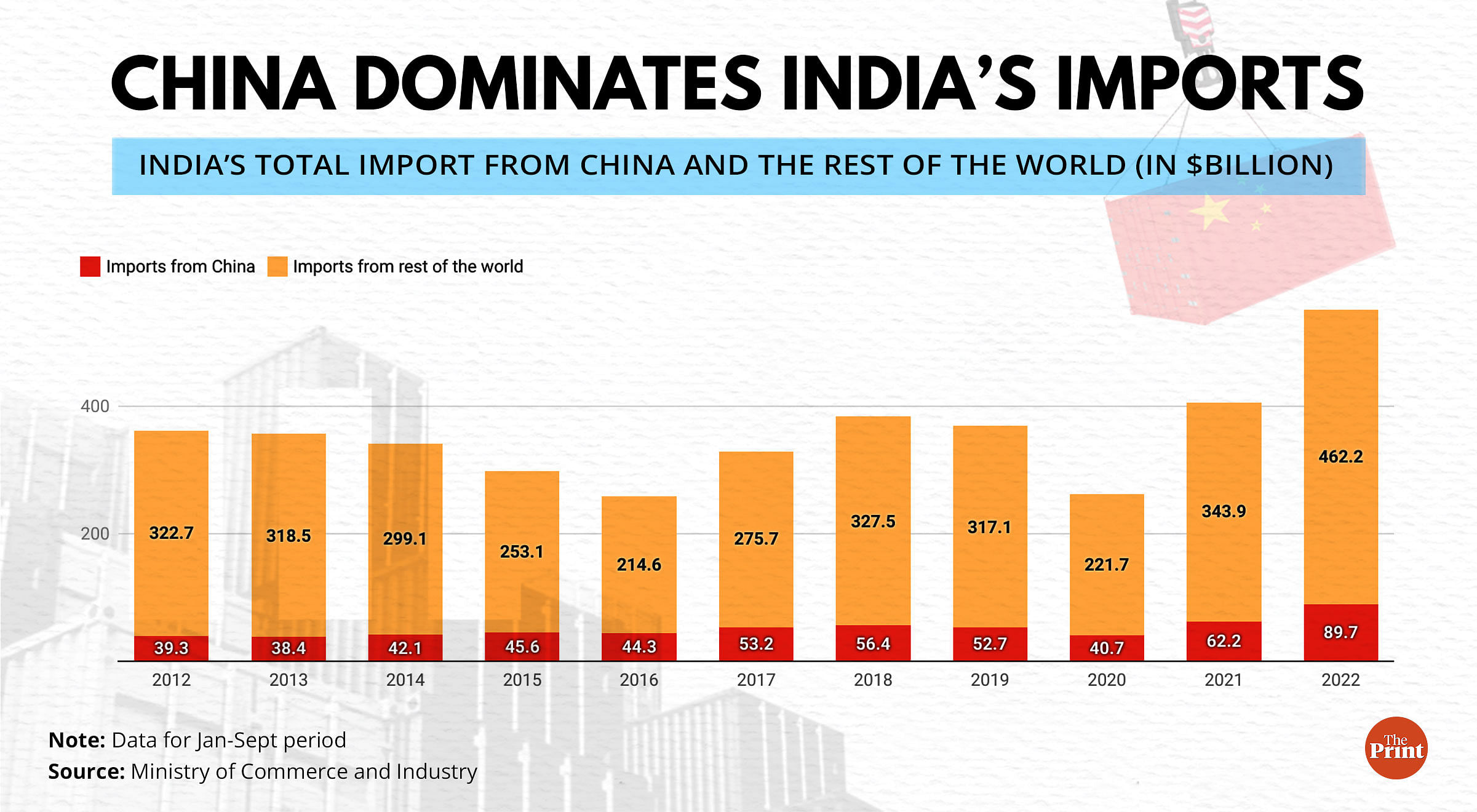

New Delhi: India’s imports from China have already surpassed $89 billion in the first three quarters of 2022 and look set to cross $100 billion by the end of the year, mainly driven by capital or industrial goods.

This is despite the calls for boycott of Chinese goods in the wake of border tensions between the two nations.

In 2021, by September, India had imported goods worth $62 billion from China and the figure has surged 44 per cent in just one year, according to data from the Ministry of Commerce and Industry.

The growth in imports of Chinese goods is significantly higher than the growth of India’s overall imports. Between January and September 2022, India’s total import bill was about $551.8 billion, which is a 35 per cent jump from last year’s import bill of $406 billion.

The faster growth in imports from China means that its share in India’s total imports has risen from 15.3 per cent in 2021 (January-September) to 16.2 per cent in 2022 (January-September).

A deeper look at India’s foreign trade with China reveals that most of the rise in imports is on account of “input goods” or capital goods, which are used to produce other goods.

The United Nations’ Comtrade database shows that India’s imports from China are swelling largely because of imports of capital or industrial goods. Over the past 10 years (from 2011 to 2021), India’s imports of capital goods from China have grown by an average of 4 per cent every year.

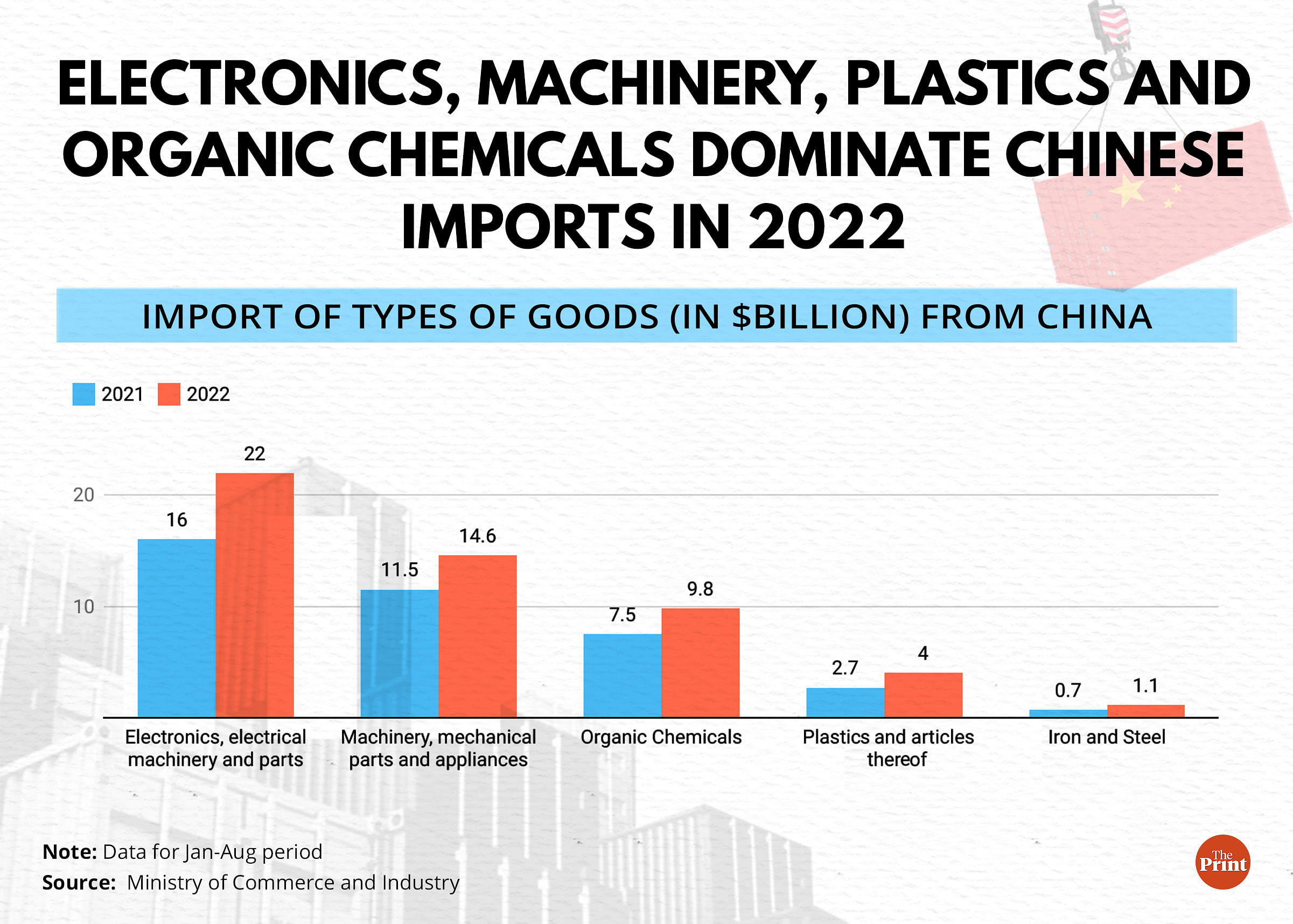

In India, the Ministry of Commerce and Industry has provided unit-level data for the types of commodities imported till August 2022.

Of all the commodities whose imports were more than $1 billion in 2022, “iron and steel” saw the steepest rise in imports from China. During January-August 2021, India had imported iron and steel worth $0.74 billion. The figure stood at $1.14 billion in 2022 — a jump of 54 per cent.

Similarly, imports of plastics and their articles from China are also disproportionately higher in 2022. India imported around $4 billion worth of plastics in January-August 2022 compared to $2.7 billion in the same period of 2021, according to the ministry.

Electronics and electrical machinery and their parts — which form about a third of India’s imports from China — have also risen by 37 per cent, from $16 billion in 2021 to about $22 billion in 2022 over the period under consideration.

Also Read: The long road to Atmanirbhar Bharat: India’s trade deficit with China hit record $77 bn in FY22

Manufacturers are main beneficiaries

In India, calls for the boycott of Chinese products — mainly consumer goods — have frequently been made in the wake of bitter border ties. However, data suggests that consumer goods have never dominated India’s imports from China, and so a boycott will not have much impact.

In 2021, according to data from Comtrade, India imported consumer goods worth $2.84 billion from China, which is not even a tenth of its total imports from the nation. From 2011 to 2021, there has been an average decline of 1 per cent in the import of consumer goods from China. This has, however, been more than compensated for by 3 to 4 per cent average annual growth in the imports of capital and industrial goods from the nation.

