Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

With India joining the pack of top 5 economies (by GDP), it is a viable idea to bet on further progression. The GDP and the growth rate reflect the traction that India’s economy has generated. Though the per capita GDP still remains low, a consistent growth should certainly assist in moving the per capita in the right direction.

It is no secret that to maintain the trajectory, India will have to compete for capital and skill, both, to retain and attract. The world is far more connected, and regardless of geo-political forces, international trade and commerce may take a short pause from restrictive policies, but unlikely to hold for longer period. Labour arbitrage can be at best an entry-level enabler.

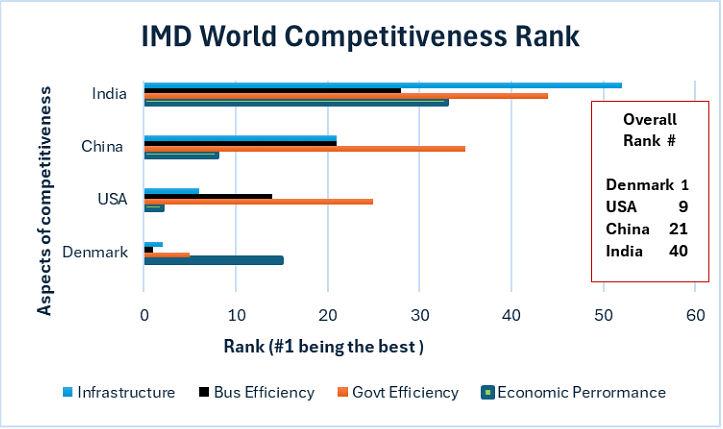

The IMD World Competitiveness Report (Source : IMD World Competitiveness yearbook) is a useful reference document and its credibility based on the high-quality publication over last 35 years. It divides the national environment into four main factors. A simplistic chart based on the 2023 report shows the overall rank as well as the 4 underlaying factors. I have included Denmark as the top ranked, and China and USA as India’s two main trading partners. India ranks 40.

Interestingly, if we overlay the 2023 Corruption Perceptions Index Ranking ( Source : Transparency International) to the competitiveness ranking, we get a sense of the task at hand. Denmark at rank 1 i.e. least ‘corrupt’ and India at 93. These are indicative and there is room for some ‘biases’, as is the case with any form of research or survey, but also a reliable reflection on a global scale. Generally speaking, higher corruption would attract more regulations and often arbitrary enforcements (different from guard rails) , and both could be counter-productive for business and value-generation.

Capital and skills are both more aligned to ethics and transparency than ever before. Some due to democratisation of participants enabled partly by digitization. Both are highly mobile and cannot be restrained by restrictive regulations. Closed economy and prosperity are contradictory, and violently so in the current era. One has to look no further than Brexit. Post Brexit, UK’s outward migration of high-Net-Worth Individuals has been 3rd highest in the world, just behind China and India. There is a reason, a country like Singapore has been a highly successful business-hub despite its small domestic population. Its ranked # 4 in Competitiveness and 5th in Corruption Perceptions Index in 2023. It does not just attract capital but is also a centre for influence.

A growth loop is unlikely to sustain if the overall environment is not ready for success. Growth creates value and it leans heavily on effective governance to move to a bigger loop. If we go through the list of seemingly unassailable blue-chip companies even from 25 years back, we will have a long list of corporations that are now in survival mode, while some of the then-fledglings are ticker symbols of current success story. In most cases of disappointment, it was not the unforeseen market-forced vulnerabilities that got them, but a sense of misplaced belief that no transformation was needed to keep them competitive.

While regulators and regulations have a role in facilitating the environment, it’s actually on the business leaders to set higher standard in governance. Regulations will be less effective as long as businesses are swayed by form over substance. India Govt’s stated objective to privatise all State-Owned Enterprises in non-strategic sector is a strong indication of Govt’s trust in the private enterprise. Productivity of capital goes a long way in ensuring GDP growth, as it does in attracting capital and skill, thereby becoming a point of influence. In 2023, India had the third largest IPO proceeds globally. It’s no more a junior market when it comes to raising capital. There is enough space for growth, fuelled by a growing demand and the only way to keep the trajectory trend on is to elevate the governance of business and sharper management. Businesses do not have to be brazen bulls only to be stopped like a spaniel at a (regulator’s) reprimand. This would be most desirable contribution from business, as India ushers in improved competitiveness index as well as corruption perceptions index. Of course, the state and the regulatory bodies have a role, but its really the business that will drive the improvement. Is there a timetable for this ? No, there isn’t, but the world is competitive and what appears to be incidental can be singled out as essential.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.