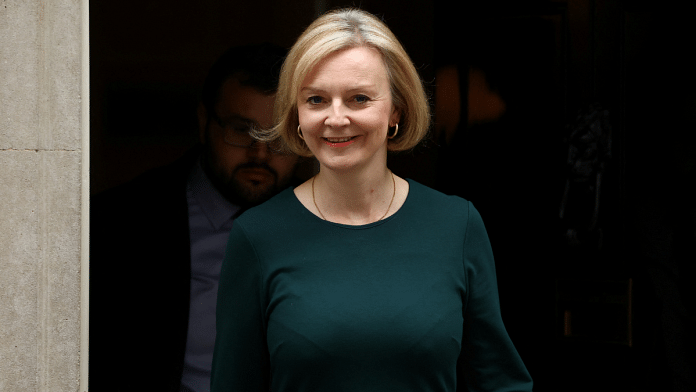

London: Prime Minister Liz Truss is rethinking tax-cut plans that sent markets into turmoil with a possible U-turn on business levies, British media reported on Thursday, although her office said there would be no change of course.

Truss’s economic package, announced last month, has caused a rout in the government bond market, with some investors and Conservative Party lawmakers calling on her to reverse a plan for 43 billion pounds ($48 billion) of unfunded tax cuts, including a move to hold corporation tax at just 19%.

Sky News cited sources as saying discussions were under way over whether to scrap some parts of the plan, and the Sun newspaper said Truss was now considering raising corporation tax after all. It was not clear whether any decisions had been made.

The pound – which has fallen sharply since Truss emerged as the front-runner to become prime minister in August – leapt against the U.S. dollar and British government bond prices recovered some of the steep losses incurred since the “mini-budget” announcement on Sept. 23.

U.S. stocks were also set to open higher after the reports.

Truss has come under huge pressure from within her governing Conservative Party to change course as polls show support has collapsed, with some lawmakers pondering whether she should be removed from the job only a month after becoming prime minister.

The government has repeatedly said it would stick to most of her tax cut plans while also protecting public spending, but economists and critics say something has to give.

On Thursday, foreign minister James Cleverly shied away from confirming or denying whether the government would retain its corporation tax policy, saying only it was important to keep businesses competitive.

Asked about Cleverly’s comments and whether Truss would again commit to no further U-turns in her tax cutting package, her spokesman said: “Yes … the position has not changed.”

LEADERSHIP

There has been vocal criticism of the government’s overall plans from some in the Conservative Party.

Asked about the growing dissent, Truss’ spokesman said she was focused on delivering growth and challenges such as the war in Ukraine.

But newspapers reported that some lawmakers who never wanted Truss to replace Boris Johnson as leader in the first place already wanted her out.

“I think that changing the leadership would be a disastrously bad idea, not just politically but also economically, and we are absolutely going to stay focused on growing the economy,” Cleverly said of Truss.

Truss, the 47-year-old former foreign secretary, was elected in September by Conservative members on a promise to snap the economy out of years of stagnation by cutting taxes and reforming areas such as planning, migration and employment.

Any reversal to her plans would be a huge embarrassment.

The mechanism to remove Truss is unclear. Under current rules, lawmakers can only write letters to call for a no-confidence vote when the leader has been in place for a year.

But a fire-sale in the government bond market has driven up borrowing costs and mortgage rates and forced the Bank of England to intervene to protect pension funds.

“I can see only one outcome: the withdrawal of most of the mini-Budget,” Paul Goodman, editor of the influential Conservative Home website said.

REALLY ILL PATIENT

The BoE’s emergency bond purchases are due to end on Friday but many analysts think it will have to maintain some kind of support with investors still alarmed by the government’s plans.

“A central bank is like a doctor: if the patient is really ill, and even if the patient has misbehaved, it is very difficult for a doctor to walk away,” said Mohamed El Erian, chief economic adviser at Allianz and president of Queens’ College, Cambridge.

“So the reality of central bank emergency interventions is that they tend to continue for longer than what is expected. And central banks simply will not walk away,” he told BBC radio.

Finance minister Kwasi Kwarteng is due to present a full fiscal policy to parliament along with borrowing and growth forecasts on Oct. 31, but El Erian cautioned that damage was being done in the meantime.

“People’s confidence and business confidence is coming down. So if we wait another three weeks, there will be more damage not just to actual growth, but also potential growth,” he said.

There are already signs that a rise in borrowing costs is feeding through into the real economy as higher mortgage costs cool the housing market.

The Royal Institution of Chartered Surveyors said on Thursday that house prices showed the weakest growth in September since early in the coronavirus crisis and they look set to fall with mortgage rates recently jumping further.

The country’s largest homebuilder, Barratt, has flagged a plunge in reservations in recent months, causing it to issue a profit warning after what has been a robust few years for the sector. –Reuters

Also read: India-UK trade deal on ‘verge of collapse’ over visa comments