The data goes against the popular perception that consumers are the drivers of imports from China. In fact, it is Indian manufacturers who are relying heavily on Chinese imports.

According to the data, about 40 per cent of India’s total capital goods imports in 2021 came from China.

So why is it that our industries have to rely on Chinese input goods?

One answer is that Chinese intermediate or input goods are quite competitive in the market, and that both pricing and logistics work in their favour, according to Saon Ray, visiting professor at the Indian Council for Research on International Economic Relations.

“The reason why our manufacturers opt for Chinese capital goods is the price at which they offer,” Ray told ThePrint. “The economies of scale and other factors allow China to offer a competitive price, which reduces the input costs of production. There could be alternatives available, say from Germany or any other industrial goods-savvy nation, but Chinese inputs are competitive.”

She added that import of capital goods also provides an impetus to domestic growth.

“The import of capital or industrial goods means that the product is going to come in our value chain (either for domestic use or export),” Ray explained. “It will generate employment and increase production activities, which are fruitful for a nation. Going for expensive alternatives is not viable.”

Electronics and electrical machinery has also dominated India’s imports, which Ajay Sahai, from the Federation of Indian Export Organisations, finds relieving.

“It’s good that electronics and electrical machinery forms a major chunk of India’s imports from China, as India is moving ahead in localising the manufacturing of these products,” Sahai said.

“The government has announced fiscal incentives to electronics manufacturers in the country in the name of ‘performance-linked incentives’,” he added. “A lot of investment has already come to India which should start yielding results in the coming years. We are looking at a deceleration in both overall imports of electronics and imported goods from China.”

Bornali Bhandari, senior fellow at the National Council of Applied Economic Research, also believes that Chinese manufacturers have an edge over global manufacturers owing to the cost of doing business and scale of operations.

“But whether or not the import of capital goods from China benefits India needs a detailed investigation,” she said. “We need to ascertain how much value addition is being done on these Chinese input goods coming to India. The greater the value addition done at home, the more output it generates, the more employment it provides and vice versa. This needs a sector-by-sector analysis.”

(Edited by Nida Fatima Siddiqui)

Also Read: Uh oh. Data shows India-China trade deficit widening, Indian exports falling for 1st time in yrs