New Delhi: The government’s strategy when it comes to managing its public sector enterprises is shifting from focusing on disinvestment to weeding out the non-performing companies and instead increasing the dividends it receives from the operating ones.

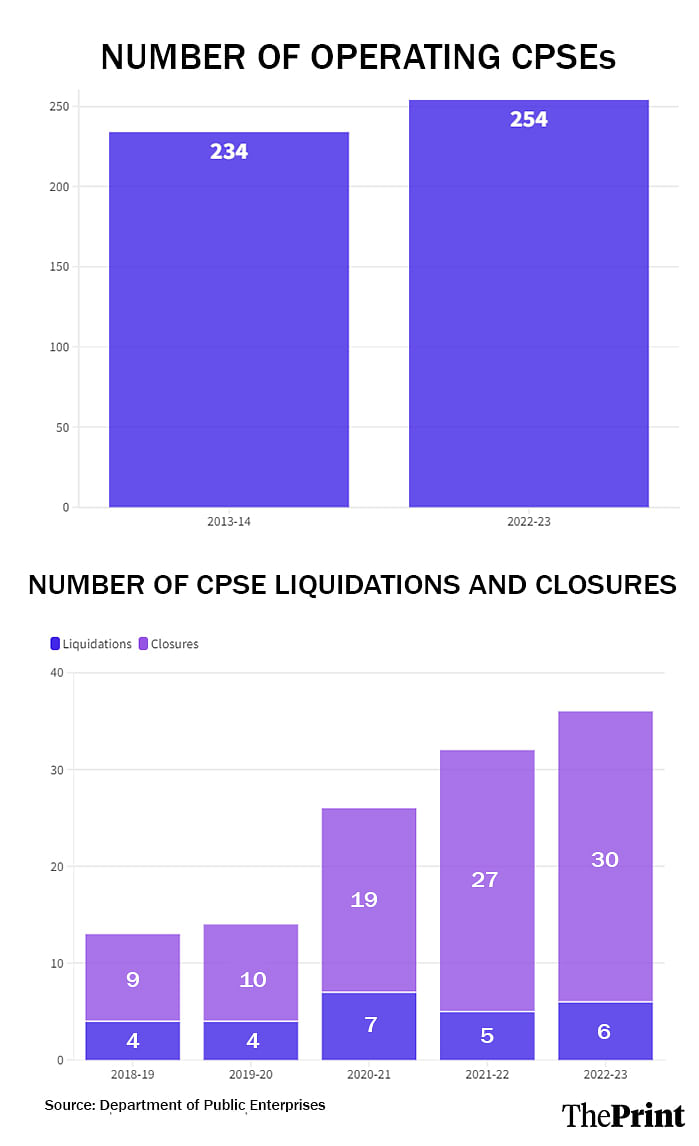

An analysis of data with the Department of Public Enterprises (DPE) for the period 2013-14 to 2022-23, the latest period for which the data is available, shows that the number of closures and liquidations of central public sector enterprises (CPSEs) has almost tripled in the last five years.

While closing several CPSEs, the central government has also been opening new ones, meaning that the total number of operating CPSEs has been increasing. The data shows 20 CPSEs have been added to the overall number of operating public sector companies since 2013-14.

Notably, though, a focus on improved financial performance has meant a rising share of the operating CPSEs are now profitable and the profit earned by them has also been increasing. As a result, so has the dividend payout from these companies to the government.

On the other hand, these increased dividends have been balanced by lower disinvestment receipts, leaving it unclear whether this new strategy is a winning one.

The data on CPSE closures and liquidations only goes back to 2018-2019, but it shows a substantial increase. That is, while only 13 CPSEs were shuttered or liquidated in 2018-2019, this number rose to 36 by 2022-23.

“Overall, I think there has been a lot of operational efficiency improvement that has been brought in and the focus has been on this efficiency translating into financial performance,” Ramendra Verma, national sector leader (government) at professional services firm Grant Thornton Bharat, told ThePrint.

“Several loss-making companies have also been either sold or closed, but taken off the books in one way or the other,” he added.

Also Read: The pains and gains of Modi’s reforms are deferred—GST, banks to demonetisation

Concerted effort by government

This has been part of a concerted effort by the government, according to a senior official in the Union Ministry of Finance—under which lie the DPE and the Department of Investment and Public Asset Management (DIPAM), the two nodal departments for the operation and sale of CPSEs.

“The focus on CPSEs has always been there, but it really came to the fore during the pandemic, when the Public Sector Enterprises Policy was announced,” the official told ThePrint.

“Even though the PSE policy was publicised as a privatisation policy, the fact is that it also contained a major aspect of closures, which was largely ignored by commentators,” the official added.

According to the PSE policy, announced as part of the pandemic-oriented Atmanirbhar Bharat package in May 2020, the government would maintain a “bare minimum presence” in a few strategic sectors and would completely exit the non-strategic ones.

“All PSEs in non-strategic sectors shall be considered for privatisation, where feasible, otherwise such enterprises shall be considered for closure,” the DPE website says about the PSE policy.

In keeping with this, the DPE in 2021 also issued detailed guidelines for how CPSEs could be closed down.

