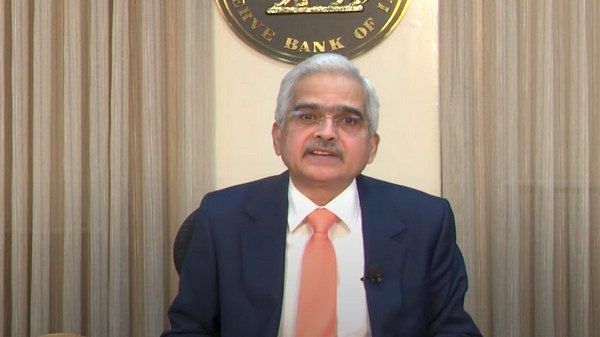

Shaktikanta Das is the twenty-fifth and current governor of the RBI. He is a retired IAS officer of the Tamil Nadu cadre, although he is originally from Odisha. Das studied history at St. Stephen’s College at the University of Delhi. He has served in various positions for both the Government of India, such as economic affairs secretary, revenue secretary, fertilizers secretary, special secretary to the Department of Economic Affairs of the Ministry of Finance and as a joint secretary to the Department of Expenditure of the Ministry of Finance, and the Government of Tamil Nadu, such as principal secretary (Industries), special commissioner (Revenue) and as the district magistrate and collector of Dindigul and Kancheepuram districts in the Tamil Nadu government. He has also served as India’s alternate governor for the World Bank, Asian Development Bank, New Development Bank and Asian Infrastructure Investment Bank. He has represented India at the IMF, G20, BRICS and the South Asian Association for Regional Cooperation (SAARC) meets. After his retirement from the IAS on 28 May 2017, Das was appointed a member of the Fifteenth Finance Commission. In December 2018, Das resigned from his position in the Fifteenth Finance Commission to assume the charge of the twenty-fifth governor of the RBI.

Das was appointed as the governor of the RBI on 11 December 2018 for a period of three years. He succeeded Urjit Patel, who had resigned on personal grounds, although it was widely speculated that his resignation was due to the rift created between the RBI and the government over the RBI placing 11 public-sector banks under a PCA framework on account of their enormous stressed assets. After the stormy tenures of Rajan and Patel, the government opted for a career bureaucrat instead of a career economist, as was widely expected. Das, along with Patel, had ably guided India through the demonetization exercise in 2016–17 and had strongly defended the measure in various fora. There was considerable media speculation as to how he would fare as the governor without a formal education in economics and, to his credit, Das has proved many of his critics wrong since 2018.

Das has been outspoken about the lack of governance in banking and has called for tighter rules for state-owned banks, which comprise 60 per cent of India’s banking sector. To make the banking system more robust, the RBI is to set up a college for supervisors with the aim of improving supervisory skills. Das has brought in measures to tighten the rules around shadow banking, refusing to bail out non-banking financial companies (NBFCs). He is aiming instead for issues to be managed within the financial system, which is possibly a risky move but one that will reduce dependence on the RBI.

With Das assuming charge of the RBI, lenders outside the traditional bank network have been placed under a greater level of scrutiny. Even housing finance companies have been brought under the regulation of the RBI and will have to adhere to the same framework of rules as that of NBFCs. The RBI is also proactively providing assistance to India’s smaller banks. As the threat from newer micro-finance institutions looms, Das has moved to help the country’s urban cooperative banks install a robust IT system that will allow them to offer better banking services at a lower cost and also protect client’s money and data.

The RBI, under Das, has also mandated banks to offer benchmark-linked lending rates, with most choosing to follow the RBI’s 5.15 per cent repo rate. Das was quoted as saying: ‘An environment of macroeconomic stability, as reflected in low and stable inflation, notwithstanding its recent spike that is expected to be transient; a sustainable current account deficit; and rising foreign exchange reserves have contributed towards maintaining financial stability and laying a platform for sustained growth.’

Also read: Bengaluru’s Oota, Bombay Canteen, Gurugram’s Comorin—Indian chefs dig into regional cuisine

Das’ lack of formal education in economics has proven to be a gift that allows him to make unconventional choices with great success. Early in his tenure as governor, in March 2019, Das introduced a $5 billion swap window to infuse durable liquidity in the system. The response from the market participants for the scheme was huge when they offered more than three times the notified amount, which encouraged the central bank to repeat the scheme. He also introduced innovative measures to address issues of liquidity and bond yields. Exploring ‘Operation Twist’ (a monetary policy intervention by the central bank, conducted through OMOs where the central bank buys longterm government bonds and, at the same time, sells short-term government securities with a view to soften long-term yields and improve monetary transmission) and targeting long-term repo operations to enhance liquidity underlines the governor’s penchant for unconventional measures to address critical issues. This has been vital in the COVID-19 pandemic.

This excerpt from RBI Governors: The Czars of Monetary Policy (1935-2021) by Gokul Rathi has been published with permission from HarperCollins India.

This excerpt from RBI Governors: The Czars of Monetary Policy (1935-2021) by Gokul Rathi has been published with permission from HarperCollins India.