New Delhi: A section of economists and former officials of the Securities and Exchange Board of India (SEBI) is not convinced with the Supreme Court’s decision to form a committee for assessing and recommending ways to strengthen the existing securities market regulatory framework.

The main criticism of this group with whom ThePrint spoke to centres around the premise that looking into market volatility and other market-related issues should be left to the SEBI, while the decision to form a panel to review the functioning of the regulator should remain with the government.

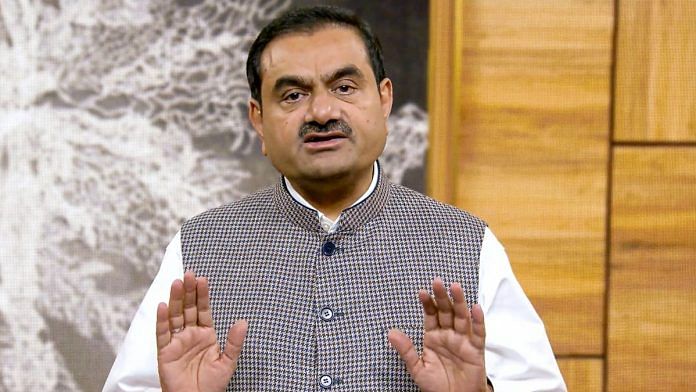

On Thursday, the Supreme Court passed an order directing the SEBI to conclude its investigation into the allegations made by short-seller Hindenburg Research on the Adani Group within two months. It also formed a panel of six members with a wide remit of duties, including investigating the Adani issue and if there was a failure to disclose relevant information on related parties.

The top court nominated veteran bankers O.P. Bhatt and K.V. Kamath, Justice J.P. Devadhar (retired), Infosys co-founder Nandan Nilekani and advocate Somasekharan Sundaresan as its members, and Justice A. M. Sapre (retired) as its head.

The remit of the committee would be to “provide an overall assessment of the situation including the relevant causal factors which have led to the volatility in the securities market in the recent past,” it said.

Other duties of the panel include suggesting measures to strengthen investor awareness, investigating whether “there has been regulatory failure in dealing with the alleged contravention of laws pertaining to the securities market in relation to the Adani Group or other companies”.

Such a step, however, was considered by this section of voices as judicial overreach, outside the purview of the courts, and a bad precedent.

“The Supreme Court by setting up a “market” committee has ventured into an area in which it has no domain expertise, and neither does it have a Constitutional remit to do the same,” Surjit Bhalla, former Executive Director at the International Monetary Fund, said.

‘Surprising that petitions were entertained’

“I was somewhat surprised to see the Supreme Court entertaining the petitions in the first place,” former SEBI chairman M. Damodaran told ThePrint. “One petition was to ban short-selling, which is not something a court should be looking into. Short-selling is a common market practice and if any tweaking is required, it should be done by the regulator.”

“The other petition was to prosecute (Hindenburg Research founder) Nathan Anderson, which is something SEBI should look at,” Damodaran added.

Regarding the third petition, which was about protecting investors, Damodaran said the apparent loss to investors was a notional one, since a loss arises only when these investors sell their shares.

“There is nobody forcing any investor to sell at this lower price,” he said. “The second point is that retail investors in Adani companies were a very small proportion, and the mutual funds did not invest at all. So, any ‘losses’ were to large investors.”

Also Read: Month after Hindenburg report, Adani stock fall shows short seller’s findings could have been right

Volatility a normal part of markets

The problems with the Supreme Court’s intervention issue also extend to the fact that the committee it formed is to look into market volatility, which is part and parcel of the fair price discovery and market operations, according to Bhalla.

“In January 2008, when Indian benchmark indices fell 20 per cent in one day, there was no call for the Supreme Court’s intervention. So, why now?” he asked. “Neither the judiciary nor the government is responsible for market behaviour, and nor should they be involved in the price discovery of markets. This does not happen anywhere in the world and nor should it happen in India.”

However, former investment banker Praveen Chakravarty said the Supreme Court was correct to intervene since the Adani-Hindenburg saga has become a larger issue than merely the activities of a single group of companies.

“There’s a larger impact of this issue,” Chakravarty, who is also the chairman of the data analytics wing of the Congress, told ThePrint. “India’s capital market credibility on the foreign stage is at stake. This is not a Congress or a BJP issue. In that sense, the Supreme Court is right to take cognisance.”

“Unfortunately, SEBI has not inspired confidence,” Chakravarty added. “The heart of the matter is the beneficial ownership of the investors in the Adani companies. SEBI has not released even a single statement on this, or whether it is looking into it.”

He added that, although it is not for the Supreme Court to intervene in the day-to-day workings of the market, it bodes well for the Indian markets that the top court has intervened in this case “where there has been a failure” by the regulators.

Regulators are first line of defence

“The stability as well as rights and rules of market behaviour is the responsibility of the exchanges and the regulator, not the government or judiciary,” Bhalla explained. “Worldwide, the first line of defence in ensuring the orderly functioning of markets lies with the exchanges and the regulator.”

This assessment is in line with the view held by Damodaran, who said that the Supreme Court “should not be the first port of call for persons with such complaints”.

“I wish the Supreme Court had left it to the government to constitute a committee,” he added. “But one good thing is that the committee at least doesn’t include any former SEBI officials.”

Regarding the composition of the committee, another former SEBI chairman said that he was not convinced about how proper it is that a former head of the Securities Appellate Tribunal — the body to which the SEBI orders can be appealed to — was appointed to the committee to look into SEBI’s operations.

Justice J. P. Devadhar (retired), a member of the Supreme Court appointed panel, was formerly the presiding officer of the SAT.

The former SEBI head also said that the constitution of this committee poses procedural problems.

“Any action by SEBI can be appealed in the SAT and the SAT’s order can further be appealed in the Supreme Court,” he explained. “However, what happens if it is the Supreme Court itself that has directed SEBI to investigate a matter, as has happened in this case?”

(Edited by Tony Rai)

Also Read: How Hindenburg report is affecting Adani’s business abroad — limits on trading, probes