First pandemic, then geopolitical tension, and now inflation have continually disrupted the

banking sector. Rising interest rates, market dynamics, climate change, cybercrime, and many

more pin out the significance of – Resilience and Sustainability in this sector.

Non-performing assets: The Concept

NPAs are loans or advances whose principal or interest remains overdue or in arrears for

more than the prescribed duration i.e., generally 90 days or more The following are key

classifications of NPAs:

1. Substandard assets: When assets become non-performing for a time period of less

than one year.

2. Doubtful assets: When any asset remains substandard for more than one year period is

said to be a doubtful asset.

3. Loss asset: These are NPAs which is identified as a loss by the bank but not written

off yet.

Additional terms:

1. Gross Non-Performing Assets (GNPA): It is said to be the summation of all the loans

that have defaulted by individuals from financial institutions. GNPA ratio is defined

as a percentage of GNPA with total assets.

2. Net Non-Performing Assets (NNPAs): It is calculated by subtracting provision for

doubtful debt maintained by respective banks from GNPAs. The NNPAs ratio is

defined as a percentage of NNPA with respect to total assets.

Financial Stability and Indian banking

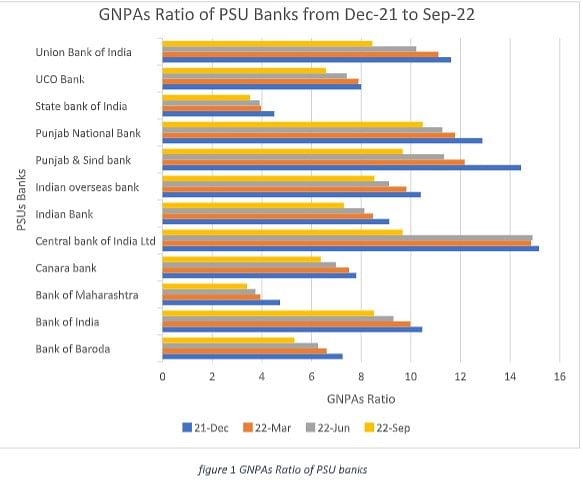

Indian banking sector recovered from the pandemic with high and strong revenue growth and reduced NPAs. According to the Financial Stability Report (December 2022), the GNPA

ratio of public sector banks has reduced to a seven-year low of 5% in September 2022. The

banking sector performing well or even improving. However, this may not be the case.

Public sector banks (PSUs) have also reported a double-digit growth percentage in profits

from December 2021 to September 2022. Stocks are outperforming the NIFTY bank index

and possible reasons for the same could be a rise in interest income, a reduction in GNPAs,

and the ability to reattract corporate borrowings from the private sector to PSUs.

GNPA/NNPA can be improved for two reasons: First- repayment of loans that were earlier

considered as NPAs or are either written off by the bank. In light of the global pandemic, the newly founded MSMEs bore the brunt of the economic downturn. To support them, the

government granted working capital to restart their business under an Emergency Credit Line Guarantee Scheme (ECLGS). The banks assigning credit to these MSMEs get 100%

guaranteed by the government. Within three months of launching this scheme facility,

repayment begin in 38% of accounts, and further, within a year, it rose up to 82%.

Furthermore, the significant reason behind the improvement in the GNPAs and NNPAs ratio

could be written off bad loans worth Rs 7 trillion by public sector banks in past five years.

Risk: Global to Geographical

A McKinsey survey comprising 30+ Chief Risk Officers (CROs) from the world’s leading

banks in late 2021, identified that prevailing high inflation and geopolitical turmoil pointed

toward the looming threat in form of market dynamics, climate change, and cybercrime.

Being highly dependent on the agricultural-based economy, India is still conditional on the

natural climate. Perhaps, financing the rural agricultural sector would result in even more

NPAs.

Cybercrimes related to data, technology, and risk through embedded financing platforms and cyber risks are also coming shortly which could change the lending culture in the banking sector.

However, discussing market dynamics from the side of geopolitical tension and inflation is

initially positive for the banking sector. Inflation has led to an increase in the interest rate

which is resulting in higher profitability. According to McKinsey, global baking revenue is

likely to increase by 5% to 6% in the coming future. Consequently, it may be expected that

the resultant increase in profitability may improve the return on equity (ROE) and would

further could rise to approximately 12% in 2023. That may be the reason why banks are

outperforming during the recent financial period.

Nonetheless, this is the silver lining. If the recession is going to hit, it would perhaps result

for the banks in a reduction in volume, increasing costs, and more delinquencies. Depending on the scenarios, this effect will be small or large.

Resilience: The Way Ahead

Over the next, five to ten years market pressures and technological disruptions in the form of Fintech innovations would lead to a collapse in the fundamental structure of banks. Banks would need to improve their short-term resilience and innovate in long term. It has to focus on financial resilience, to make the revenue model agile and a cost-to-income ratio of at least 35%-40%. Operational resilience, to manage risk and Digital and technological resilience, for superior data security. Lastly, Organizational resilience, with agile workforce and leadership.

References:

1. Dietz, M., Kincses, A., Seshadrinathan, A., & Yang, D. (2023, January 27).

McKinsey’s Global Banking Annual Review. McKinsey & Company. Retrieved

January 28, 2023, from https://www.mckinsey.com/industries/financial-services/our-

insights/global-banking-annual-review

2. Risk and resilience priorities, as told by chief risk officers. McKinsey & Company.

(n.d.). Retrieved January 28, 2023, from https://www.mckinsey.com/capabilities/risk-

and-resilience/our-insights/risk-and-resilience-priorities-as-told-by-chief-risk-officers

3. Operational resilience in banking. Metricstream. (n.d.). Retrieved January 28, 2023,

from https://www.metricstream.com/operational-resilience-in-banking.html

4. https://www.rbi.org.in/

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS