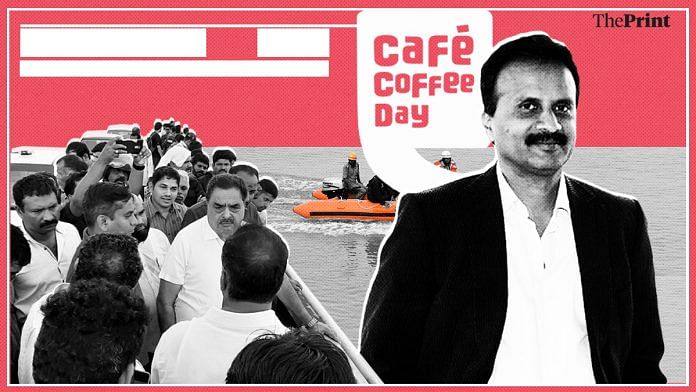

Cafe Coffee Day founder V.G. Siddhartha’s body was found Wednesday near Mangaluru, 30 hours after he went missing Monday evening. In a note he purportedly wrote before the disappearance, he talks about pressure from lenders and a private equity partner. He also mentions harassment by tax officials.

ThePrint asks: Are economic slowdown & tax terror creating dread among Indian businesses?

Bankers are no longer seen as sensible fiduciary friends but proponents of look-out notices

Atul Nanda

Atul Nanda

Advocate General for Punjab

John Betts, a stockbroker with a prestigious seat on the New York Stock Exchange, poisoned himself in the weeks following Black Thursday, the largest crash on the NYSE in the Great Depression Years. The suicide note attributed to V.G. Siddhartha acknowledging his financial failures has been consuming media space since the past few days.

The ominous similarity? Men built on entrepreneurial spirit and ambitious zeal succumbing to abject rout and making the most public (yet most personal) declaration of defeat – by taking their own lives. These cases demand psychological autopsy to understand the reasons that pushed people to the edge.

History reveals an unpropitious bond between economic distress and suicide. But when the distress caused is not a happenstance but institutional, then all desire for innovation and industry stands obliterated with it.

Bankers are no longer seen as the sensible fiduciary friends but proponents of look-out notices, ‘wilful defaulter’ stamps and non-extradition agreements. With state agencies now in predatory rather than regulatory mode, the ease of business has translated into the fear of doing business. Systems must function fairly for all. When a businessman finds himself as the marginalised victim of a systemic stranglehold, leaving suicide as the only other alternative, it is not only logical but imperative to rationalise and restructure such systems.

Daniel Defoe knew both, economics as well life in our times, when he famously wrote “things as certain as death and taxes”. It would appear they now go hand-in-hand. Stockbroker Wellington Lytle, down to his last four cents, left a chilling will: “My body should go to science, my soul to the Secretary of Treasury, Andrew W. Mellon and my sympathy to my creditors”.

Can’t say there is economic slowdown; people are keen on investing & cash flow is decent

K. Vaitheeswaran

K. Vaitheeswaran

Co-founder of AGAIN Drinks and author

One doesn’t exactly know what happened in the case of V.G. Siddhartha of Café Coffee Day because nothing has been confirmed yet.

However, whatever has happened is extremely tragic. But the cause and effect are unclear for anyone to comment on the case.

On whether there is an economic slowdown, it would not be correct to make a sweeping statement because there is just not enough data to determine so. I have just re-entered the startup space with my product ‘Again Drinks’ and I have not witnessed any such thing. An economic slowdown essentially means a stagnation in consumption and demand, which is not happening in the business currently. There has been a significant uptake for our product. It is a beverage worth Rs 50 – it is a reasonably premium product and there is still enough consumption.

In terms of taxation, there was considerable pressure on startups earlier but a lot of that has been addressed in the recent budget. Given what the government has done with the angel tax in the budget, it will become much easier for startups to flourish. There are people who are keen on investing and there is also a decent cash flow. Therefore, I do not think one can say that there is an economic slowdown.

Govt must support genuine entrepreneurs while going after the rogues

Pranjal Sharma

Pranjal Sharma

Economic analyst and author

It is difficult to estimate the extent of turmoil in V.G. Siddhartha’s mind. The role of tax authorities and PE funds needs to be examined. Without commenting on his special circumstance, my view is that the Indian industry is in the throes of transition pangs. It’s shifting to totally new rules of business landscape – from access-based entrepreneurship to effort-based business success.

Compliance laws for directors are stringent. GST has forced tax transparency on organisations that used to keep two sets of accounting books. Ownership of firms through multiple shell companies is under attack. A fundamental cleansing of India’s industrial ecosystem is also taking place. However, the changing governance system is not enabling entrepreneurship to succeed. The gap in the promise of ease of doing business has run into the mess of rent-seeking ecosystem of compliance authorities, which still sees everyone as a crook.

