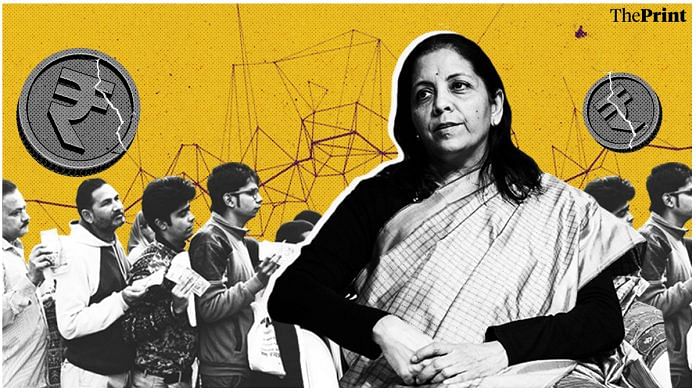

India’s GDP grew at 5 per cent in the first quarter of FY20, the lowest in six years. Finance Minister Nirmala Sitharaman announced mergers of 10 public sector banks, days after rolling back FPI surcharge and angel tax introduced in July. There is a demand from the industry that the government reduce GST on automobiles, and economists argue that tax cuts are needed as fiscal stimulus to arrest slowdown.

ThePrint asks: Can tax cuts be an effective stimulus for Modi govt to combat slowdown?

Tax cuts in India have potential to boost economic growth but only if other conditions are also met

Suyash Rai

Suyash Rai

Fellow at Carnegie India

Tax cuts have the potential to boost economic growth, but only if other conditions are also met. Cutting corporate tax — a promise made by the Narendra Modi government in 2015 — could boost growth by making firms more competitive in exports, and by leaving them with more money to invest. This can work if other reforms are implemented to improve competitiveness and investor sentiment.

Second, tax cuts that leave more money with individuals and families (for example, excise duty on petroleum products) lead to higher consumption or savings. Higher consumption has been a driver of growth, but has been faltering lately. Increased household savings will make more resources available for investments.

In the medium to long run, if tax cuts boost growth, tax collections may also pick up. However, the Modi government faces a difficult choice in the short run.

At present, the government’s finances are stretched. In 2018–19, actual tax collections were much lower than budgeted. To meet expenditure, the government is borrowing much more (a lot of it off-budget), and cornering most of the financial savings of households. If tax cuts lead to lower revenues in the short run, and the government ends up borrowing even more domestically, it will make it more expensive for households and firms to borrow for investment or consumption. This would defeat the purpose.

So, the Modi government must also identify and cut unproductive expenditure at the same time. In other words, tax cuts can work if productive expenditure by private sector replaces unproductive expenditure by government.

Another way of achieving a similar substitution is through privatisation of public sector enterprises that are not performing well. Over time, improved productivity of these enterprises could boost growth.

Also read: India’s growth forecasts being lowered, more interest rate cuts predicted

Tax cuts won’t help in short-term and the current economic slowdown needs a short-term answer

Gurcharan Das

Gurcharan Das

Author & Former CEO of Procter & Gamble India

For the Narendra Modi government to combat the economic slowdown, what is required right now is a short-term answer. And in the short-term, tax cuts will not help. To counter this slowdown, the more useful measure would be to create demand.

The best way to create demand is by restarting the stalled infrastructure projects. This will create jobs and put money in people’s pockets. Another quick creator of jobs is the housing sector, especially programmes related to affordable housing.

The problem currently is that the Modi government does not have money, not even enough to meet the basic commitments mentioned in the Budget. Therefore, it should not go for a big fiscal stimulus but frontload the disinvestment programme. Also, the government holds shares in many private sector companies. It should sell those shares.

Moreover, the government also has a lot of surplus land it does not need, which it should sell. It can even cut some of the non-merit subsidies. All these steps will help raise the money to invest in infrastructure, construction and housing. It can take these steps because of the huge mandate PM Modi got in the 2019 Lok Sabha elections.

If he waits too long to take the unpalatable steps like cutting subsidies, the honeymoon period will be over and he will have lost the opportunity.

These are many of the ways to raise money & kickstart the virtuous cycle of demand, investment and economic growth. Cutting taxes is a slow process and I would not encourage it.

Uncertainty around policies adversely affects demand. A predictable tax regime could boost consumption

Radhika Pandey

Radhika Pandey

Fellow at National Institute of Public Finance and Policy

The recently released GDP numbers have reiterated the presence of a chronic slowdown in the Indian economy. Until recently, the monetary policy was doing the heavy-lifting of addressing slowdown woes through interest rate cuts. Banks are being told to pass on the rate cuts by linking their lending rates to the policy rate. Steps have been taken to infuse liquidity in the system. Banks are also being encouraged to lend to NBFCs (non-banking finance companies) to spur lending.