More profitable CPSEs, rising profits

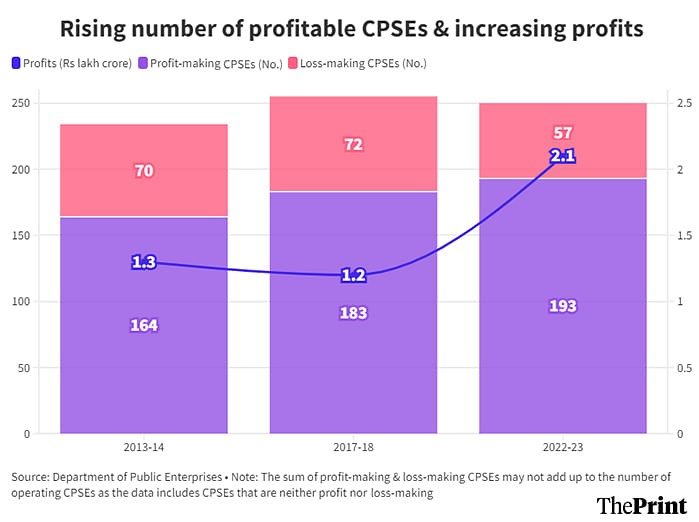

What these closures have meant is that the proportion of profit-making CPSEs among those that continue to operate has been rising. The data shows that, in 2013-14, 70 percent of the CPSEs that were operating were profitable. This has since risen to 76 percent by 2022-23.

This is particularly notable because the overall number of operating CPSEs has also been rising. The data shows that there were 234 operating CPSEs in 2013-14, which grew to 254 by 2022-23.

Further, not only is the number of profitable CPSEs rising, but their profits have also been increasing.

The overall profits of the CPSEs rose from Rs 1.3 lakh crore in 2013-2014 to Rs 2.5 lakh crore by 2021-2022, before declining somewhat to Rs 2.1 lakh crore in 2022-2023.

That said, even though the number of loss-making CPSEs has decreased, the losses borne by them have increased, which means the surviving loss-making CPSEs are doing worse than before. The losses of the CPSEs increased from Rs 21,341 crore in 2013-2014 to Rs 28,827 crore in 2022-2023.

Dividends vs Disinvestment

Back in 2023, DIPAM secretary Tuhin Kanta Pandey had spoken at length to ThePrint about the change in the government’s policy towards balancing disinvestment with dividends, rather than simply focusing on the former.

“Up till recently, the focus has been one-sided on disinvestment, out of these two,” he had said at the time. “However, disinvestment of shares also means that future receipts on account of dividends are sacrificed. Therefore, a holistic perspective on the issue is important.”

This focus on increased profitability and creating value among the CPSEs has meant that the government has seen significant returns on its investment—both in terms of the value of the stock it holds in CPSEs, and also the dividends it receives from them.

It’s unclear, though, whether Pandey’s “holistic approach” has really paid off. After all, the value of the government’s holdings in CPSEs is a notional number until it actually sells those holdings. In the event of a stock market correction, the value of the government’s holdings will also fall.

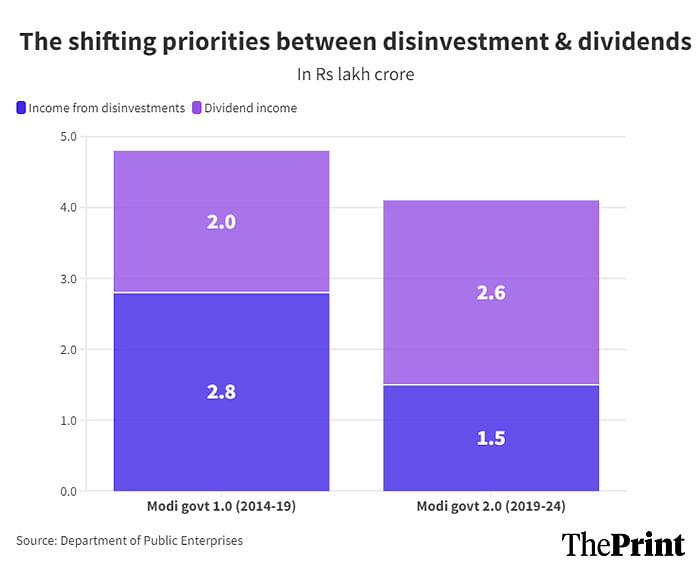

As far as actual money coming in is concerned, the total of disinvestment and dividend receipts has actually been lower in the second term of the Modi government than in the first, although the balance between the two sources has shifted considerably.

That is, between 2014-15 and 2018-19, the government earned a total of Rs 4.8 lakh crore from disinvestments and dividends taken together. Of this, disinvestment accounted for nearly 60 percent.

In the second term of the Modi government (2019-2020 to 2023-2024), the government’s earnings from these two sources had fallen to Rs 4.1 lakh crore, with disinvestments now accounting for just 36 percent.

Profit concentration and market dominance

The other notable factor about the CPSEs’ profits is that they largely remain concentrated among 10 companies, which continue to make up 60 percent of the total profits of CPSEs. Further, the profit-making CPSEs largely operate in sectors where the government is overwhelmingly dominant.

For example, in 2018-2019, the top 10 CPSEs accounted for nearly 62 percent of the total profits of all CPSEs. By 2022-2023, this had marginally fallen to 60 percent. Given that the total number of CPSEs had increased during this time, this meant that the profits were becoming even more concentrated in just a few companies.

Further, the analysis found that the five sectors of crude oil, coal, financial services, power generation and petroleum refining and marketing accounted for 78 percent of CPSE profits in 2018-2019. By 2022-2023, just four of these sectors—since petroleum refining and marketing had fallen off the list—accounted for 72 percent of CPSE profits.

Public sector companies have a dominant position in almost each of these sectors. For example, CPSEs occupy 79 percent share in the domestic oil production market, more than 70 percent share in coal production, and 66 percent share in petroleum refining and marketing.

(Edited by Nida Fatima Siddiqui)

Also Read: India’s economic indicators telling a story—of growth, recovery, robustness