At a policy level, the government wants to make life easier, but the levers of implementation are still rooted in a past where nobody is above suspicion. When a tax officer begins with the assumption that every individual or institution is indulging in fraud, the result will always be unpleasant. And, this leads to overreach in tax penalisation. But several instances of GST fraud have indeed been exposed.

To manage the transition, the government must support the good while going after the rogues. This is the toughest part of transition. The govt must swiftly rein in over-aggressive tax officials. Tax officers must sharpen their sense of distinguishing between bonafide and malafide intentions.

Also read: CCD founder VG Siddhartha goes missing, days after his ‘letter’ talked of failure

Assessment & appeal process should be non-adversarial and less-time consuming for taxpayers

Amit Maheshwari

Amit Maheshwari

Managing Partner and International tax lead of Ashok Maheshwary & Associates

The tax department has been much more aggressive in the last few years. It has followed up with a number of taxpayers for not paying advance tax on time, although the law allows them to pay while filing return albeit with interest.

Tax demands have been enforced with notices for freezing of bank accounts in cases where the mandatory deposit for filing appeals has not been submitted. We have also seen an increase in the number of summons, information requests, Section 148 notices issued to taxpayers due to deployment of data analytics and exchange of information.

The number of prosecutions launched have also increased in the recent years. In fact, with the revised compounding guidelines, compounding will become very difficult.

As per the Economic Survey, tax disputes have risen considerably. The CBDT’s recent announcement on withdrawing appeals below a certain threshold will help reduce tax litigation since the tax department is the biggest litigator.

With the rechristened benami law and the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, tax officers are expected to become even more aggressive in tackling tax evaders/defaulters.

Therefore, it is imperative that taxpayers take tax compliance with all seriousness. For the government, it is important that tax officers are made accountable for their actions. The entire assessment and appeal process should be non-adversarial and less-time consuming for taxpayers.

Also read: How Siddhartha turned Cafe Coffee Day into a multi-billion dollar ‘success story’

By Revathi Krishnan, journalist at ThePrint

It is astonishing that while everyone wants ascribe his ills to a depressed economy yet CCD has made profits in the last three years.

The highest being 18-19 FY.

Strange is it not.

I agree with “Govt must support genuine entrepreneurs while going after the rogues” view of Mr Pranjal Sharma. Hue and Cry about tax terrorism indicates that there are so many rouges in Indian entrepreneurs who want to make easy money through illegal means have no place in today’s India. It’s time for Indian businesses to come clean otherwise they should not be in business.

Indian economy needs boost. No doubt. However, giving freebies and writing off loans to support entrepreneurs is a bad idea. What I hear is that tax terrorism. In this country, there are good amount of cases where business men declare their undisclosed income only after taxmen chases them. It is not that all the tax notices are paid and settled. There were cases, that it went to higher courts and many decisions were against tax authorities. If someone comes as says that I have earned money long time ago and I did not pay, but now I am in deep trouble and incurring loss and cannot pay. Many times large borrowers default and put the bank in stressful position affecting capital adequacy norms. The system should be strict enough and deterrent against errant borrowers. Siddarth has ventured into many things from Cofee plantation to Confee retailing to resorts to investment in software and other companies to buying forest in Amazon. He borrowed heavily and landed himself in trouble. Too much of chasing and breaking norms, rules and laws, got him into trouble. His letter hides more than revealing. We can keep blaming economy, budget and environment and all. But the real problem is entrepreneurs who do not have control on themselves.

Prof PK Sharma, Freelance Journalist,Barnala (Punjab)

Ironically, the nation faced the music during the past five years because the national polity and those at the helm of affairs had been at their wits end to find solutions to the burning and sensitive problems staring the nation in its face on various fronts- be it tottering economy, unemployment, farmers distress, flip-flop foreign policy , poverty and communal conflicts etc. !

History is being found repeating it self even now as well .

Such like mishaps will remain the order of the day because those at the helm of affairs in various ministries at centre happen to be jack of all trades but master of none ! It is so too because “objectivity ” and “true national spirit ” have been alluding the nation !

The nation is in the deep throes of uncertainty, insecurity and chaos pertaining to different streams of life !

Prof PK Sharma, Freelance Journalist

Pom Anm Nest, Barnala(Punjab)

As against this story, the CAG has observed laxity on the part of Income Tax authorities while dealing with claims of exemption for high value agricultural income in ITRs. The CAG has concluded : “As such, it was not possible to determine whether the system in place was robust enough to ensure that assessees were being allowed exemption for agricultural income, only after adequate examination in the process of assessment.”

The Budget should have been the new government’s coming out moment. A blueprint for the next five years. A route map to restoration of higher growth, with its components of investment and consumption. Both authentic facts and figures and a serious, credible declaration of intent. Instead, a largely political speech, spanning more than two hours. How the markets have reacted is seen in the trillions of national wealth that has been washed away. One does not know if the buying by domestic institutions that has stemmed the haemorrhage was spontaneous or directed. 2. Without a change of heart and some top level changes of personnel, even a Professional Optimist like me needs a thermal imager to locate the sun.