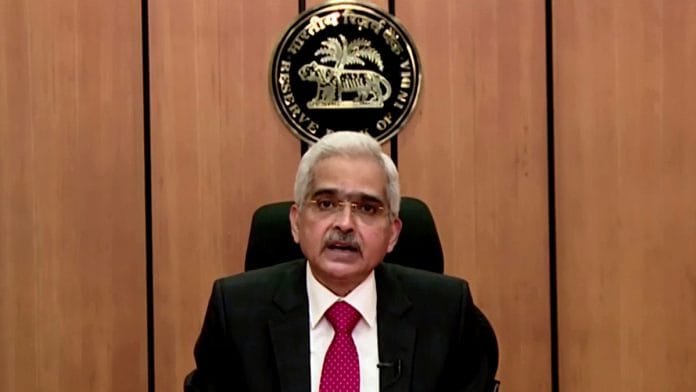

New Delhi: The economy has exhibited a stronger than expected recovery but the recent surge in Covid-19 cases in some parts of the country poses a key risk to that revival, Reserve Bank of India (RBI) Governor Shaktikanta Das said Thursday.

“After witnessing a sharp contraction in GDP of -23.9 per cent in the first quarter of the current financial year and a multi-speed normalisation of activity in the second quarter, the Indian economy has exhibited stronger than expected pick up in momentum of recovery,” he said while addressing an event organised by the Foreign Exchange Dealers’ Association of India.

The Indian economy is expected to contract by a much lower magnitude in the July-September quarter as compared to the April-June quarter when the country reported the highest economic contraction in its history.

The second quarter GDP data is due to be released Friday by the National Statistical office.

Das pointed out that even as the growth outlook has improved, the downside risks to growth continue due to recent surge in infection in parts of India.

After peaking in mid-September, the Covid-19 infections had started falling. However, the festive season gatherings and people flocking to overcrowded markets has seen many states including Delhi and Maharashtra reporting a rise in infections in the last few weeks.

“We need to be watchful about the sustainability of demand after the festivals and a possible reassessment of market expectations surrounding the vaccine,” Das said.

Also read: Indians consumed less meat, fish, ice-cream in first half of this fiscal due to Covid fear

‘Surplus current account balance key to resilience’

Das said the surplus current account balance has been the key source of resilience for the Indian economy.

“The monetary policy guidance in October emphasised the need to see through temporary inflation pressures and also maintain the accommodative stance at least during the current financial year and into the next financial year,” he said. “A key source of resilience in recent months has been the comfortable external balance position of India supported by surplus current account balances over two consecutive quarters, resumption of portfolio capital inflows on the back of robust FDI inflows, and sustained build-up of foreign exchange reserves.”

Das also talked about how a calibrated opening up of the economy can supplement domestic savings and help finance growth and development.

On the issue of capital account convertibility, Das said this will continue to be “approached as a process rather than an event, taking cognisance of prevalent macroeconomic conditions”.

“A long term vision with short and medium term goals is the way ahead,” he said. Full capital account convertibility refers to a situation where there are no curbs placed on residents or firms to invest overseas in different instruments as well as repatriate money.

Also read: Single window clearance for investors by March end, will enable easy access to policymakers