New Delhi: Four decades ago, Israel was troubled by a variety of economic hardships — hyperinflation, stagnant per capita income levels, and a heavy reliance on imports. In 1984, Israel’s per capita GDP was valued at about $6,600.

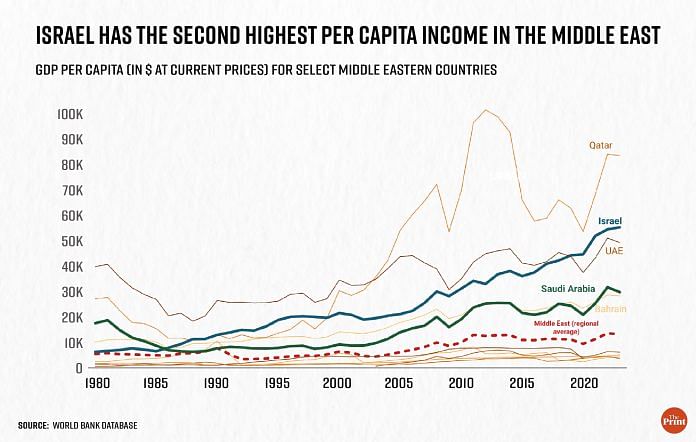

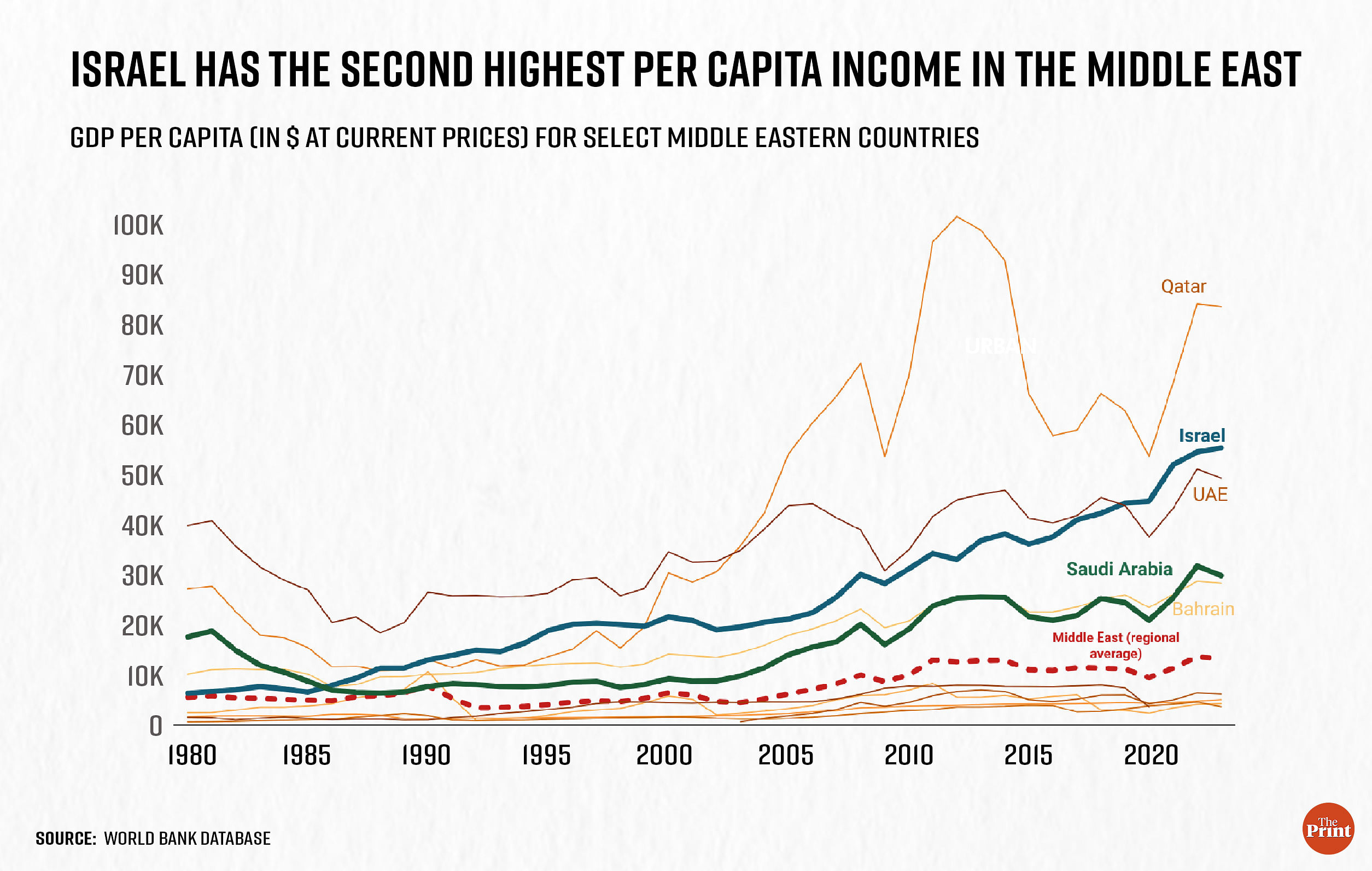

Fast forward to 2023, and Israel now has a per capita income almost double that of oil-rich Saudi Arabia and higher than that of ‘developed’ economies like the UK.

According to the International Monetary Fund’s World Economic Outlook database, Israel’s per capita income has multiplied by more than nine times to reach $58,273, which is the second highest in the Middle East after Qatar ($83,890). In fact, in 2023 prices, Israel’s per capita income is higher than that of many ‘developed’ countries such as the United Kingdom ($46,370), Germany ($53,800), France ($45,190) and Saudi Arabia ($29,920).

Israel also stands tall among its neighbours, with a per capita income almost 11 times higher than Jordan’s ($5,050) and about 14 times higher than that in Egypt ($3,611) and Lebanon ($4,136).

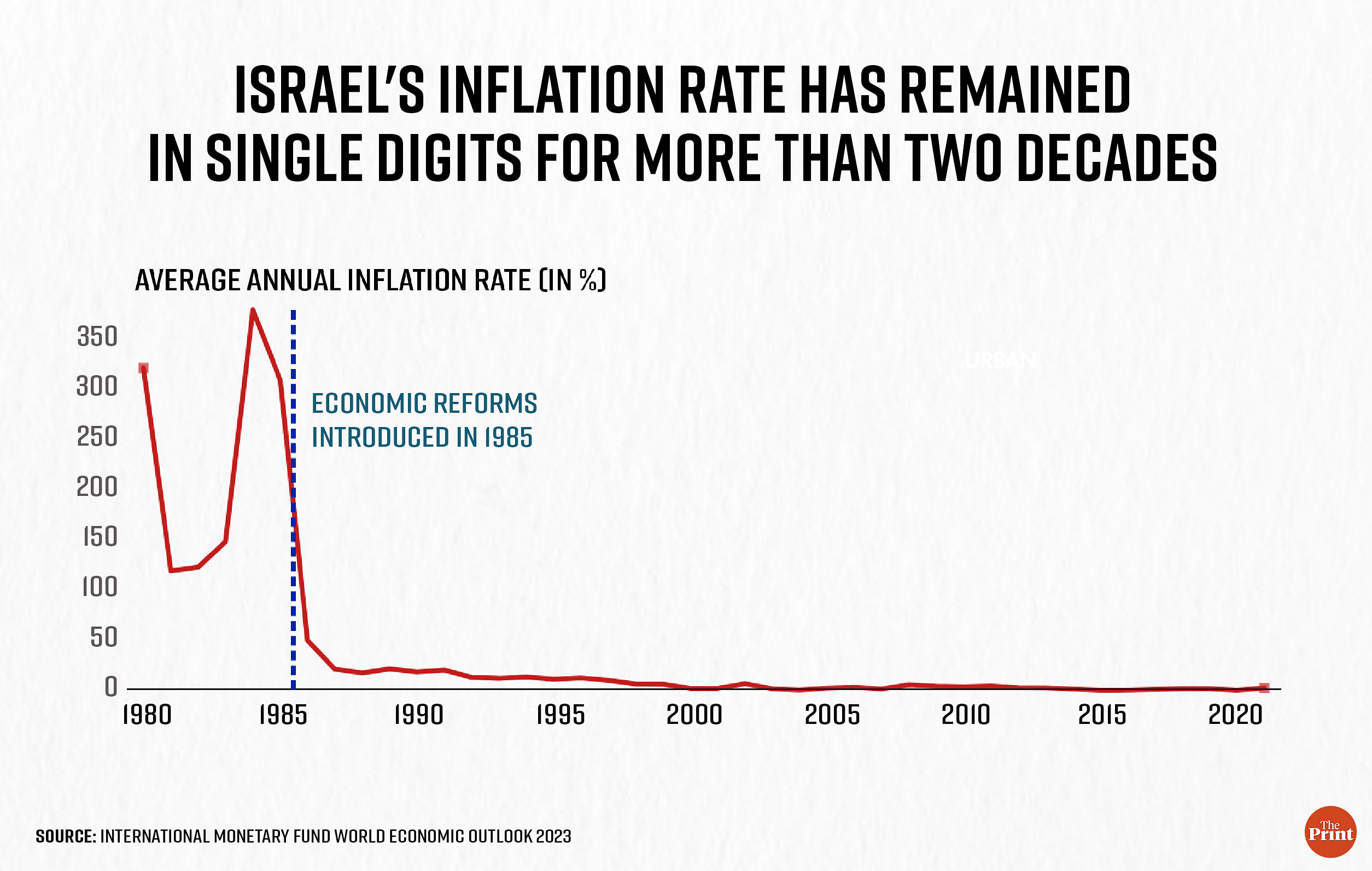

The annual inflation rate has also remained in single digits since the late 1990s, and it has become an export-surplus country, despite a relatively unfriendly neighbourhood.

So, how did Israel grow so big, so fast? Experts credit the nation’s success story to measures taken in the aftermath of the economic crisis, heavy investment in R&D, export of technology and “some luck”.

“The 12-month inflation rate fell quickly from 450 percent in mid-1985 to 20 percent by the start of 1986. Indeed, Israel’s stabilisation programme remains one of the most successful on record,” noted the IMF working paper.

Speaking to ThePrint over the phone, Professor Tomer Fadlon, lecturer and academic adviser for the Master’s programme in cyber, politics and government at Tel Aviv University, said: “Israel is a success story of a nation that faced a severe crunch of resources. It’s that scarcity coupled with an economic crisis that made us look for better and beyond, and look for avenues to grow. Scarce resources made us work harder, and that sums up all the economic success that has followed.”

Also Read: Why Israel must be seen as a sister democracy of India

From crisis to growth

In the early 1980s, Israel’s government was spending a lot, mostly on defence, and thus the economy ran with a huge deficit.

Public debt as a ratio of Gross Domestic Product (GDP) in Israel was about 125 percent, which shot up to 157 percent by 1985, the IMF working paper noted. In simpler words, the money owed by the Israeli government was almost 50-60 percent higher than the value of production the country had at that point of time.

