New Delhi: A month after the release of the Hindenburg Research report, which claimed stocks of the Adani Group’s companies are substantially overvalued, its assessment seems to be turning out to be correct and in some cases — nearly exactly so. The report was released on 24 January.

In its original report, Hindenburg Research, a US-based short seller, had said that the stocks of the Adani Group’s seven listed companies “are 85 per cent overvalued, even if you ignore our investigation and take the companies’ financials at face value”.

Data from the Bombay Stock Exchange (BSE), as of the close of trading Thursday, showed that several Adani companies’ stock prices had indeed fallen by close to 70-80 per cent.

Adani Total Gas, for example, saw its stock price fall to Rs 793.25 Thursday, from Rs 3,892.5 per share on 23 January — a fall of nearly 80 per cent. The shares of both Adani Transmission and Adani Green Energy fell about 73 per cent over the same period.

The flagship company, Adani Enterprises, was the next worst performer, with a fall in share price of nearly 60 per cent over the past month.

This, however, could have been exacerbated by a recent report by the crowd-sourced online encyclopaedia, Wikipedia, which said it had found multiple instances of employees of the Adani Group improperly editing and altering posts relating to Adani Group chairperson Gautam Adani, his family members, and of Adani Enterprises, among others.

“Over 40 later banned or blocked sockpuppets or undeclared paid editors created or revised nine related articles on the Adani family and family businesses,” Wikipedia’s report said. “Many of them edited several of the articles and added non-neutral material or puffery.”

Following the release of Wikipedia’s report, shares of Adani Enterprises and some other Adani companies fell as much as 12 per cent, intensifying their downward trend.

Also Read:Thackeray-led Shiv Sena objects to Gautam Adani’s son on Maharashtra Economic Advisory Council

Fall in Adani wealth

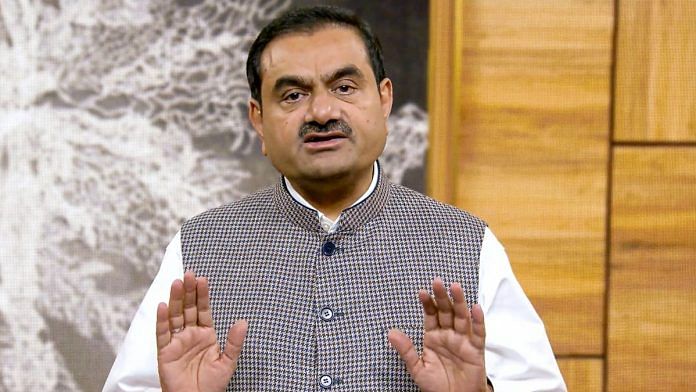

What this drastic fall in stock prices has meant is that, over the past month, businessman Gautam Adani has seen a tremendous erosion of his wealth and a sharp tumble in the ranks of the world’s most wealthy people.

From being the third-richest person in the world, he is now out of the top 25. According to reports, his wealth has fallen to about $49 billion currently, from $120 billion just a month ago.

What’s worse for the embattled billionaire and his family is that the Hindenburg report brought to light the possible involvement and alleged malfeasance of his elder brother, Vinod Adani, who had, so far, remained out of the spotlight.

ThePrint recently reported on the various ways that the Hindenburg report has hurt Adani’s business prospects abroad. The bad international press didn’t stop there. The UK’s The Guardian reported that the “Adani stock rout leaves tens of millions in Australian retirement savings exposed”, with several Australian pension funds that had invested in Adani stocks seeing their investments worth a fraction of their original value.

(Edited by Richa Mishra)

Also Read: ‘Slowing growth more worrying than inflation’ — why 2 members of RBI panel opposed repo rate hike