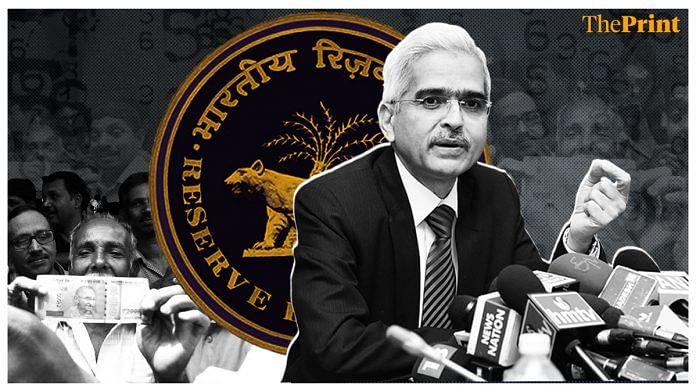

With the economy facing a slowdown, the Reserve Bank of India Wednesday cut the repo rate by 35 basis points in its fourth consecutive policy rate cut this year. The RBI’s monetary policy committee had previously cut repo rates in February, April and June. The current repo rate stands at 5.4 per cent. But banks have failed to pass on the benefit to the borrowers.

ThePrint asks: Have RBI rate cuts lost their ability to boost economic growth

Rate cuts and improved transmission need to be supplemented by measures that boost private and foreign investments

Radhika Pandey

Radhika Pandey

Fellow, NIPFP

The monetary policy committee (MPC) has cut the policy rate by 35 basis points. It has also maintained its accommodative stance signalling that more rate cuts may be in the offing. In total, the policy rate has been reduced by 110 basis points this year. The outlook remains benign with the MPC revising downwards the growth forecast for this fiscal.

Interest rate cuts are expected to stimulate demand in a weak economy. While MPC is taking steps to boost growth, actions are required on multiple fronts to lift a sagging economy. Improvement in monetary policy transmission is an immediate priority. The MPC acknowledges that the weighted average lending rate (WALR) of banks has reduced only marginally in the current easing phase. While some banks have linked their lending rates to policy rates; more effective measures are needed to improve the transmission. Competition in the banking sector with easy entry and exit norms, and development of deep and liquid bond market are critical reforms needed to improve transmission.

Rate cuts and improved transmission need to be supplemented by measures to boost private and foreign investments. Policy uncertainty on key issues such as taxation hamper investments even in an environment of eased interest rates. On the fiscal policy front, a commitment towards fiscal discipline and transparency in fiscal numbers would do good to encourage private investments by lowering yields on government securities.

Views are personal

Also read: RBI cuts repo rate for fourth time this year — by surprise 35 bps now

Monetary easing won’t be sufficient if income generation activities growing at slower pace

Devendra Pant

Devendra Pant

Chief Economist and Public Finance Head, India Ratings

The slowdown in growth we are witnessing today is due to a variety of factors. While it’s mostly production and expenditure side of the economy which is analysed, there is another way to look at why growth is slowing down — the institutional side view.

A large number of unorganised and unregistered entrepreneurs are part of the household sector. This sector has the highest contribution to the gross value addition, savings, and investments. These are the three main macroeconomic indicators which we should be looking at. If this sector is not witnessing growth — what will happen? If my income is not growing, my repayment capacity is being hampered. Now, will a monetary boost to the economy help household sector in the short run?

There will be some impact of monetary easing and consequent increase in demand. However, if income generation activities are growing at a slower pace, then chances are this may not be sufficient to kickstart the economy. Unless we address issues related to the household sector, where production activities are heterogeneous, it is unlikely that we will have sustained growth momentum. We may require sectoral policy interventions – enterprises in the household sector operate in different kinds of economic activities. One-size-fits-all won’t work here.

A major reason for consumption slowdown is the collapse of agricultural output rises. In a situation where our volumes are not growing significantly and prices are either stable or growing at a very low pace, the nominal income growth is at a low level, thus affecting consumption demand. This is what farmers are facing. Their income is growing at a low pace and agricultural labourers are facing a similar scenario, which would impact rural wages also. The net result — aggregate demand is growing very slowly.

Views are personal.

Also read: 3 rate cuts by RBI this year have done little to boost lending and spur growth

Misleading to say rate cuts didn’t revive growth. Money market liquidity turned into surplus in June

Shubhada Rao

Shubhada Rao

Chief Economist, Yes Bank

The monetary policy rate along with the prevailing liquidity conditions play an important role in guiding the interest rate spectrum in the money market, and thus influence broader economic activity including asset allocation decisions.

The trickle-down impact of rate cuts is usually noticed after two to six quarters depending on how fast banks re-price deposits and thereby loans.

In the current cycle, it appears that past rate cuts have not helped to revive economic growth so far. It would be misleading to make that inference because, between February and June 2019, banks’ weighted average lending rates have come down by 29 basis points at a time policy rate saw a cumulative reduction of 75 bps. However, one should note that money market liquidity emphatically turned into a surplus in June. Since then, the magnitude of liquidity surplus has widened on the back of policy actions and seasonal factors. This should enhance the transmission of monetary policy signals in the coming months.

Moreover, a gradual reduction in banks’ asset quality concerns and policy intervention to support the non-banking financial companies should also aid monetary transmission.

Banks’ interest rate is not determined by demand & supply of credit but its cost in the market

Pronab Sen

Pronab Sen

Former Chairman of National Statistical Commission

The RBI rate cuts haven’t really lost their ability to boost economic growth. The fact is that in India, the transmission of the RBI rate cuts depends on factors that differ from those in other countries. People should not expect their bank’s interest rates to come down by the same amount if as the RBI’s repo rate.

As far as bank interest rate is concerned, they are not determined by the demand and supply of credit in the market. They are determined by the cost of credit. Because of this factor, banks find it difficult to pass on the rate cut. It will go against the RBI guidelines. If repo rate drops, it increases liquidity but does not affect the deposit rates. If your cost of deposit remains the same, then the bank can’t do a rate cut. What it can do, at most, is reduce the interest it charges to individual customers, which would be some mark up above the base interest rate. Then you are not talking about the base interest, but the cut in the mark up.

By Revathi Krishnan and Taran Deol

Promoting growth is not the RBI’s primary responsibility. As someone who was on TV almost each evening after 8 November 2016, Governor Das is aware of what set off the downward spiral in the economy. The repo rate is down to 5.4%. Unclear how much further it can go. The RBI should study the graph of household savings, which feed the credit cycle. Britannia – what Shri Shivam Vij calls Slow Moving Consumer Goods – is selling fewer packs of biscuits. Amidst this desolate wasteland, what is the traction that a final rate cut of 35 basis points will have on the real economy, whether its slowdown is structural or cyclical.