In 1985, the Israeli government decided to take up economic reforms to ameliorate the situation — which became a turning point in the nation’s economic history.

According to the IMF working paper, the country cut down its expenditure by slashing subsidies to the social sector (food and transportation), reduced its defence expenditure, and brought down the fiscal deficit substantially.

With the many reforms the country introduced, it also devalued its currency, the shekel, and gave more power to its central bank — the Bank of Israel — which controlled the credit supply.

The results were visible right from 1986, when the inflation rate fell to about 23 percent. Per capita GDP also started rising quite fast.

IMF records show that Israel’s per capita GDP (at current prices) was about $8,000 in 1986, which jumped to around $20,000 by 1996.

In the next 10 years, Israel’s per capita GDP didn’t rise as fast, and was hovering around $22,700 in 2006, partly because the Israeli economy entered a recession in the early 2000s.

By 2016, however, the country’s per capita GDP surged to $37,000 and, in the next five years, it reached $52,000, according to IMF records.

R&D, high-tech exports & some ‘luck’

One of the many positive outcomes of Israel’s 1985 economic liberalisation was the investment in research and development (R&D), Fadlon pointed out.

“Post-economic liberalisation, Israel opened the gates for foreign direct investment (FDI), and government spending on security and defence came down from about 25 percent of GDP to around 5-6 percent,” he explained.

“In the following decade (early 1990s), Israel spent a lot on research and development. Consequently, the spending on R&D as a share of GDP increased dramatically to 5 percent and created a gap between Israel and other countries,” he added.

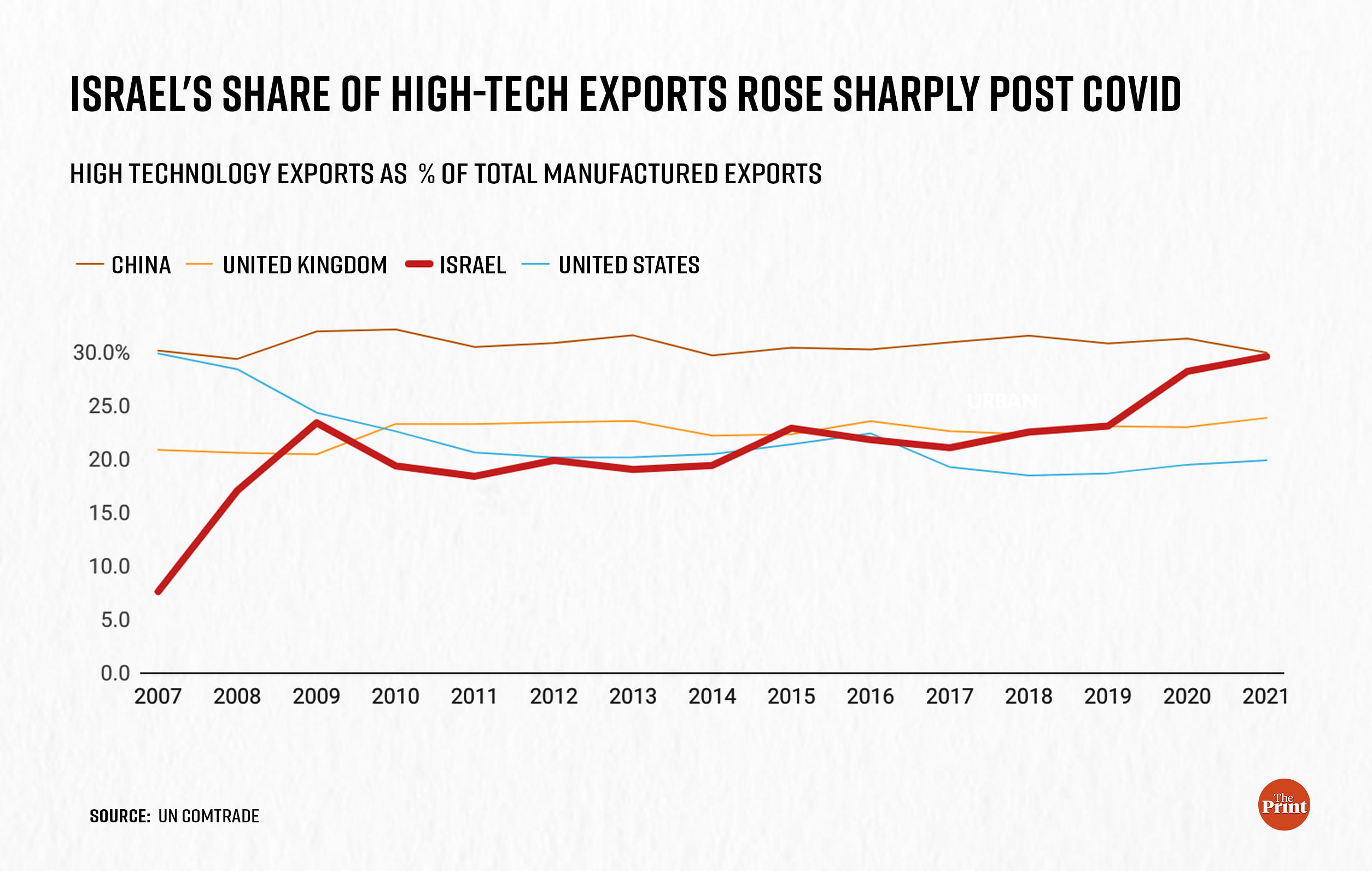

The jump in Israel’s per capita income after 2006 can be attributed to the country exporting high volumes of high-quality technology abroad.

According to the UN Comtrade (a repository of global trade statistics), high technology exports “are products with high R&D intensity, such as in aerospace, computers, pharmaceuticals, scientific instruments, and electrical machinery”.

Data has been available on the repository since 2007. In that year, Israel’s high-tech exports were worth $3.12 billion, which was 8 percent of its manufactured exports. This jumped to $10 billion in 2008 (17 percent). The figure remained between 18 and 20 percent from 2009 till 2014, and about 23 percent between 2015 and 2019.

Since 2020, however, Israel’s high-tech exports have really surged. In 2021, Israel exported $17 billion worth of high technology, which was about a third of its manufactured exports — almost equal to the share of such goods in China’s manufactured exports.

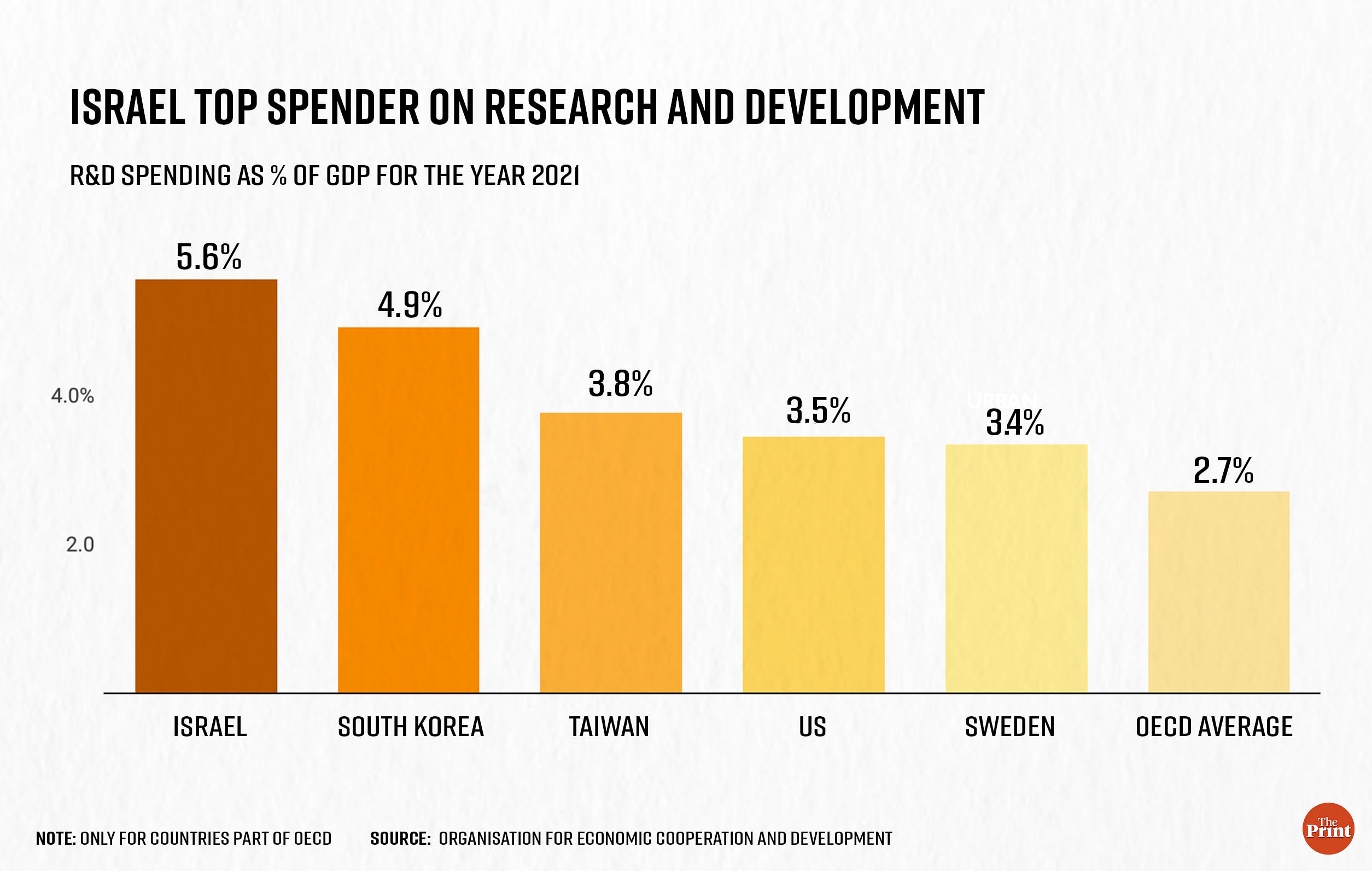

Data from the Organisation for Economic Cooperation and Development (OECD) shows that, in 1996, Israel’s expenditure on R&D was 2.6 percent of its GDP. At the time, this was higher than that of the US (2.4 percent), UK (1.7 percent) and China (0.57 percent).

By 2021, Israel’s expenditure on R&D had jumped to 5.6 percent of GDP — the highest in the world — followed by South Korea (4.9 percent) and Taiwan (3.8 percent), according to estimates by the OECD.

“We were lucky we spent (on) research way before everyone else and, by the time information technology boomed, we had already achieved comparative advantage, that too without cross-border trade, since most of the services exports are intangible in nature,” Fadlon said. “Unlike trade in goods, trade in services has been increasing dramatically in recent years.”

Data from the World Bank shows that services now account for more than 70 percent of Israel’s GDP and, according to Fadlon, Israeli companies make up about one-third of the total cybersecurity exports in the world.

This is in contrast with Israel’s neighbourhood, which comprises mostly oil-exporting countries.

When it comes to Israel’s almost-immediate neighbour, Saudi Arabia, its share of high-tech exports was not even 1 percent of its total manufactured exports from 2010 to 2020.

(Edited by Nida Fatima Siddiqui)

Also Read: Why Adani’s purchase of Haifa Port is Israel’s message to America