Calling for greater dialogue with the finance ministry, Bank Boards Bureau says it is merely functioning as an appointment board.

New Delhi: The Bank Boards Bureau (BBB) has claimed that the Department of Financial Services had rejected its recommendations for reforms in the state-owned banks.

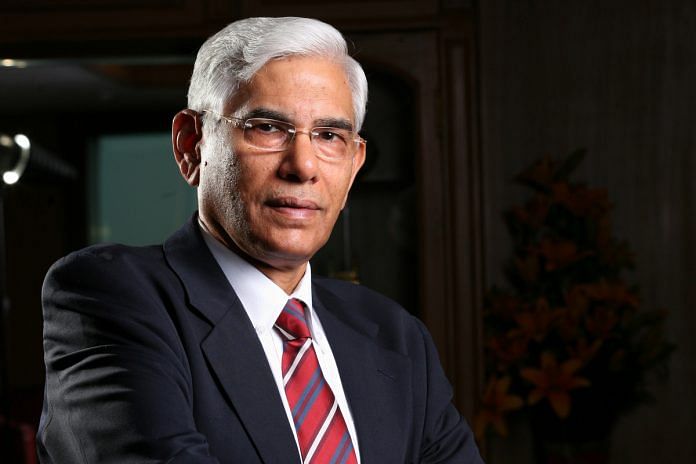

In its report released this week, the BBB headed by former CAG Vinod Rai called for greater dialogue with the finance ministry, and said the body is merely functioning as an appointment board.

The Rs 13,500-crore PNB scam has caused wide ripples prompting rating agencies to downgrade the banking and economy of the country. Goldman Sachs Tuesday cut its forecasts for India’s economy and warned tighter regulations may stifle credit growth.

In the wake of the PNB scam, questions have been raised on the rationale behind the existence of BBB, which was set up ironically to improve the “governance of public sector banks”.

The six-member BBB was set up in April 2016 with the aim of advising the government on aspects such as appointments, code of conduct and ethics at PSBs.

The Bureau says it can help RBI in reducing the conflict of interests arising from acting as a regulator and supervisor of the banking entities in the public sector.

RBI governor Urjit Patel, last week, admitted that dual regulation ownership by the finance ministry and the RBI has led to a deep crack in the banking regulatory setting. Citing the limitations of the regulatory body, Patel said RBI has limited powers when it comes to public sector banks as it is incapable of removing directors and management at PSBs, forcing mergers, revoking licences, and triggering liquidation.

The BBB has made recommendations to develop an independent perspective on asset quality in general and stressed asset resolution strategy, in particular, that transcends business cycles as also possible way for concerted and co-ordinated effort among PSBs towards recovery and, more so, in the case of wilful defaulters.

The recommendations also include consolidation of the PSBs that would minimise the reliance on the tax payers and reworking the Articles of Association of IDBI Bank Ltd., so that it mirrors to the extent possible the Articles of Association of other such institutions which were earlier in the public sector.

Additionally, the BBB was asked to help PSBs devise a capital raising plan, however, the DFS has not engaged with the body in deciding the allocation of capital to public sector banks, the report says.

However, as the government swerved into action with proposed bills to deal with loan defaulters and stricter norms to govern and monitor the activity in the PSBs, there is some speculation that it may be curtains for BBB with Rai’s retirement in March.

The report signed by Rai says it is unrealistic to expect that nearly half a century old systems and processes, set up in the wake of nationalisation of banks, can be undone overnight.