Most of the measures announced so far have focused on the supply side. The real problem, however, lies on the demand side. Even though banks are flush with liquidity, the demand for credit is tepid. There is a reluctance to spend on consumption and investment. The crash in the manufacturing GVA growth (gross value added) to 0.6 per cent is a reflection of slack in demand.

While the increased surcharge on the super-rich and foreign investors proposed in the Union Budget has been withdrawn, the negative investor sentiment caused by the decision will take some time to reverse. The uncertainty around government policies adversely affects demand.

The capacity to raise public capex is limited. Some of the flagship infrastructure projects may suffer due to the ballooning debt of the National Highways Authority of India. With limited capacity to spend, the Modi government should adopt measures to reverse the negative investor sentiment. Rationalising tax rates and more importantly having a predictable tax regime could do well in boosting demand for consumption which is needed to kick-start investment.

Views are personal

The way to get out of our economic mess is to cut expenditure first, then taxes

Shubho Roy

Shubho Roy

Consultant at National Institute of Public Finance and Policy

Lower taxes are usually better for the economy. This is because it leaves more money for the private sector, which creates more value out of the money it invests than what the government’s expenditure does.

However, lower taxes are not achieved by cutting taxes. If the government is committed to spending a certain amount, the money has to be obtained through other means. So, cutting taxes usually leads to higher government borrowing. In India, the government borrows through financial repression – the process of forcing banks and other financial firms to purchase government securities through law. The Statutory Liquidity Ratio is an example.

Higher government borrowing removes the same amount of money available to the private sector that was given through tax cuts. Even if the government did not commit financial repression and borrowed the money through market mechanisms, it still has consequences. Higher government borrowing is the same as deferred higher taxes. When the borrowing matures, the government has to repay the bonds with interest. This can be done by levying higher taxes, which reduce the money available with the private sector. Alternatively, the government could print more money and repay its lenders, causing inflation. Inflation, in turn, reduces the value of the money with the private sector. This defeats the main purpose of cutting taxes: to increase funds in the hands of the private sector.

The government has three choices. First, it can increase the efficiency of its expenditure by spending on public goods, instead of competing with the private sector by spending on private goods. Second, the government could reduce spending. The third choice is to increase the productivity of capital that Indian businesses have. This involves reducing restrictions on businesses and not protecting inefficient industries.

Views are personal

Also read: Modi’s bank mergers have come too late to avoid an economic crisis

Govt should cut tax across the board. Indian economy needs a boost now, not after it has declined further

Ila Patnaik

Ila Patnaik

Economist & Professor at the National Institute of Public Finance and Policy

The slowdown in the Indian economy, led by a deceleration of investment, is now visible in consumption slowing down. In addition to structural change, the Narendra Modi government must act immediately to pump prime the economy. There are two ways to do this — monetary and fiscal. The RBI has been easing monetary policy, but weak transmission means the impact is slow. A fiscal stimulus can be provided in two ways: either the government spends more or the government taxes less. In both cases, the fiscal deficit increases and the economy gets a stimulus.

For any government-spending to take place, bureaucrats have to identify projects, get them approved, meet norms, float tenders, follow procurement processes, choose vendors and then release the money. The capacity of the Indian state to spend has reduced over the years, especially after various scams.

The fastest option in this situation would be across the board tax cuts. The slowdown is pervasive, the problem is macroeconomic, the solution needs to be macroeconomic. Instead of going sector by sector, debating whether a 28 per cent tax is responsible for the automobile sector slowdown, the Modi government should cut GST rates across all industries.

If the states are not willing, the Centre can at least cut the central GST sharply. Similarly, it can cut income taxes and corporate taxes for all income categories. Money in the hands of consumers and investors spent immediately is several times worth more than the money spenta few months later. The Indian economy needs a boost now, not after it has declined further.

Views are personal

By Revathi Krishnan and Taran Deol

Very happy the conversation is shifting from government spending more – relaxing fiscal discipline – to its leaving more money with households to spend and businesses to invest. 2. The government system is raising 20% of GDP as tax, borrowing 10%, spending 30%. Household savings of 9% are being fully absorbed by it. Despite such ultra loose fiscal policy, the continuously declining figures of growth are before us. Private consumption is wilting, leaving no rational justification for investments to create fresh capacity. 3. Infrastructure ki toh baat hi mat kijiye. Took the banking system to the cleaners. 4. Don’t expect a turnaround in one or two quarters, this is a long, tough trek. However, to lift the mood, the government could announce a large burst of genuine privatisation. How will IOC buying BPCL help the economy ? 5. Individuals and corporates both deserve tax cuts. What the percentages should be, that is for the experts to decide. Part of the solution, although the government needs to do a lot more to raise growth to a respectable figure. 6. Itne shaandaar mandate se toh Indians ke haath ki lakeerein badal sakte hain.