New Delhi: Consumer confidence is returning as reflected by several indicators, Reserve Bank of India (RBI) Governor Shaktikanta Das said Friday, reiterating the focus of the monetary policy on growth revival.

The recent inflationary pressures are transitory and any preemptive measures by the Monetary Policy Committee (MPC) could kill India’s nascent and hesitant economic recovery, Das said.

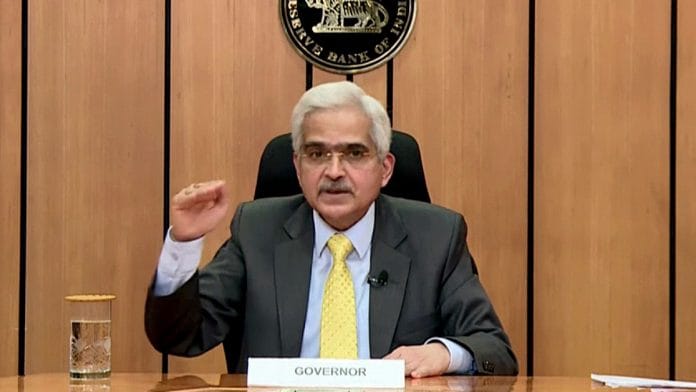

The governor was speaking after a three-day meeting of the MPC that met against a backdrop of inflation exceeding 6 per cent for two consecutive months.

While announcing the six-member committee’s decision to keep the repo rates unchanged even as inflation was higher than the upper inflation targeting band for the months of May and June, Das said that economic indicators show that consumption, investment and external demand are improving.

He also pointed out that the situation now is much better than the previous meeting of the MPC in June.

However, RBI has retained its growth forecast for the current fiscal at 9.5 per cent citing global commodity prices, episodes of financial market volatility and taking into account the vulnerability to new waves of infections.

“At this stage, continued policy support from all sides — fiscal, monetary and sectoral — is required to nurture the nascent and hesitant recovery,” Das said, adding that the recovery remains uneven across sectors and needs to be supported by all policy makers.

Also read: India’s uncertain growth trajectory makes it tough for RBI to tinker with interest rates

‘Domestic economic activity normalising’

RBI remains in a “whatever it takes” mode and is ready to deploy all its policy levers while preserving financial stability, Das said.

“At this juncture, our overarching priority is that growth impulses are nurtured to ensure a durable recovery along a sustainable growth path with stability,” he added.

Das pointed out that domestic economic activity has started normalising with the ebbing of the second wave of the virus and the phased reopening of the economy. High-frequency indicators suggest that both private and government consumption, investment and external demand are all on the path of regaining traction, he said.

“Further easing of restrictions and increasing coverage of vaccinations are likely to boost private spending on goods and services including travel, tourism and recreational activities, propelling a broad-based recovery in aggregate demand,” he noted.

RBI’s consumer confidence survey for July suggests that one year ahead sentiments returned to optimistic territory from historic lows, Das said, adding that this along with the healthy growth in sales, wage growth and profitability reported by corporates are good signs for disposable income of consumers.

On the inflation front, the RBI expects inflation to average 5.7 per cent during the year.

“The recent inflationary pressures are evoking concerns, but the current assessment is that these pressures are transitory and largely driven by adverse supply side factors,” Das said explaining the MPC’s decision to ‘look through’ the high inflation numbers.

“The supply-side drivers could be transitory while demand-pull pressures remain inert, given the slack in the economy. A pre-emptive monetary policy response at this stage may kill the nascent and hesitant recovery that is trying to secure a foothold in extremely difficult conditions,” he pointed out.

(Edited by Manasa Mohan)

Also read: Why RBI isn’t very concerned about current increase in inflation — former dy governor explains