Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

Within any merger or acquisition, upfront costs are likely exorbitant, especially from the transaction costs alone, but this is ideally being offset from realizing the goals of cost savings or increased revenues via synergies from the merger or acquisition!

- According to Gartner, most successful M&A transactions have occurred “by aligning the IT integration team with the integration management office (IMO) as soon as the deal is closed.”

Successful firms have innovated and grown in market shares through M&A transactions and if the synergistic values gained can be properly monitored, showing the benefits outweighing the costs, it can be a Value Center! But monetization and tracking using predictive analytics it is paramount!

A merger of companies typically involves a merger of teams, products, and IT departments, with consolidation of ERP, CRM, and back office systems, usually at high initial costs, but with the intent of greater market shares, and cost optimization when things stabilize. These all can be managed and tracked within Value Stream Management solutions, showing metrics before, during the merger and after the merger. The value proposition of the merger can easily be determined, which can justify the M&A IT solutions.

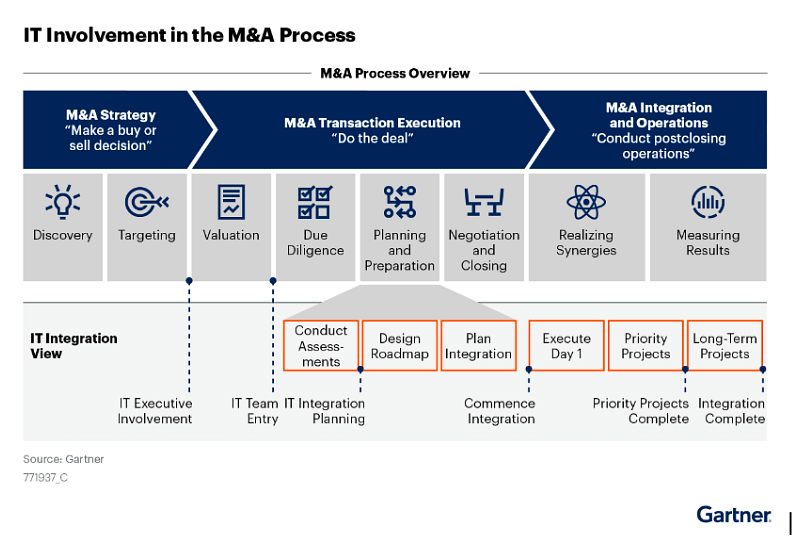

According to Gartner’s report published on Aug. 19th, 2022, entitled: “Four Considerations for Successful IT M&A Integration Planning,” advanced planning for a merger and acquisition requires thorough IT integration in order to realize deal synergies. Their key findings include the following:

- IT plays the largest role in the acquisition integration process, according to 82% of respondents to the 2021 Gartner M&A Success Criteria and Metrics Survey.

- Only 18% of top-performing organizations align IT in the mergers and acquisitions (M&A) process during the strategy phase, and 52% of the top-performing organizations involve IT during the execution phase, indicating a need to involve IT earlier in the process.

- To enable better planning, 67% of the top-performing organizations involve IT in the acquisition due diligence functions prior to closing.

- Top performers regularly plan resources for functional teams, as well as current and upcoming M&A transactions.

What Gartner Recommends!

Gartner’s recommendations include:

- Alignment of IT leadership with the executive and corporate development teams before due diligence commences.

- Development and communication of a coordinated roadmap for the integration by applying the established strategy and goals provided by the corporate development team.

- Establishment of the basis for successful integration by forming the IT Integration team, conducting IT due diligence and beginning integration planning during the transaction execution phase.

- Delivery of integration success by aligning the IT integration team with the integration management office (IMO) as soon as the deal is closed.

Gartner’s IT involvement in the M&A Process is as follows.

Where a sample timeline from pre-Day 1 to Day 1 of the M&A, to Day 100 after the M&A concluded is as follows.

We see a cloud-native infrastructure as critical to the success of building a M&A IT Digital Transformation strategy, and virtualized core network, with Pay-as-a-you-Grow Industry4.0 Applications.

AI/ML for Policy Compliance, Risk Management, and Predictive Trend Analysis is likely a newer area for analysis. This can be solved via platform providers like Accure.AI.

As client CIOs and CTOs Digitally Transform to cloud-based services, there still will be a need for localized integration services, due to policy, security, privacy, and latency needs. These could be:

- Inventory Management with solutions from ERP vendors,

- Resource Catalog, Service Ordering and Resource Ordering, Service Inventory Management, Service Activation and Configuration,

- CRM issues such as customer issue management coming from CRM providers, and how these are holistically managed, tracked, and delivered.

The Revenue portion is often missing from the competitors in the M&A IT space as they primarily focus on Cost savings and neglect the Revenue side of the equation.

So, Indian firms should allow an M&A IT team to provide Revenue Management functions too within it’s M&A IT solution set, using Value Stream Management Platform solutions.

This can help transition the M&A IT Dept. from a Cost Center to a Value Center!

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint