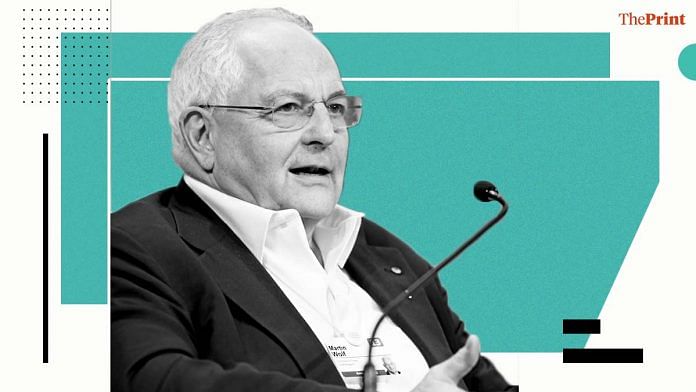

New Delhi: The Indian economy has been hit hard by the pandemic and the government needs to spend substantially more to revive demand, said Martin Wolf, Chief Economics Commentator at The Financial Times.

In a conversation with Editor-in-chief Shekhar Gupta at ThePrint’s digital Off the Cuff, Wolf said the Indian government should have gone stronger on the fiscal stimulus, especially given that the economy is forecast to be headed towards a contraction in 2020-21.

“The government has to provide a lot more support to sustain demand,” he said, adding that the government could directly provide more money to the people.

It is important to sustain incomes for a year through this difficult period and not worry about the fiscal deficit, he said, adding that India can afford to borrow more and can increase its debt-to-GDP ratio to 90 per cent from the existing 70 per cent. He, however, pointed out that borrowing in foreign currency is not a good idea for India.

“Reviving demand will limit the economic decline and improve business confidence”, he said, adding that the problem of unemployment will get exacerbated.

“Allowing the economy to shrink so much is problematic. There was a huge unemployment problem even prior to the pandemic,” he said.

The Indian economy is forecast to contract in the range of 5-12 per cent due to the impact of the Covid-19 pandemic and the subsequent prolonged lockdown that created disruption in economic activity. In its recent forecast, the International Monetary Fund had projected the Indian economy to shrink by 4.5 per cent.

Wolf said that the projections indicate a 10 percentage points swing and is a dramatic decline as the economy was initially poised to grow at 5-6 per cent and now is expected to contract by 4.5 per cent.

Wolf termed Prime Minister Narendra Modi as bold but pointed out that in some instances, this boldness has been unwise. “Demonetisation was not a sensible policy and neither was the decision to impose a lockdown overnight,” he said.

Also read: India’s debt binge will widen overall 2020-21 fiscal deficit to 13%, HSBC says

Credibility of Indian statistics under a cloud

Wolf said that he did not trust Indian economic data, though, historically, Indian statistics has been credible.

“It is plausible for me that for some years, actual growth may be significantly lower than what has been reported … It affects the credibility of India in the world,” Wolf said, adding, “I would have thought that by now, a serious effort would have been made to explain the discrepancies and reconcile them. That doesn’t seem to have happened. That suggests to me that there has been some measure of deliberate obfuscation.”

Privatisation of state-owned banks

Wolf favoured privatisation of state-run banks and flagged how India’s immediate hurdle was fixing the twin balance sheet problem of stress, both among banks and corporates.

“I favour privatising state-owned banks … at least some of them, as I understand it, is a politically difficult decision,” he said.

Also read: Banks have the money, but nobody is asking for credit amid low economic activity: SBI chief

Replacing Chinese products not cost efficient

Wolf pointed out that replacing Chinese products with domestically manufactured products will be a costly proposition.

“China is the world’s largest manufacturer. It has a huge range of manufacturing production that is generally cheap and good quality. No one can displace it or replace it as replacing it means higher costs,” he said.

Instead, Wolf said, India can capitalise on the trade friction between China and the Western world, but will have to bring about substantial changes to exploit the opportunities and get a pie of the labour-intensive, export-oriented industry.

“You need world-class infrastructure, world class internet connections, hard working, well trained and disciplined workforce and the ability to organise it without interference of the bureaucracy,” he said.

Export growth crucial for India to achieve 7-8 per cent growth

Wolf said that it is impossible for India to grow at 7-8 per cent without exports growing at least as fast as GDP.

“Exports need to grow at 8-10 per cent. India can’t be a self-sufficient economy and grow fast. It needs to be forward looking, outward looking and open,” he said.

“If India wants to be a developed economy, it needs to develop world class businesses producing world class products and that can’t be done by being suspicious of trade,” he said.

Also read: Why you shouldn’t fixate on V-, U- or W-shaped economic recoveries

There is little difference between Modi government and Sonia-Manmohan government. Both of them have been pathetic when it comes to economy. UPA-1 reaped the benefits of good decisions taken by ABV. Pity that our country had just two really good PMs in PVN and ABV among a plethora of substandard populist ones who have weakened India economically.