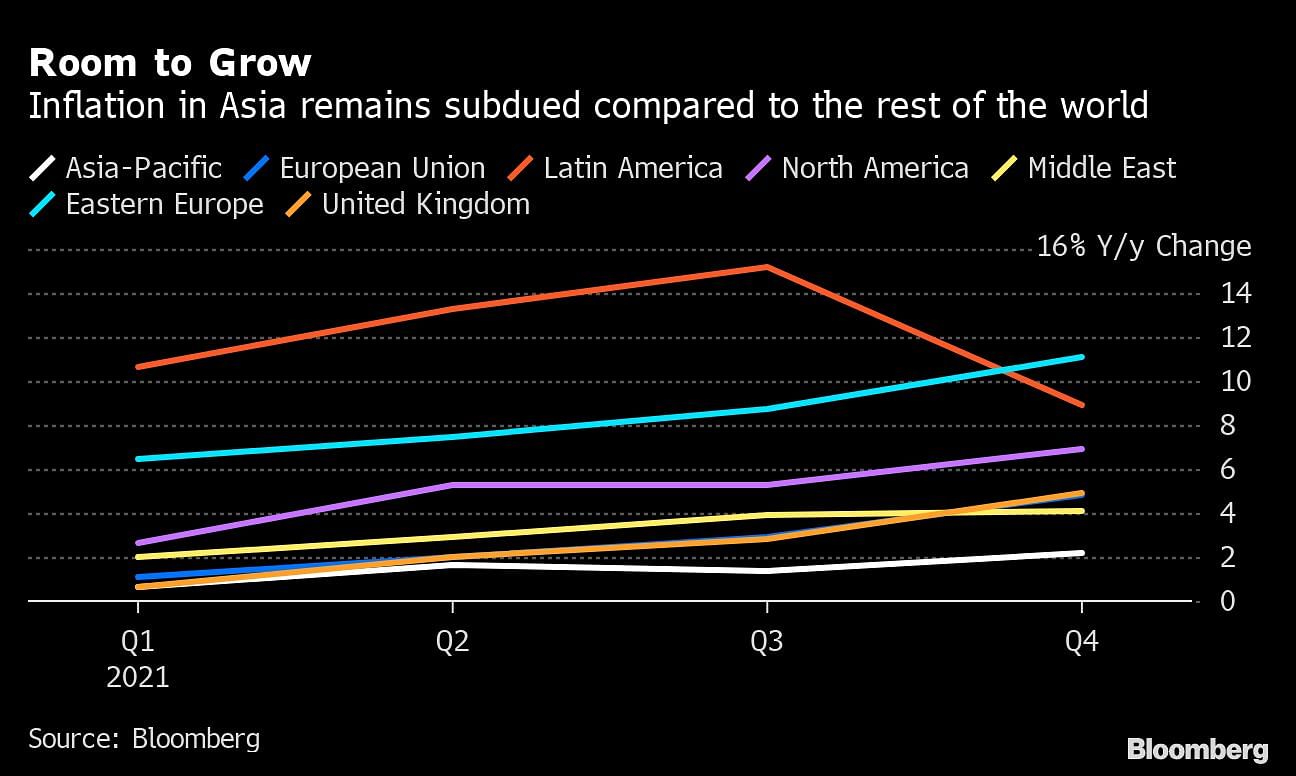

Metro Manila/United Kingdom: Emerging Asia’s central banks have enjoyed room to pause on monetary policy and focus on supporting growth, but pressure to shift course may be building as their global counterparts turn more hawkish and if inflationary pressures build at home.

India, Indonesia and Thailand kept their benchmark interest rates at record lows last week, and the Philippines also stood pat Thursday, as they navigate tentative economic recoveries amid continued virus outbreaks.

But a more aggressive U.S. tightening cycle and oil’s rise toward the highest since 2014 could change the thinking of the region’s policy makers, most of whom have indicated plans to stay accommodative for as long as needed to get their economies on firmer footing. A shift, which some markets are pricing in as sooner than earlier expected, could mean tighter financing conditions and higher borrowing costs.

“Monetary authorities may prefer to wait and see until their economic recovery continues through the first half of 2022,” said Steve Cochrane, chief APAC economist at Moody’s Analytics. “But there’s a risk they may have to act earlier than planned.”

At the Group of 20 meetings of central bank chiefs and finance ministers this week, Bank Indonesia Governor Perry Warjiyo urged his counterparts to coordinate the exit from pandemic-era policies to make sure emerging economies don’t suffer from spillovers that will restrict their ability to support recovery.

To be sure, the region has ample levels of foreign-exchange reserves to shield against volatility if the U.S. Federal Reserve raises interest rates by 50 basis points at its March meeting, as some expect. India and Thailand, where food and fuel prices are rising, also forecast that inflation should return to the target range later this year.

However, some Asian central banks could fall behind the curve as pandemic risks recede, economic activity normalizes and output gaps narrow, Nomura Holdings Inc. said in a report. A pivot in central bank policies may be nearing, it added.

Inflation could be the deciding factor in India, where policy makers have defended their sanguine view. The Reserve Bank of India’s move last week to keep the reverse repo rate unchanged surprised markets, which had expected the bank to raise rates to begin policy normalization.

Overnight index swaps are currently pricing around 36 basis points of policy rate hikes in India over the next three months, up from 27 basis points at the end of last year, signaling traders’ rising expectations of tighter policy. Meanwhile, the rupee is Asia’s worst-performing currency so far this year, down about 1% against the dollar.

“While the RBI has downplayed inflation risks during the pandemic, the catch-up could also be much swifter, if inflation does not fall toward 4% by end-2023, as the RBI now expects,” Nomura said.

Not in lockstep

In Thailand, inflation quickened to 3.23% in January, beating economists’ estimates for a 2.47% gain. That sent two-year non-deliverable interest rate swaps surging by as much as 22 basis points to near a two-year high, a breakaway from earlier market moves which signaled more dovish expectations for the Thai central bank.

Indonesia will likely be more sensitive to the Fed’s hiking cycle, in line with its goal of keeping its financial system stable. Hotter-than-expected U.S. inflation could pose fresh questions for Bank Indonesia, which indicated Feb. 10 that it expects the Fed to raise rates by a total of 100 basis points this year, lower than market projections.

The latest U.S. data point “might have been profound enough to alert BI to the heightened likelihood of a front-loaded Fed fund rate hike,” said Wellian Wiranto, economist at Oversea-Chinese Banking Corp. “That, in turn, results in a net increase in the odds of BI having to hike rates on its own accord in March too.”

In the Philippines, Governor Benjamin Diokno has said Bangko Sentral ng Pilipinas doesn’t need to move in lockstep with the Fed and is in no rush to tighten monetary policy. But with oil nearing the crucial $95 level for the BSP, it may prove difficult to maintain that stance indefinitely.

Diokno dropped a hint of unwinding pandemic support measures at Thursday’s meeting, saying, “We will commit to exit when we begin to actually see, based on our assessment, evidence of a sustainable recovery and/or increasing risk to inflation.”

“Some central banks do appear to be much more relaxed than is maybe sensible against the rising global and domestic inflation backdrop,” said Robert Carnell, head of Asia-Pacific research at ING Groep NV. “We will probably see markets respond by rewarding the currencies of more pro-active central banks more.”—Bloomberg

Also read: Inflation will be exactly what people think it will be